Is Apple Pay Safe? A Deep Dive into Its Security Features and Concerns

Apple Pay is the number one digital wallet, popular with 92% of all smartphone users across the globe. Convenience and simplicity of use make Apple Pay an attractive payment option. You can pay with your iOS device in a couple of taps without a physical credit card and entering your payment information.

However, with convenience comes a concern: is Apple Pay safe enough for daily transactions? Is everything so nice and easy with this digital wallet? To answer these questions, we’ll critically examine Apple Pay security features and its main vulnerabilities. Join us as we go through the ins and outs of this digital wallet’s security.

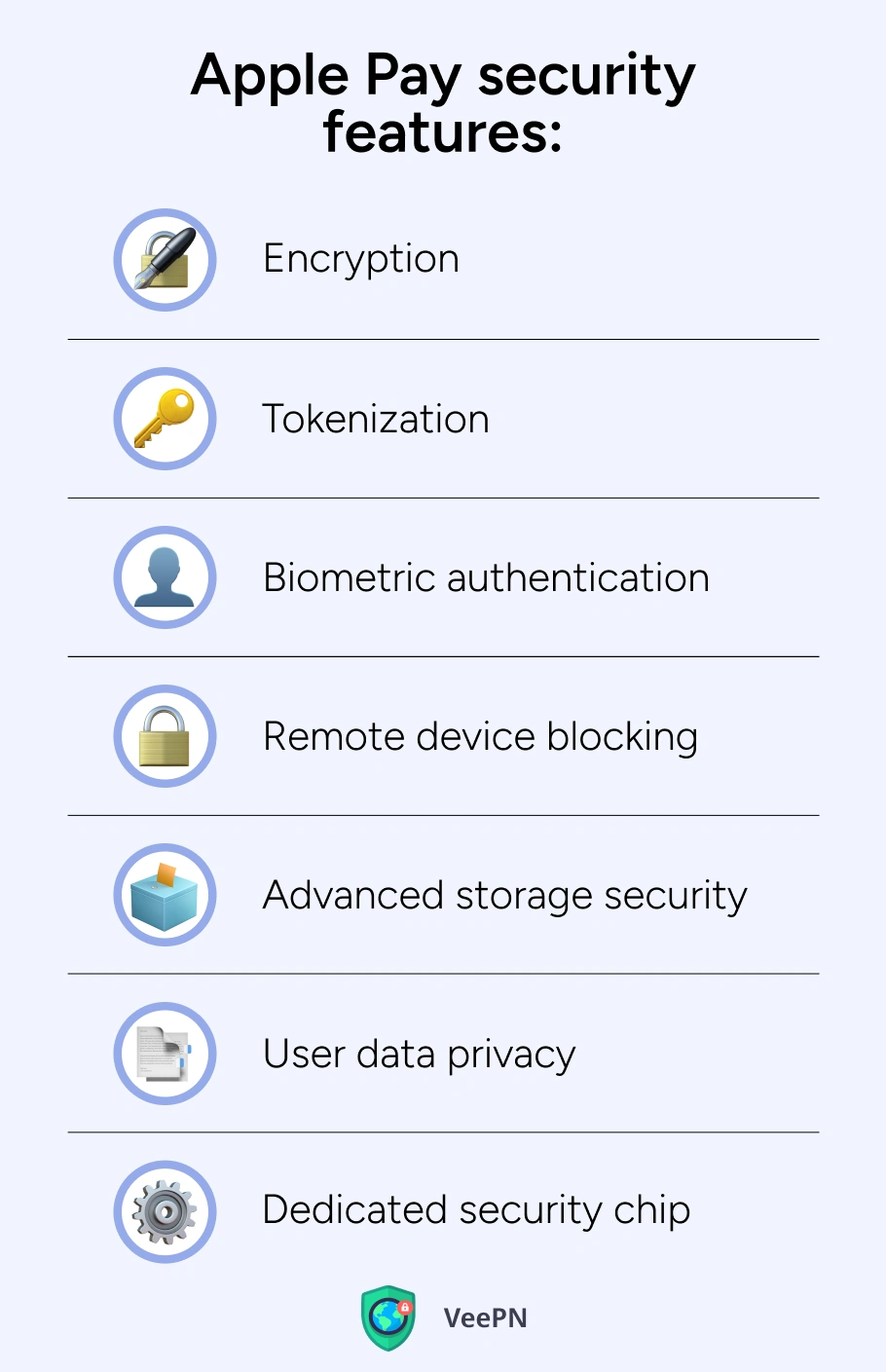

Apple Pay security features

Security, security, and once again security is one of the main Apple products’ strengths since the company’s inception. Apple Pay is no exception as this digital wallet is protected with a wide range of security features:

🔐Encryption. With Apple Pay encryption, all your financial information turns into a bunch of gibberish nobody can decipher without a special decryption key, which makes your payment data a pointless target for interception.

🔐Tokenization. Your payment details are replaced with a unique Device Account Number. This means merchants never see your real card details.

🔐Biometric authentication. To confirm a transaction, you need to use Face ID, Touch ID, or enter your passcode to validate your identity.

🔐Remote device blocking. You can use a Find My iPhone feature to remotely block the use of Apple Pay, in case your device is lost or stolen.

🔐Advanced storage security. Apple Pay doesn’t store your actual card numbers on your device or Apple servers.

🔐User data privacy. Apple doesn’t share your payment information with merchants, but they can access just enough information to complete a payment.

🔐Dedicated security chip. All Apple devices that support Apple Pay have a special chip that isolates your financial information for better security.

It looks like Apple Wallet security is just flawless. But there are several things that make the apple a little bit poisonous. Keep on reading to learn about Apple Wallet security issues!

Apple Pay security issues

Despite impeccable security features, there are certain issues with Apple Pay safety you should be aware of:

⚠️Device theft/compromise. If somebody gets access to your unlocked device, they’ll be able to make payments with Apple Pay.

⚠️Phishing attacks. If you click on a suspicious link or share your personal information with the sender of a strange message, you’re likely to fall victim to a phishing attack. In this case, even Apple’s CEO, Tim Cook, won’t be able to safeguard you from losing your money from bank cards linked to your Wallet.

⚠️Weak passcodes or biometrics. Using weak passcodes or neglecting biometric security features can increase the risk of unauthorized access.

⚠️Merchant vulnerability. Even though Apple does its best to protect your payment information, you don’t have such a solid guarantee from the side of merchants that still can possess some of your data. In case a data breach happens on their end, your sensitive information will leak as well.

⚠️Relay attacks. These attacks are rare for Apple devices but are sophisticated enough to trick unsuspecting iPhone users. A relay attack happens when hackers intercept and forward communication between two devices, like a credit card and a payment terminal, tricking them into thinking they’re directly connected. This lets the attackers steal information or complete transactions without the victim knowing. It’s like pretending to be a middleman but secretly stealing along the way. Since Apple Pay works as your digital credit card, there is a chance you can get into such a scam.

But all these security risks are easy to mitigate if you have a good command of the effective security strategies. To “depoison” your Apple Pay experience, we’ve prepared a list of actionable tips you can use to pay with this digital wallet safely.

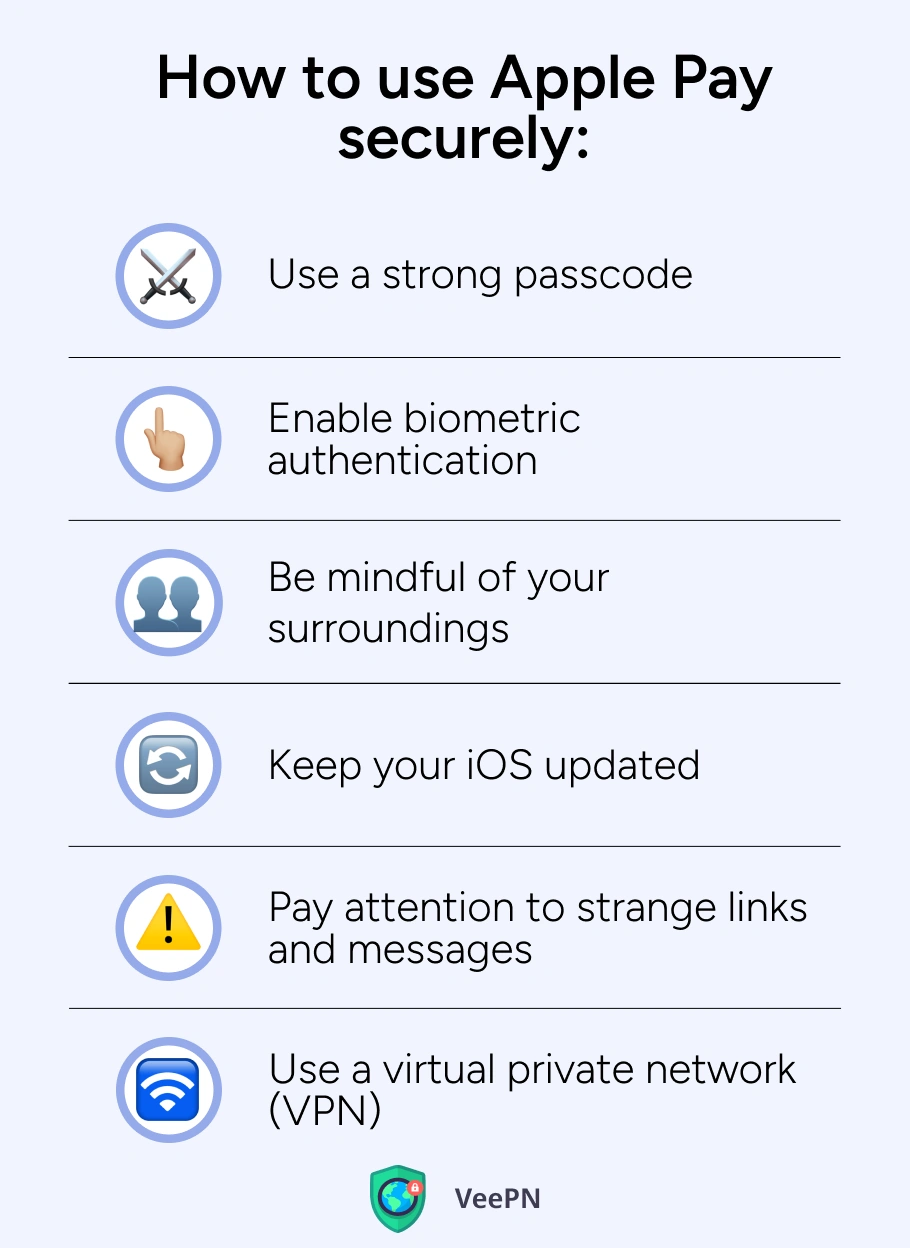

How to use Apple Pay securely

For a secure use of Apple Pay, consider following these steps:

🍏Use a strong passcode. Create a hard-to-guess passcode to avoid the possibility of cracking it with brute force. Needless to say, 00000 or your birth date isn’t strong enough to protect your financial information.

🍏Enable biometric authentication. If you turn on Face ID or Touch ID you not only minimize risks of an unauthorized use of Apple Pay but also make your payments faster. One tap — and payment is made!

🍏Be mindful of your surroundings. In spite of sophisticated hacker attacks and respectively advanced cybersecurity technologies, looking over one’s shoulder is still a good old friend of thieves and fraudsters. You have to stay vigilant and careful when you use Apple Pay somewhere in public. Watching you enter a passcode and then stealing your iPhone to make payments with it is a criminal’s low-hanging fruit.

🍏Keep your iOS updated. Just keep your iOS version up-to-date to have the most recent security patches, leaving hackers little chance to exploit any vulnerabilities for a living-off-the-land attack.

🍏Pay attention to strange links and messages. Be cautious of any offers or requests related to Apple Pay that seem too good to be true. Scammers may try to trick you into revealing your information or making fraudulent payments.

🍏Use a virtual private network (VPN). When you use a VPN app, it passes all your Internet traffic through an encrypted “tunnel” to a remote server. In such a way, nobody can intercept your payment information.

Using a VPN is particularly useful for securing your payments when you access the Internet via public WiFi networks that aren’t secure and often become easy targets for hackers and scammers. However, we advise you not to use free VPN apps as they lack robust encryption and advanced security features to shield you against the above-mentioned risks. VeePN can be a reliable premium alternative that offers 360-degree security with a range of security features and beyond. Let’s check them!

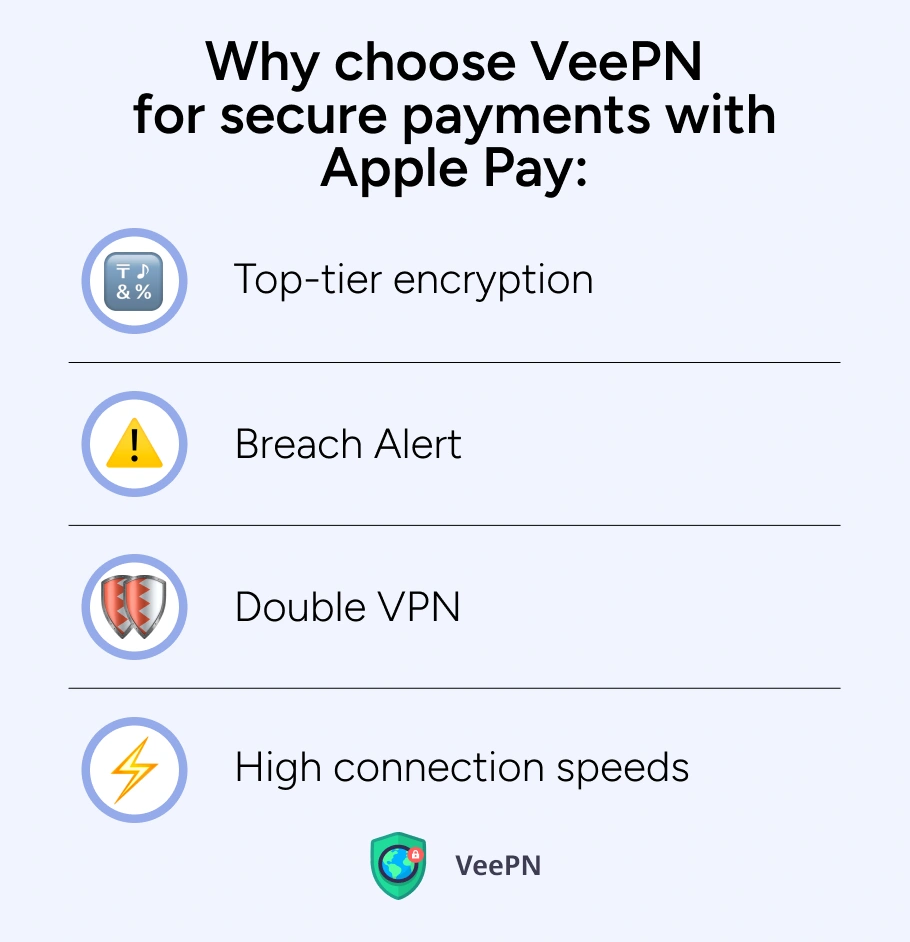

Why choose VeePN for secure payments with Apple Pay

VeePN is an all-in-one cybersecurity app that can secure your payment information, so you can use Apple Pay without any concerns. Our app offers such tools and features as:

🛡️Top-tier encryption. VeePN uses the most secure encryption standard, which makes it impossible to read a bit of your financial information without a special decryption key. It will take hackers thousands of years to crack your encrypted information.

🛡️Breach Alert. If any of your payment credentials leak and appear in hacked databases, this tool will instantly alert you to take immediate action.

🛡️Double VPN. VeePN is capable of passing your traffic through two remote servers that actually encrypt the already encrypted information. A solid layer of security that can break the sharpest hacker teeth!

🛡️High connection speeds. Even though VPN apps are believed to slow down your connection speeds, it’s definitely not the VeePN’s case. Our app uses a WireGuard® protocol that ensures reliable encryption without decreasing your Internet connection. You’ll keep using your iOS device as if there is no VPN involved.

VeePN has a standalone iOS application and offers a 30-day money-back guarantee. Install VeePN right now to secure your Apple Pay transactions!

FAQ

Apple Pay is pretty safe for purchases as it uses tokenization to replace your card details with a unique code for each transaction so your actual card info isn’t shared. It also requires biometric authentication (Face ID or Touch ID) or a secure passcode. But still, be aware of phishing or someone getting access to your device.

Apple Pay is safer than using a physical credit card as it doesn’t share your actual card details during transactions. It uses tokenization and encrypts your payment info so card skimming or data theft is reduced. And Apple Pay requires biometric authentication or a secure passcode so it’s harder for someone to make a purchase.

No, Apple Pay can’t be skimmed in the classical sense as it doesn’t use the magnetic stripe or share your actual card details. It uses tokenization, a unique code for each transaction. This makes it immune to card skimming.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan