How to Spot and Avoid Crypto Pump and Dump

The world of cryptocurrencies is not only full of innovations and opportunities, but it is also full of pitfalls and dangers, including crypto frauds and fraudulent schemes of all kinds. Although the blockchain technology is relatively safe, the speed and revolutionary nature of the market plays in favor of scammers in most cases. Cybercriminals come up with clever and insidious tricks to compromise traders’ security, access their digital wallets, or encourage deceptive investments.

One of the most common schemes running in the crypto world as a malicious technique is called pump and dump. But what is the interesting name behind? Read along to find out what is crypto pump and dump, how it works, and what is that you can do to prevent it.

What is a crypto pump and dump scheme?

Let’s kick off with the definition of crypto pump and dump schemes.

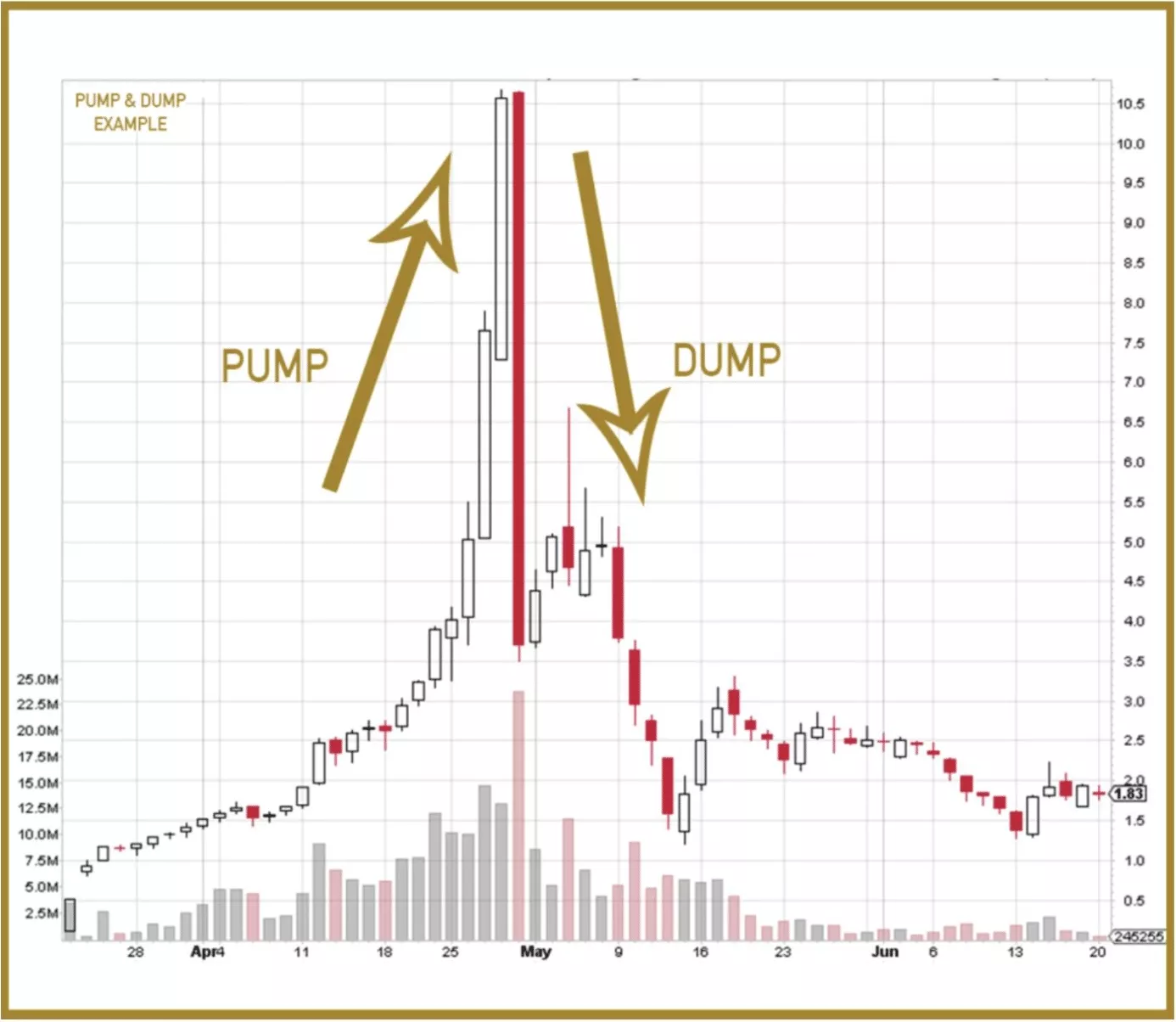

Crypto pump and dump is a form of fraud allowing malicious actors to manipulate the market, spread false or misleading statements about a certain crypto project, and sell their tokens once investors buy a sufficient number of this cryptocurrency. This creates a rise-and-fall effect since the token’s price rises rapidly and then experiences a sudden drop, leaving many unsuspecting investors with significant losses. And that is exactly why they call it pump and dump.

To be more precise, let’s look at the two main stages of a pump and dump scheme.

⬆️ Pump. Many people invest in a certain altcoin, so its price is artificially inflated (“pumped”)

⬇️ Dump. At a certain point, when the coin’s price reaches its peak, scammers sell their share, making it suddenly go down. Then, they disappear for good with the invested funds.

Another common name for crypto pump and dump is a “rug pull” scam. Here, the name speaks for itself. Scammers “pull the rug” from under investors’ feet once the crypto coin’s price goes sky-high.

But how do cybercriminals manage to carry out such a trick? And why do crypto traders keep buying into it? Let’s look under the hood of pump and dump scams to find out.

How crypto pump and dump schemes work

Although the crypto market is quite young, different types of investment fraud, including pump and dump technique, have been with us for a while, especially in the world of penny stocks and other low priced stocks. However, crypto scams are much more challenging to spot and prevent than standard stock manipulations because many tokens trade on markets with low market capitalization and limited oversight. Why? That’s because cryptocurrencies are not regulated so strictly. People trading crypto on blockchain-based peer-to-peer exchanges are relatively anonymous, so it’s not always possible to tell a legit Initial Coin Offering (ICO) from a malicious one. As a result, the risk of investing in a fake or non-existent crypto project is quite high.

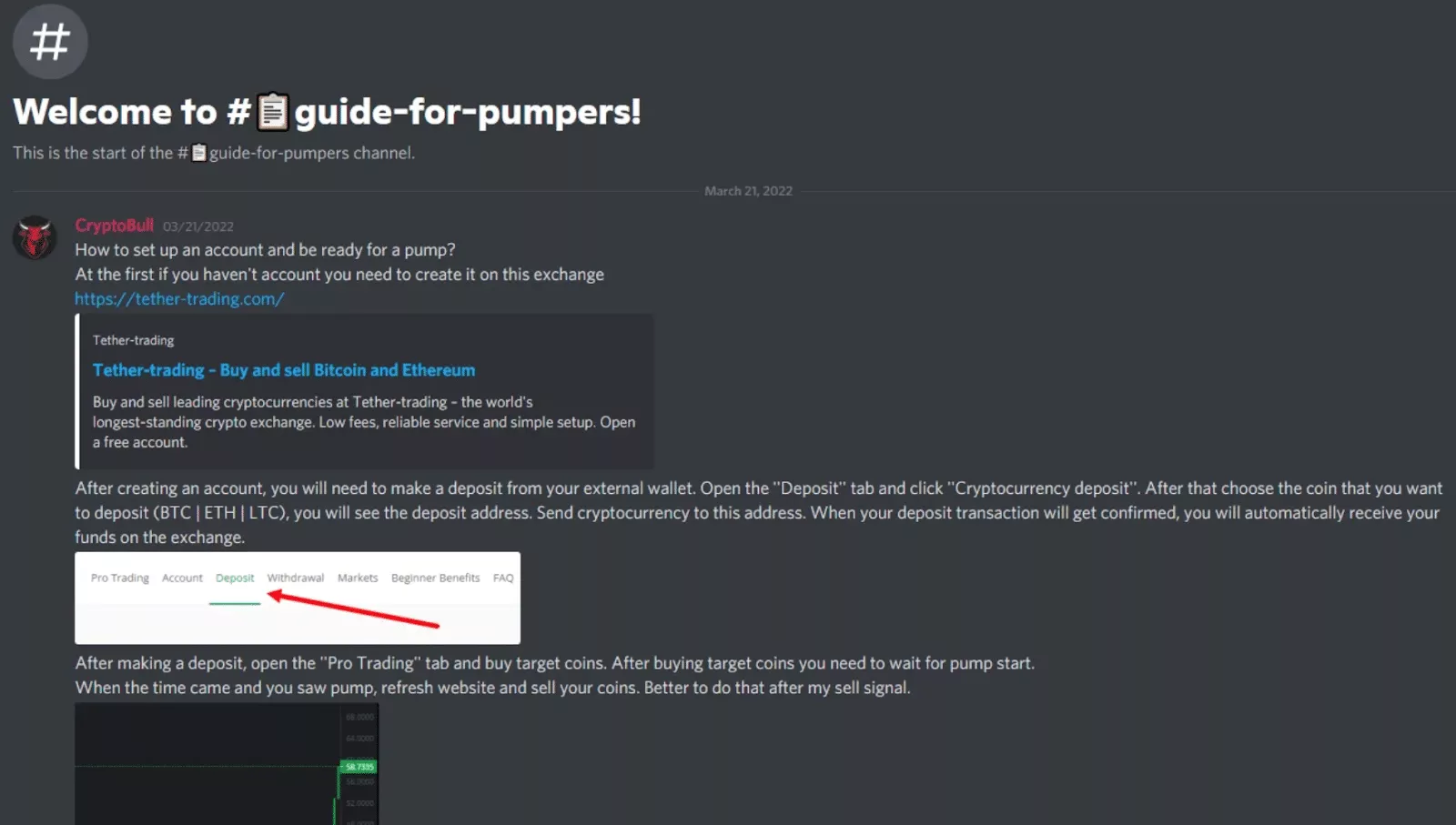

This shady and unpredictable nature of crypto pump and dump schemes makes them one of the easiest ways for scammers to deceive potential investors and make money out of thin air. In particular, they use social media channels and social media platforms such as Discord and Telegram to create groups with thousands of members interested in “pumping” cryptocurrencies and feeding off social media hype.

A recent SSRN survey identified nearly 4818 pump and dump schemes involving 300 different cryptocurrencies over 6 months. Another research conducted by Business Insider witnessed five market manipulations in a single week conducted by a “PumpKing Community” channel on Telegram. And those are just a few drops in the ocean of crypto-related manipulations.

While crypto pump and dump schemes occur so frequently, some of them are truly massive. Here are some of the best-known examples of such scams.

Examples of crypto pump and dump schemes

According to a Statista report, the most significant rug pulls stealing funds from investors were OneCoin (over $4 million), Thodex ($2.6 million), AnubisDAO ($58 million), and Uranium Finance ($53 million).

Another famous pump and dump scheme that recently shook the world was the $SQUID Game scam. Named after the popular Netflix series “Squid Game,” this “play-and-earn” crypto’s price grew from about 1 cent to over $2.800 in less than a week. However, the promised game has never been released. Instead, the creators of the $SQUID Game disappeared with nearly $3.38 million invested funds.

So what can you do to prevent yourself from falling victim to a similar fraud?

How do you spot a crypto pump and dump?

While well-known cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have pretty long track records of their ups and downs, newly emerging altcoins aren’t time-tested. Therefore, asking the reliability of every fresh crypto project is a good idea. As of the beginning of 2023, there are over 9.000 crypto coins and almost 17.000 altcoins. And it’s tough to assess whether each one of them is credible.

The process of discovering new cryptocurrencies can be an exciting one. However, it’s always worth asking yourself a few questions before you can make up your mind on investing in a crypto project:

- Is the coin experiencing too rapid and unexplainable growth?

- Who are people standing behind the project?

- Where did you learn about this crypto?

If you notice some weird activity behind new crypto, majorly through social media, social media posts that repeat the same promises, or people spreading false information, it may be artificially “pumped” to attract investors.

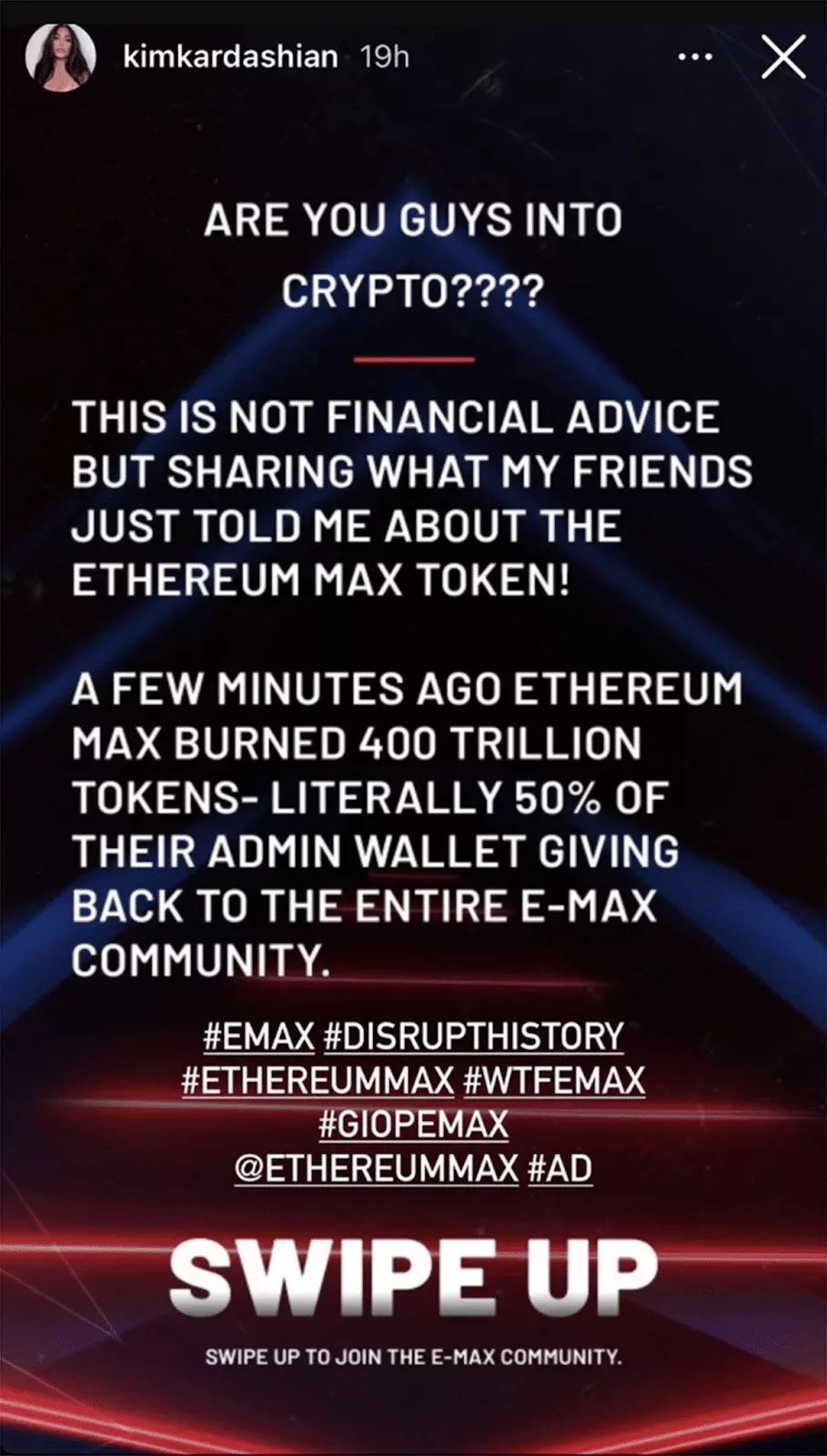

Celebrities promoting crypto

When influencers and celebrities are promoting some unknown crypto in their Instagram, Twitter or Facebook account do not rush to invest your money in it. This could possibly be a symptom of a malicious scheme involving people with a big number of followers online.

Of course, it doesn’t mean that your favorite Instagram model or blogger has got something to do with cybercriminals. In most cases the celebrities are paid for advertising new crypto without even suspecting that they are involved in something potentially illegal. However, the creators of shady crypto schemes tend to deploy their influence to get their followers to invest in their coins. For example Kim Kardashian has currently been accused of promoting Ethereum Max, which seemed to be a pump and dump scheme.

Some other examples are less obvious yet still disturbing. While Elon Musk is famous for his influence on the cryptocurrency market, some of his tweets could be perceived as pumps. For instance, after Musk’s tweets about the Moon and the Vikings, the VikingsChain, Viking Swap, and Space Vikings coins grew by 350%, 3.700%, and 600% and then suddenly went down. Besides, there were “Floki coins” (Shiba Floki and Santa Floki) that experienced dramatic rises and falls after Musk tweeted selfies with his dog named Floki. Coincidence? Maybe, but even if so, it allowed someone to make a fortune.

Intrusive ads on social media and Discord

Social media has been a perfect tool for scammers to do their crypto promotions and trick users into investing their money in fake projects. But how to tell a ubiquitous marketing game from a malicious game? The first warning sign is the saturation of different social networks with different identical promotions, such as Instagram, Facebook, Twitter and groups on the platform Discord. Most of those posts are also paid advertisements, so there are intrusive advertisements attacking you from any side, including the banner ads and pop-ups.

Such aggressive ad campaigns aren’t typical for legit projects that do not tend to go all-in advertising their coins. Instead, good companies are likely to spend more money on developing and stabilizing the product or technology. So if a new, unknown crypto suddenly starts popping up all over the web it might be an indication of a pump and dump scam.

How to protect yourself from crypto pump and dump scams

If you don’t want to get into a pump and dump trap, here are a few tips on how to prevent it. Note that this is not investment advice. We are here to help you protect private information and funds from being compromised.

- Avoid too-good-to-be-true offers and ad campaigns. Every new cryptocurrency strives to look profitable and promising. However, many of them are the exact opposite of it. If someone guarantees you instant income and promises you golden mountains right after your investment, especially if it comes as unsolicited investment advice in your DMs or inbox, do not buy into it.

- Do not trust celebrities and influencers. As mentioned above, famous people often become a tool for attracting larger audiences to malicious schemes. But remember that most often, the motives of celebrities are to get paid for placing an ad on their account, nothing more. So when they promote an unknown crypto, it doesn’t mean they’ve checked its reliability.

- Verify unknown crypto. It’s better to play safe and do your own research about crypto before investing in it, checking who stands behind the project and, if there is a legal entity, what the company’s financial health looks like. Pump and dump schemes normally involve newly emerged cryptocurrencies, expecting adventurous investors to dive in carelessly.

- Report potential scams. If you have seen some suspicious cryptocurrency-related activities, such as some intrusive adverts, scammy messages, or some fishy emails where the message is to invest in some unverified crypto coin, it’s better to keep yourself away from them and warn others. Besides, if you fall into a pump and dump trap, you can report the scam against the crypto exchange that you’re using along with the appropriate authorities including the Federal Trade Commission (FTC) and the Internet Crime Complaint Center.

- Use a VPN. To help you protect yourself against crypto scams and keep your transactions safe is a good idea to help empower your security toolkit through a reputable VPN (virtual private network). Such software will help you avoid the potentially infected links, ads, pop-ups, and phishing websites. Besides, a VPN conceals your IP address and encrypts your data while being run through a remote server. As a result, your cryptocurrency trading operations will be undetectable by hackers, fraudsters and other third parties.

Protect your crypto transactions with VeePN

Looking for a powerful cybersecurity solution to secure your crypto transactions and avoid scams? Try VeePN! It’s a trustworthy VPN service that provides multiple helpful online security and Internet privacy features to shield your crypto trading experience from potential threats. Thanks to the NetGuard feature, you can avoid malicious crypto exchanges, shady websites, phishing attacks, and public Wi-Fi risks. Besides, robust AES-256 encryption will hide your data from online snoopers and help you protect your crypto wallet from the prying eyes of cybercriminals.

Download VeePN now and keep yourself away from crypto-related schemes.

FAQs

What is a pump and dump crypto scam?

A pump and dump scheme, also known as a rug pull scam, is a malicious technique cybercriminals use to trick people into investing their money in a fake crypto project. Scammers artificially increase the price of a new cryptocurrency, making potential investors believe in the project’s prospects, and then start selling their coins to trigger a rapid price drop. As a result, malicious actors disappear with their victim’s funds.

Are crypto pumps and dumps illegal?

Just like any other market manipulation with the aim to boost the stock’s price based on a misleading statement, crypto pumps and dumps are considered fraudulent, illegal activities. However, the crypto market is less regulated than the stock market. So in some cases, it is more difficult to punish cybercriminals for using pump and dump schemes.

Are crypto pump and dumps profitable?

Crypto pump and dump can be profitable for fraudsters behind such schemes. However, such manipulations are illegal and have the opposite effect on common crypto traders. If you happen to invest in an artificially pumped crypto project, you will lose your money once the currency’s price goes down.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan