Is VPN Safe for Online Banking? (And When to Be Cautious)

A VPN is not just safe for online banking — in fact, such a tool can become your lifeline, especially when connected to unsecured Wi-Fi networks or using a mobile app for money transfers. While banks implement numerous protection measures to safeguard your personal data and funds, a VPN adds an extra security layer to your transactions. But to leverage these benefits, you need to choose your VPN wisely as not all service providers are trustworthy. Read on to discover when you need a VPN for online banking and how to pick a reliable tool for this purpose.

Is online banking safe without a VPN?

The short answer is no, it’s better to connect to a VPN when accessing your banking account online. There are several good reasons for that:

- A VPN encrypts your traffic. It runs your entire traffic through a so-called “VPN tunnel” covered with top-grade end-to-end encryption. It means that your search requests, messages, credentials, and other sensitive details remain hidden from prying eyes. Data encryption makes it extremely hard (if not impossible) for a hacker to learn anything about your online activity.

- A VPN hides your IP address. While this information doesn’t seem as sensitive as your banking app password or credit card number, it’s still an important piece of the puzzle a malicious actor can use to compromise your security.

- A VPN provides additional security perks. Premium service providers like VeePN have even more to offer. You can access additional security features like data leak prevention, anti-monitoring tools, and even double protection for particularly sensitive activities.

💡 Read also: How to secure your online banking transactions

All in all, using a VPN for banking is an excellent way to enhance your safety and security. But when do you need to turn it on, exactly? Let’s explore the most significant use cases.

When you should use a VPN for online banking

Here’s when banking online is much safer with a VPN than without it:

When connected to public Wi-Fi

Public Wi-Fi networks are among the most popular targets of cybercriminals, all because they lack some critical protection measures. Since anyone can connect to a Wi-Fi spot in a hotel, airport, restaurant, or coworking space, it’s much easier for a threat actor to manipulate or compromise it. And, if that happens, all the connected devices are at enormous risk.

For instance, a hacker could hit you with a man-in-the-middle (MITM) attack, putting themselves between your device and the network to compromise your confidential info.

Banking over public Wi-Fi with a VPN is much safer. It encrypts your Internet connection and transforms your data into an unreadable cipher. As a result, your transactions and other online banking activities will stay private and secure no matter what.

When using mobile apps

A VPN doesn’t just secure your web browsing – it scrambles data from all Internet-connected apps, counting Netflix, YouTube, WhatsApp, Instagram, and yes, your banking app account and banking apps as well.

Whether you’re exchanging money or checking your balance on the go, employing a VPN for versatile mobile banking app management makes a difference when talking about unauthorized access, third-party following, or simply cases when you want to keep your budgetary information secure.

💡 Bonus: With VeePN, one subscription covers multiple devices at the same time! So if you’re already using a VPN on your desktop, make sure to extend that protection to your mobile banking, too.

While away from home

Need to access your banking account during a vacation or work trip? As mentioned, public Wi-Fi without extra protection measures is a no-no for sensitive activities like that. Besides, your bank might indicate unusual activity when the attempt to access it comes from another part of the world. And what could be worse than being banned from your banking account in the middle of nowhere?

A VPN solves this problem with ease — connecting to a server located near your home will make it seem like you never left. All your activity will be associated with the IP address and virtual location of your choice, not the real one. Pretty convenient, isn’t it?

But, as said previously, only a credible VPN service with a proven track record and transparent Privacy Policy will guarantee all those boons. Otherwise, it might be dangerous. So, when is VPN safe for online banking?

Possible risks of using a VPN for online banking transactions

If you strive for enhanced security when accessing your bank account, make sure to avoid the following pitfalls associated with using a VPN.

Free VPN apps

Many services promote themselves as “free”, but they only seem reliable. In fact, a free VPN still needs to make a profit somehow. While not earning money on subscriptions, providers tend to take advantage of customer data in this case. Instead of being committed to protecting your privacy, they may actually violate it by collecting and selling your personal information. Vague privacy policies and “too-good-to-be-true” offers are some warning signs to watch out for.

On top of that, a free VPN service may simply lack some important features to guarantee full protection. And when it comes to matters as delicate as your banking account details, it’s better not to take any risks.

VPN scams

Okay, free VPNs aren’t 100% safe, but that’s just the tip of the iceberg. The truth is, not all of them are even real. There are numerous fake services that only pretend to protect your data while being designed to do quite the opposite. These malicious apps, also known as VPN scams, may distribute malware, spyware, adware, and other malicious programs.

If you happen to activate such an app and access your banking account, your credentials will most likely fall into the wrong hands straight away.

💡 Feel free to check out our detailed guidelines on how to avoid VPN scams.

Malicious websites

A VPN is a strong privacy and security solution that does much more than just alter your virtual location. Premium services provide additional features letting you avoid phishing links, malware-infected pop-ups, online trackers, and other threats. But keep in mind that even a secure VPN for online banking is not a silver bullet against all possible dangers lurking across the web.

That’s why it’s so important to stick to cyber-hygiene rules and Internet safety practices when accessing your bank account. Remember that even if a certain website or service looks legit, it isn’t necessarily the case. If you register an account on a malicious site, even a VPN may not save the day. Stay tuned to explore what else you can do to keep your online banking activities safe.

Switching a VPN server

Another rule of thumb for safe online banking is to avoid changing your VPN server locations when you’ve already logged in. When you switch a server, your IP address and virtual location immediately change. Your bank may perceive it as fraud and even block your account.

That said, your safest bet is to choose a server location that suits your needs best, connect to it, and only then access your banking account.

Now, let’s figure out what else you can do to improve your online banking safety.

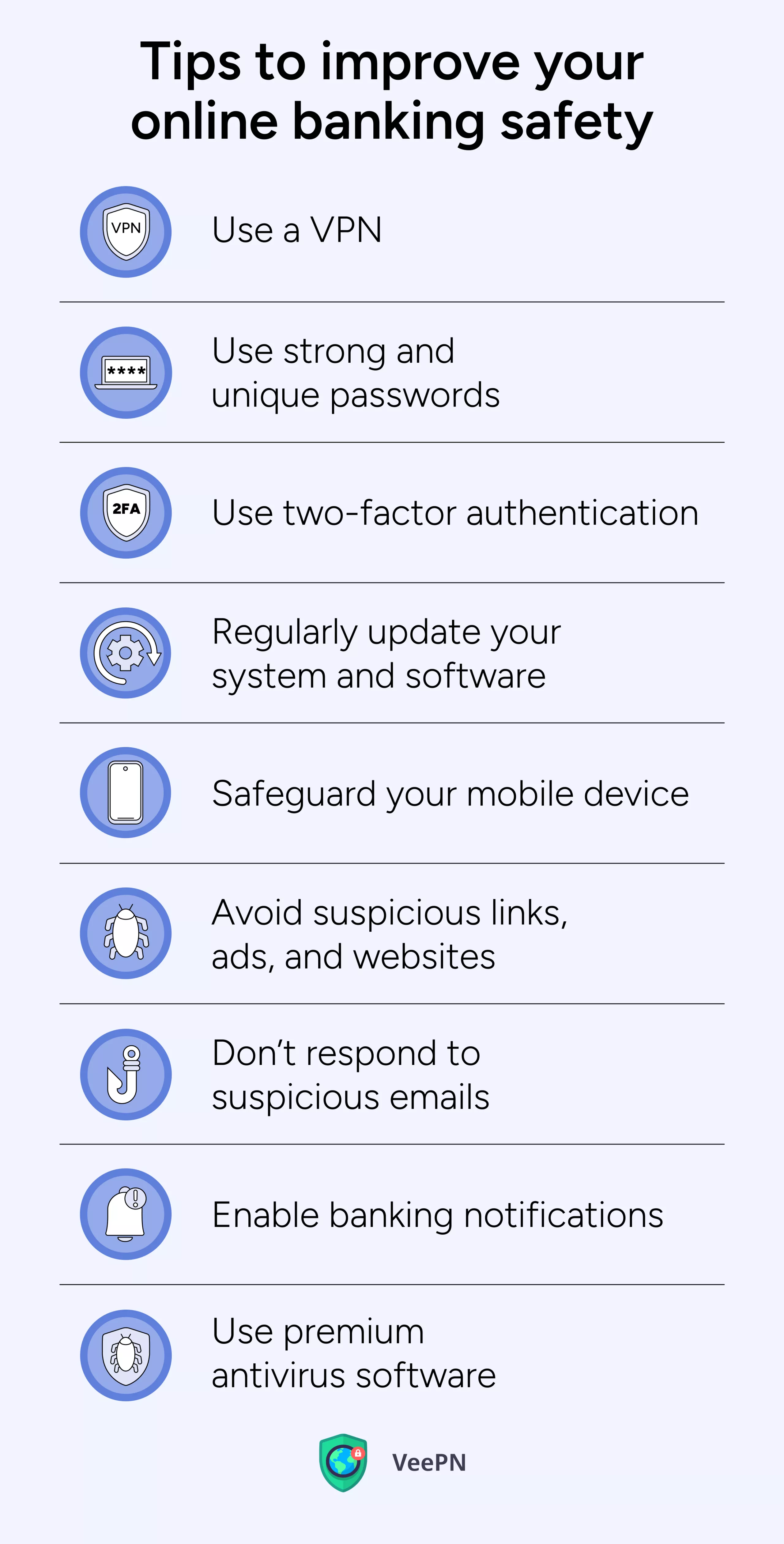

Other tips to improve your online banking safety

While a VPN and bank account security are closely related, it’s not the only thing you can do to protect your sensitive info. Here are some other important measures you should take.

- Use strong and unique passwords. With data leaks being among the most significant risks related to online banking, you need to strengthen your defenses at all levels. Avoid using weak passwords for your banking apps and never reuse your credentials on several accounts. Also, remember to update your passwords regularly to minimize the chances of unauthorized access.

- Use two-factor authentication (2FA). 2FA provides an extra security layer to your online banking account by adding one more step to your login process. Requiring a code sent to your phone number or another app makes it much more difficult for a hacker to break in.

- Regularly update your system and software. Outdated operating systems and applications might have major security flaws and vulnerabilities. Make sure to install the latest versions of your software to address those weaknesses before they cause any trouble.

- Safeguard your mobile device. Protect your smartphone or tablet using its privacy and security features, such as screen lock or security folder. You may even hide your banking app from the home screen, which will make it more challenging to access if your device appears in the wrong hands. Check out our blog to learn more about the essential Android and iPhone security settings.

- Avoid suspicious links, ads, and websites. What happens if you click on an infected link, pop-up, or ad? It may either take you to a malicious website attempting to steal your credentials or infect your device with a certain form of malware. One way or another, this brings you a step closer to getting compromised by cybercriminals. With that being said, it’s important to stay away from questionable links and dubious web pages.

- Don’t respond to suspicious emails. Have you received an email from your bank telling you that if you don’t take urgent action, your account will be frozen? Even if it looks alarming, don’t follow these instructions immediately. Instead, check whether the email is genuine, as you may be dealing with a phishing trick. It’s best to contact your bank directly and clarify the incident.

- Enable banking notifications. If anything unusual happens to your bank account, you should react as soon as possible. Allow your banking app to send you notifications and take control whenever required.

- Use premium antivirus software. Enrich your online security toolkit with a strong antivirus to gain protection against malware, spyware, and other harmful programs or files. Run regular system scans to ensure nobody is stealing your sensitive data from right under your nose.

Try VeePN — your reliable online banking guardian

Looking for the best VPN for online banking? Check out VeePN — a powerful online security solution that comes with the following perks:

- 10 devices per account: Set up VeePN on your smartphone, tablet, PC, or any other device — ensure banking safety for all your family with a single subscription.

- AES-256 encryption: Cover your entire traffic with advanced VPN encryption for banking. Don’t let anyone snoop on you, even on public Wi-Fi.

- Protection against phishing and monitoring: Stay away from phishing attacks, scams, malware-infected websites, and other online threats. Enhance your cybersecurity with the VeePN NetGuard feature.

- Kill Switch: Even if your VPN connection suddenly fails, your private data will remain safe and sound with Kill Switch. It immediately interrupts your Internet connection to prevent any possible leaks.

- Breach Alert: Your banking data could fall into the wrong hands without you even knowing it — but not on our watch. VeePN Breach Alert will instantly inform you once your credit card details, SSN, or banking account credentials are noticed in a security breach.

- Antivirus: Run scheduled system scans and enjoy 24/7 protection with VeePN Antivirus. Secure your Windows and Android devices from malware, hacks, injection attacks, and other possible risks.

Look at VeePN’s pricing plans and try it out today with a risk-free money-back guarantee!

FAQ: Is VPN safe for online banking?

Yes! It’s much safer to access your online banking account with a VPN. This tool encrypts your Internet traffic, prevents third-party monitoring, and keeps you away from various cyber-threats. Protect yourself from phishing attacks, scams, and public Wi-Fi threats with VeePN — a reliable solution to safeguard your online banking experience.

While banks don’t tend to encourage their customers to use VPNs, it’s definitely not illegal to do so in most parts of the world. In fact, a VPN for online banking is worth it as it protects your data, encrypts your traffic, and prevents different types of cyber-attacks. Check out this article for more details.

Much safer than without it! When you’re connected to a VPN, your entire traffic, including all browsing and app activity, goes through an encrypted tunnel. Therefore, it’s nearly impossible for a hacker or snooper to compromise your connection, steal your credentials, or gain unauthorized access to your banking account.

While there are numerous decent services out there, we recommend VeePN — perhaps, the best VPN for online banking. Reliable AES-256 encryption, robust VPN protocols, and additional security features like NetGuard provide solid protection against potential risks you may encounter. Give VeePN a shot with a 30-day money-back guarantee!

Yes, secure online banking with a VPN is possible — but only if your service provider is trustworthy. Many free VPN services are dangerous since they collect and share sensitive customer information. Moreover, some of them may turn out to be malicious programs designed to compromise your data. In contrast, credible services like VeePN provide all the necessary features to enhance your Internet security for banking.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan