How to Use an Anonymous Credit Card to Avoid Online Payment Risks

Protecting your financial identity online has been a goal for a long time. With over $1.59 billion lost to payment-related frauds, many users are turning to alternative solutions like an anonymous credit card. According to the Federal Trade Commission, reports of credit card fraud continue to rise, so you need stronger consumer protections and secure payment methods. These tools promise more privacy and fewer risks during online purchases. But how do they work and are they really secure?

This guide will walk you through everything.

The dangers of traditional online payments

Credit and debit cards can expose the following sensitive information to hackers:

- Your name and address

- Card numbers and CVVs

- Spending habits and location data

Even with security protocols in place, data breaches happen. That’s where VeePN comes in. It encrypts your traffic and hides your IP address, so your identity and the data mentioned above are out of reach from cybercriminals and advertisers.

Why users seek anonymous payment methods

From phishing scams to intrusive tracking, online payments leave a digital trail. Using incognito mode while making online payments can further enhance your privacy. Privacy credit cards help protect your privacy and sensitive information by keeping your personal details hidden.

Here are the main reasons why people look for anonymous payments:

- Identity theft: Anonymous cards save you against data theft including your name, address and bank account information: the holy grail of hackers.

- Targeted advertising and monitoring: With traditional payment solutions, the advertisers and the platforms can create a profile of your purchases. Anonymous cards help to lessen the data you provide.

- Confidentiality in delicate purchases: Be it a medical supply, personal goods or giving to a cause under the radar, the anonymity of the card is a preferred feature sought by many consumers.

What is an anonymous credit card?

Anonymous credit cards let you pay online without revealing your identity. No payment method is completely anonymous, but anonymous credit cards are the closest by minimizing the personal information shared. They help you avoid exposing:

- Billing address

- Full name

- Linked bank accounts

Some services even let you use an assumed name when signing up for an anonymous credit card.

These cards act as a buffer between you and the merchant, protecting you from unwanted data collection and fraud. They often use a virtual card number to further protect your real financial details.

Benefits of anonymous transactions

Anonymous transactions bring many advantages for anyone concerned about online security and privacy. By using untraceable credit cards, you can keep your sensitive data safe from prying eyes. Since these cards aren’t linked to your main bank account, your financial details are protected even if a merchant suffers a data breach.

One of the best benefits is the ability to set spending limits and expiration dates on virtual cards. So you can avoid unwanted recurring payments or accidental overspending, you have more control over your online purchases. If a subscription service tries to charge you after your card’s expiration date, the payment won’t go through.

Overall, the benefits of using anonymous transactions card are the following:

- Better privacy: Such cards do not give your personal and financial information to databases of merchants, decreasing the chances of identity theft.

- Control of spending: Most of the anonymous cards (and more so those that are virtual cards) allow you to control the amount of money you spend by setting limits as well as expiry dates preventing you from overspending and this also prevents the overcharging concept.

- Fraud protection: You can avoid connecting the card to your primary bank account so that in an event of a breach or a scam you can keep the losses at a minimum.

- No paper trail: To people who may wish to keep quiet about their expenditure either due to security or privacy.

Types of anonymous cards and how they work

Let’s take a look at the most common types of anonymous cards:

Prepaid cards

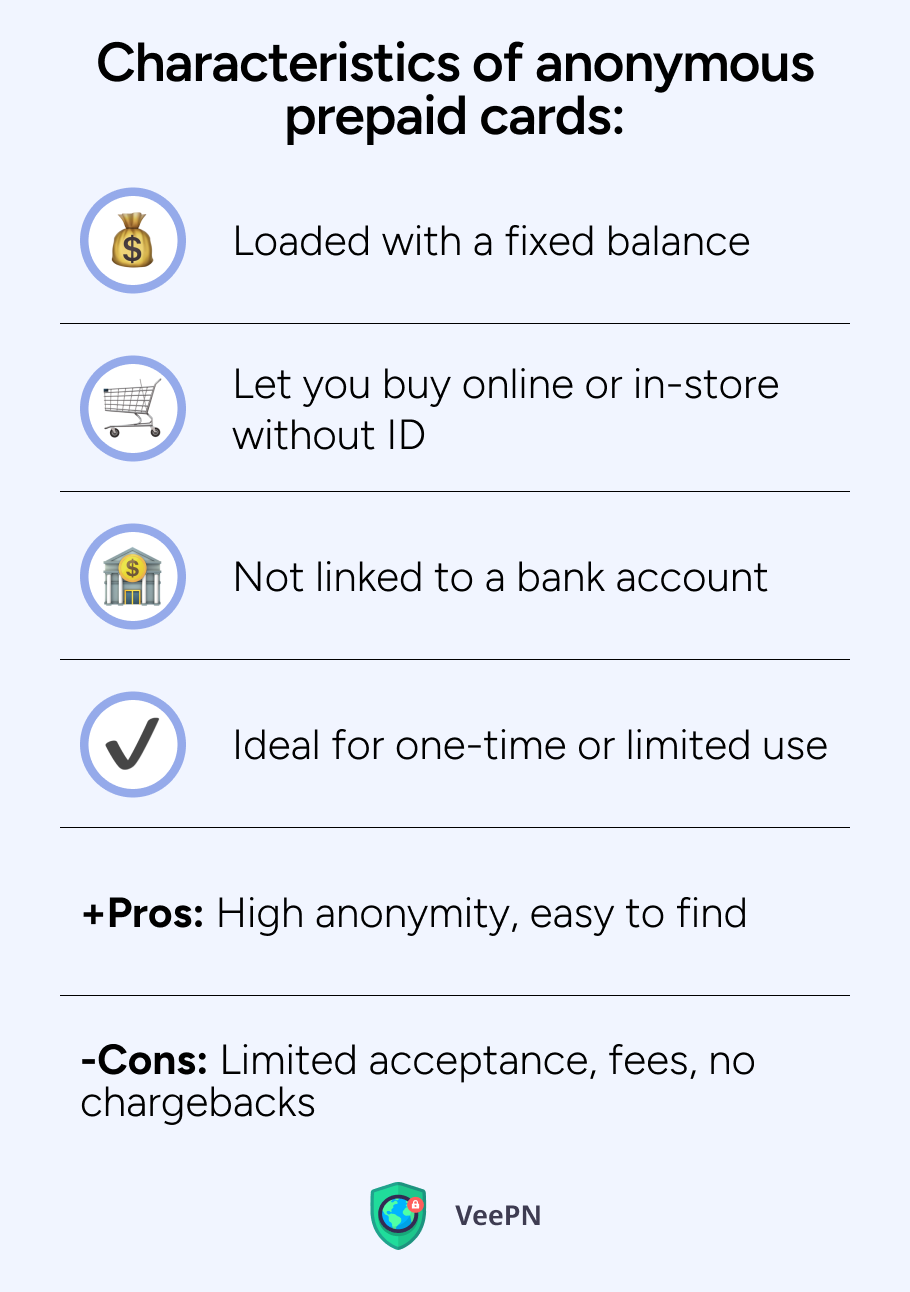

Anonymous prepaid credit cards are:

- Loaded with a fixed balance

- Let you buy online or in-store without ID

- Not linked to a bank account

- Ideal for one-time or limited use

➕Pros: High anonymity, easy to find

➖Cons: Limited acceptance, fees, no chargebacks

Virtual cards

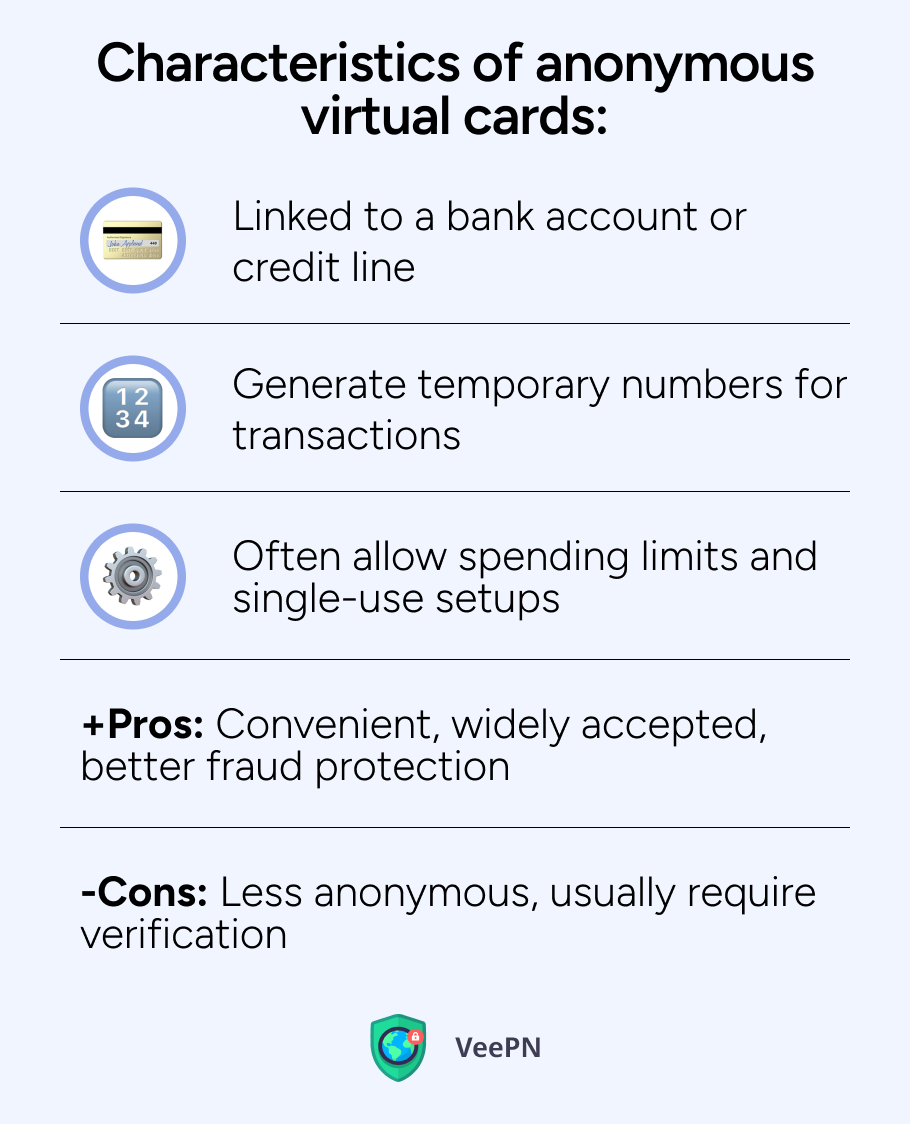

Anonymous virtual credit cards can offer the following benefits:

- Linked to a bank account or credit line

- Generate temporary numbers for transactions

- Often allow spending limits and single-use setups

➕Pros: Convenient, widely accepted, better fraud protection

➖Cons: Less anonymous, usually require verification

Prepaid vs. virtual cards: What to choose?

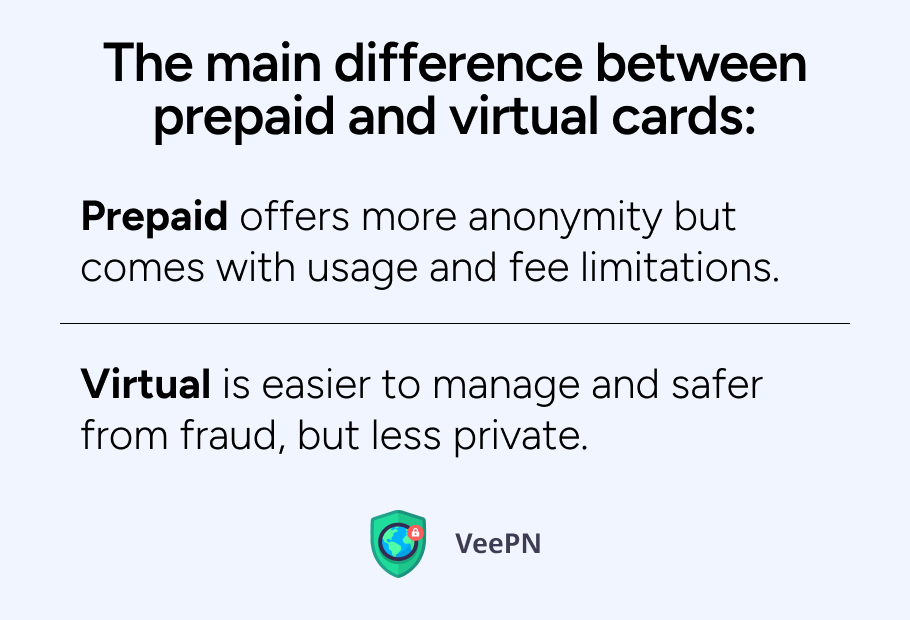

Here’s the main difference between prepaid and virtual cards:

- Prepaid offers more anonymity but comes with usage and fee limitations.

- Virtual is easier to manage and safer from fraud, but less private.

⚠️Advice: Choose based on what matters more to you: privacy or flexibility.

Remaining risks: You’re still trackable

Even if your payment is anonymous, your device still shares:

- Your IP address

- Location info

- Device fingerprinting data

Hackers, Internet Service Providers (ISPs), and merchants can track this info. That’s where a virtual private network (VPN) comes in to ensure your Internet privacy. Let’s discuss it in more detail!

The solution: Use a VPN to secure your transactions

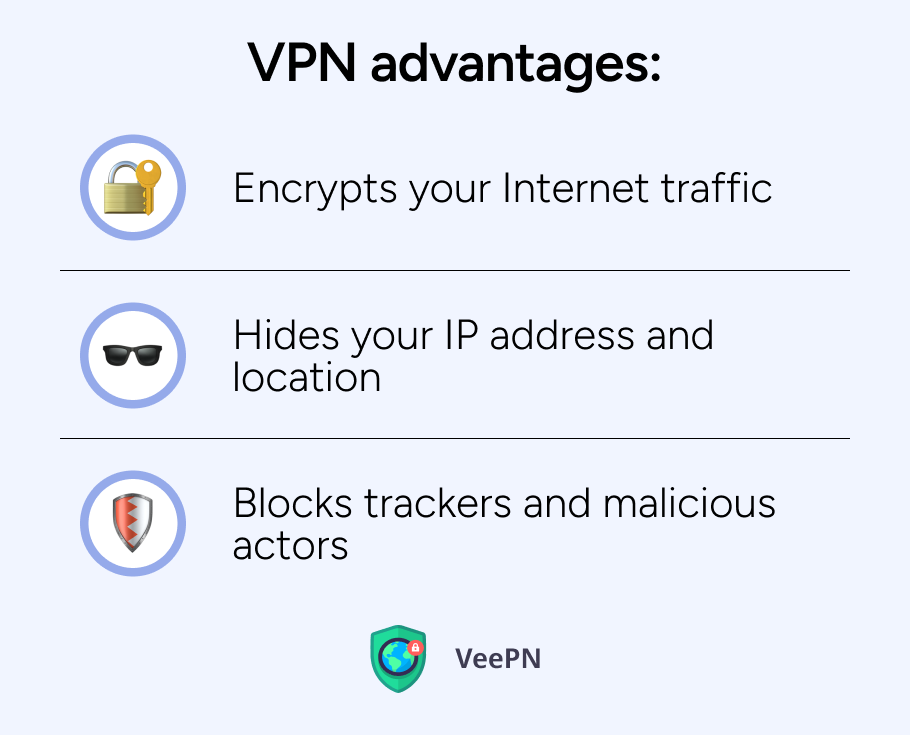

A VPN like VeePN adds another layer of privacy and offers the following advantages, if you do care about your privacy:

- Encrypts your Internet traffic. This means nobody can read your sensitive info even if they manage to intercept your connection.

- Hides your IP address and location. This means you and your transactions remain truly anonymous, as you won’t reveal your whereabouts.

- Blocks trackers and malicious actors. Your device will remain completely secure from malware and spam.

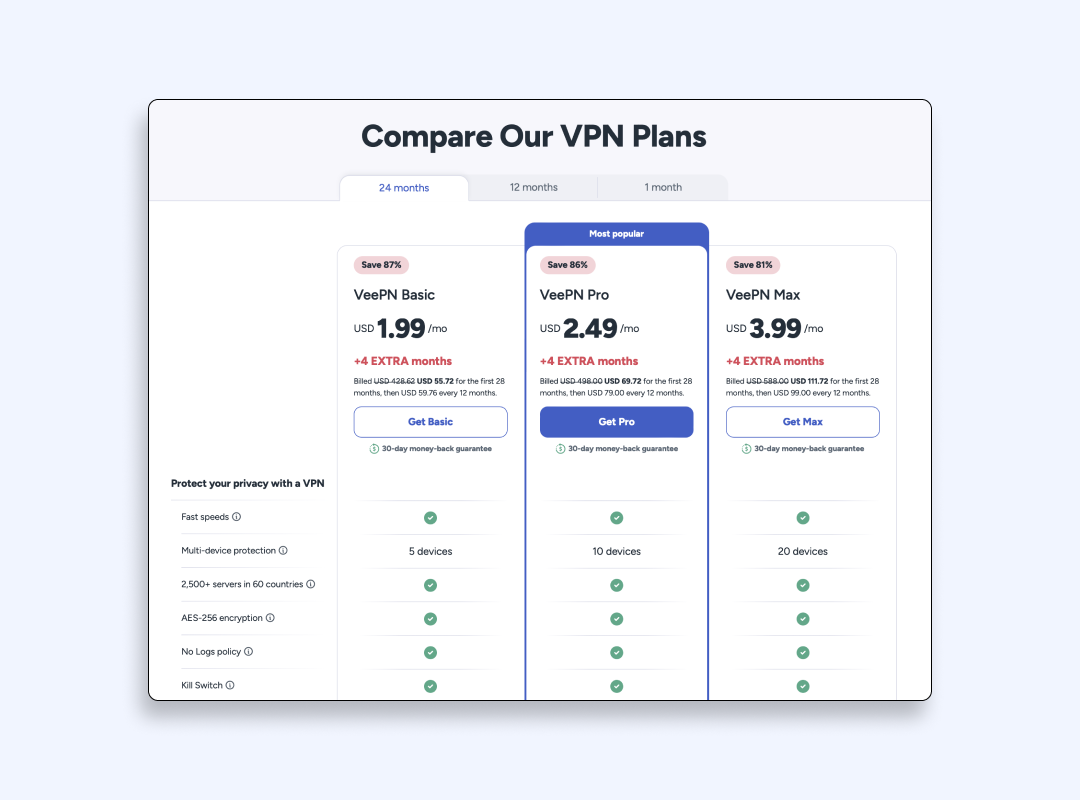

In terms of online transactions and privacy protection, VeePN is a top-notch VPN service? Let’s find out what you get from this solution.

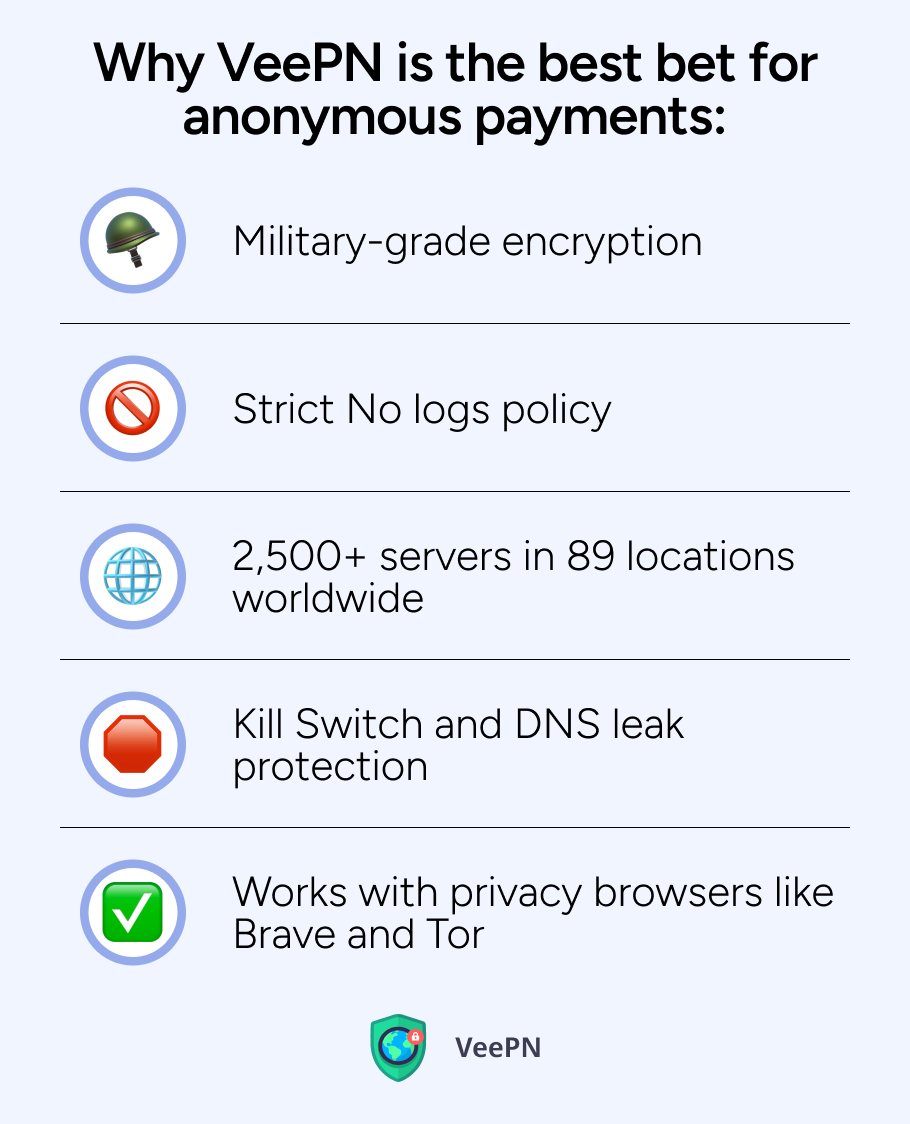

Why VeePN is your best bet for anonymous payments

VeePN offers a wide range of features and benefits such as:

- Military-grade encryption. It’s the best standard so far, so your sensitive data will be secure.

- Strict No logs policy. We don’t collect your personal information for commercial purposes.

- 2,500+ servers in 89 locations worldwide. You’ll have a high-speed and stable connection anywhere.

- Kill Switch and DNS leak protection. Even if a VPN connection drops, your device will be secure.

- Works with privacy browsers like Brave and Tor. It’s safe to use these browsers when VeePN is running on your device.

How to stay anonymous online using a virtual card and VeePN

Here’s a step-by-step guide on how you can use VeePN for anonymous transactions:

- Get a virtual card from a provider like Privacy.com.

- Download and subscribe to VeePN.

- Connect to a secure VPN server.

- Use a private browser like Brave or Tor.

- Make your purchase without using real personal info.

Get VeePN now and try it risk-free for 30 days!

FAQ

Use a prepaid card bought with cash at a store or a virtual card tied to a masked payment service like Privacy.com. These don’t link to your identity, but you can’t use them with your real name or on accounts tied to your identity. For extra privacy, use a VPN and burner email when online shopping.

Yes, you can use anonymous credit or prepaid cards for online shopping as long as the website accepts them and doesn’t require full identity verification. Just make sure the billing ZIP code matches what the card issuer provides or you’ll get transaction failures.

Yes, using anonymous or prepaid credit cards is legal in the US for privacy-conscious purchases. But using them for illegal activities or to evade financial regulations (like AML/KYC laws) is strictly prohibited and can get you in legal trouble.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan