Anonymous Payment Methods: 10 Ways to Pay Privately and Stay Secure

Anonymous payment methods are no longer a form of unnecessary obsession. They are a necessity for privacy. The FBI reports that Americans lost $16.6 billion to online scams in 2024, which is 33% more than the year before. Every breach, phishing attack, or sneaky tracking cookie chips away at our privacy, exposing names, billing addresses, and bank account details to crooks or data brokers.

When even major companies like Ticketmaster can leak data on 560 million customers, paying online without leaving a trace doesn’t feel like paranoia and more like a must-have habit.

In this article, you will find 10 private payment methods that you can start using today, with pros and cons, real-world examples, and a VPN tool to keep your every transaction safe.

How adding a VPN will enhance the safety of your anonymous online payments

A little warning before giving the list. Even if you use the most anonymous online payment methods, your privacy can still be exposed through your IP address. Each time you visit or log in to a site, your IP address reveals your location that can be used to trace your activity, even though your name is not disclosed on your payment app or virtual card.

That’s why pairing these tools with a virtual private network (VPN) is essential. A good VPN like VeePN:

- Hides your real IP, replacing it with one from another location

- Encrypts your connection, so no one can see what you’re doing — not hackers, not websites, not your ISP

We’ll give more details after the list below. Now, let’s see how you can make your payments anonymous.

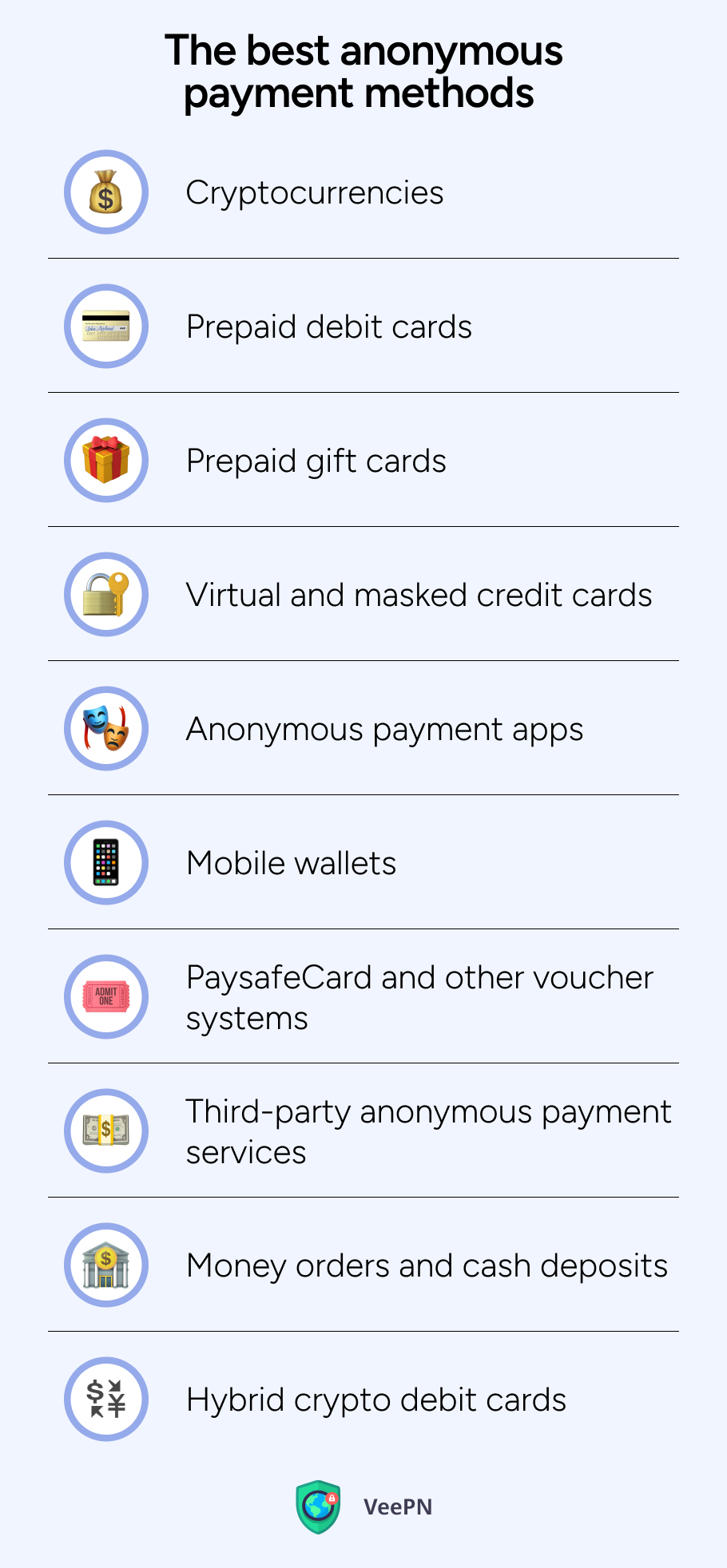

Top 10 anonymous payment methods

Here are 10 of the most practical and widely available anonymous payment options if you don’t want to expose your name, bank account, or credit card. They will be helpful in case you want to avoid identity theft, dodge tracking, or just stay private when making online transactions:

1. Cryptocurrencies

When most people think of anonymous payments online, they think crypto. But here’s the deal: not all cryptocurrencies are private by default. Bitcoin is the most well-known, but every transaction is logged publicly. If someone links your wallet to your identity, even once, your entire transaction history can be traced.

That’s why privacy coins like Monero and Zcash are better bets from this point of view. They’re built for anonymous transactions, hiding key info like sender, receiver, and even the amount.

The dark side of cryptocurrencies. Many exchanges ask for personal documents before letting you buy or sell, which cancels out the whole point of staying anonymous. Also, many crypto trading platforms like Binance or KuCoin are blocked in the US for not adhering to the local regulations, so you need a workaround to access them without restriction.

| Pros | Cons |

| 👍 No need to share your personal details for making transactions. 👍 Privacy coins hide your identity by default. 👍 Works globally without financial institutions. | 👎Some cryptocurrencies are publicly traceable. 👎Exchanges often require ID. 👎Crypto prices can swing wildly. 👎Some trading platforms may be unexpectedly blocked due to local regulations. |

2. Prepaid debit cards

You’ve probably seen those reloadable Visa or Mastercard cards in stores. Buy one with cash and you’ve got a simple way to pay online without sharing any bank account information.

They work just like a regular debit card, but you only spend the money you put on them. That makes them great for keeping spending limits in check. Just be ready for small activation fees, and make sure the store ZIP code matches if you need to register it online. They won’t last forever, and if something goes wrong with a transaction, refunds are rarely easy.

| Pros | Cons |

| 👍 You can pay with total anonymity when buying in cash. 👍 Works well with most online merchants. 👍 Good for setting spending limits. | 👎 May charge activation and usage fees. 👎 Not always easy to get refunds. 👎 May require a ZIP code for registration. |

3. Prepaid gift cards

These are probably the easiest way to make a completely anonymous payment. Walk into a store, pay cash for a gift card, and walk out without ever showing an ID.

The only downside is that they’re limited to the store they’re issued for, like Amazon or Steam. Prepaid gift cards are great for one-time online purchases, but not ideal if you need flexibility. And if you lose it, that money’s gone for good.

| Pros | Cons |

| 👍 Totally anonymous when paid for in cash. 👍 No name, billing address, or login needed. 👍 Perfect for small, low-risk online transactions. | 👎 Only works with specific retailers. 👎 Not valid on many international sites. 👎 Lost cards can’t be recovered. |

4. Virtual and masked credit cards

These cards don’t physically exist, they’re digital. You just need to connect them to your main credit card or bank account, and they give you a fake number to use for online shopping. That means if one site gets hacked, your real card is safe. You can also set limits or cancel the number after one use, which makes them perfect for trial services or websites you don’t fully trust.

But remember that to use this method, you still need a real account behind masked credit cards. So while merchants don’t see who you are, the card provider does.

| Pros | Cons |

| 👍 Keeps your real card details hidden. 👍 Great for subscriptions or risky websites. 👍 Lets you create limits or auto-expiring cards. | 👎 Still tied to your identity at the backend. 👎 Some retailers won’t accept them. 👎 Needs an existing bank account or card to work. |

5. Anonymous payment apps

There are apps like Cash App, PayPal, and Venmo that are fast and easy. But not very private by default.

For example, Venmo has a social feed that literally shows who paid whom and for what unless you change the settings. CashApp is a bit better, as it lets you use $cashtags instead of real names, but you’ll still have to verify your identity if you want to send or receive larger amounts.

| Pros | Cons |

| 👍 Easy peer-to-peer payments. 👍 Used by most online services and side hustles. 👍 Offers some buyer protection. | 👎 Requires verification for higher limits. 👎 Public feeds can leak private info. 👎 Scam risks are high. |

6. Mobile wallets

If you’re paying in a store or app, Google Pay and Apple Pay are super convenient. These mobile payment services use tokenized numbers to hide your real card info from merchants.

But unless you fund them with a prepaid card, they’re still linked to your actual bank account or credit card. That defeats the purpose of anonymous online payments.

In addition, mobile wallets are getting attacked by scammers who install malware called “Ghost Tap” to steal your tap-to-pay system and use it to spend your money without users knowing it.

| Pros | Cons |

| 👍 Hides your real card number from stores. 👍 Quick and easy for in-app purchases. 👍 Built-in security like biometrics. | 👎 Still linked to real financial accounts. 👎 Can be exploited by tap-to-pay scams. 👎 Not anonymous unless funded with prepaid tools. |

7. PaysafeCard and other voucher systems

Paysafecard and similar voucher services let you pay online without using a card or bank account at all. You just buy a paper voucher at a store, scratch off the code, and enter it online.

Voucher systems don’t require attached signups and personal information. They are great for gaming and subscriptions. But there are limits. You can’t use it everywhere, denominations are fixed, and if you lose the paper, you’re out of luck.

| Pros | Cons |

| 👍 No bank or card info needed. 👍 Fully private when paid for in cash. 👍 Great for underage users or low-trust sites. | 👎 Only works at specific online stores. 👎 Denominations are limited. 👎 Lost vouchers are gone forever. |

8. Third-party anonymous payment services

With sites such as BitRefill and CoinCards, you can use crypto without interacting with stores. You exchange your coins to purchase gift cards for Amazon, Uber or other platforms. These services work as a privacy buffer. Instead of giving your info to an online store, you just redeem a gift card that can’t be traced back to your name.

There are trade-offs, though: fees, availability, and occasional delays. And you’re trusting a middleman, so pick one that’s well-reviewed and based in a privacy-respecting country.

| Pros | Cons |

| 👍 Helps keep your identity hidden from merchants. 👍 Lets you use crypto even on fiat-only platforms. 👍 No personal info needed for gift card redemptions. | 👎 May charge service fees. 👎 Gift card options vary by country. 👎 Some delays in delivery or activation. |

9. Money orders and cash deposits

Old-school but effective. If you need to pay someone, like a landlord or service provider, you can still use a money order. Buy it with cash at a post office or store, mail it out, and your name never enters the system.

Some people also use cash deposits directly into another person’s bank account. It’s not always accepted these days, but in certain cases, it’s still an option for anonymous money transfers. The downsides are obvious: slow, inconvenient, and you’ll usually have to go in person.

| Pros | Cons |

| 👍 No digital trail or online profile. 👍 Doesn’t require a bank account. 👍 Still useful for specific services or people. | 👎 Time-consuming and old-fashioned. 👎 Not accepted by most online platforms. 👎 Risk of physical loss or theft. |

10. Hybrid crypto debit cards

These cards offer convenience. You put them on them with Bitcoin or any other digital currency, and it is exchanged to regular cash when you make purchases. It’s a good way to use crypto for online shopping at stores that only take Visa or Mastercard. You don’t need to convert your crypto manually or wait for a transfer.

But to get one, you’ll need to complete Know Your Customer (KYC) checks, which means full identity verification, and the card issuer still tracks your activity. Therefore this option is not fully private.

| Pros | Cons |

| 👍 Lets you spend crypto like a normal debit card. 👍 Works with nearly any online payment system. 👍 Great for frequent travelers or mixed-use wallets. | 👎 Requires full identity verification. 👎 Exchange rates may be poor. 👎 Issuer can still track your transactions. |

So, using such anonymous payment methods is a smart way to protect your privacy. But as we said at the beginning of the article, if your IP address, device info, or location gets exposed, the whole idea of private payments is useless. That’s where a trustworthy VPN like VeePN comes in handy.

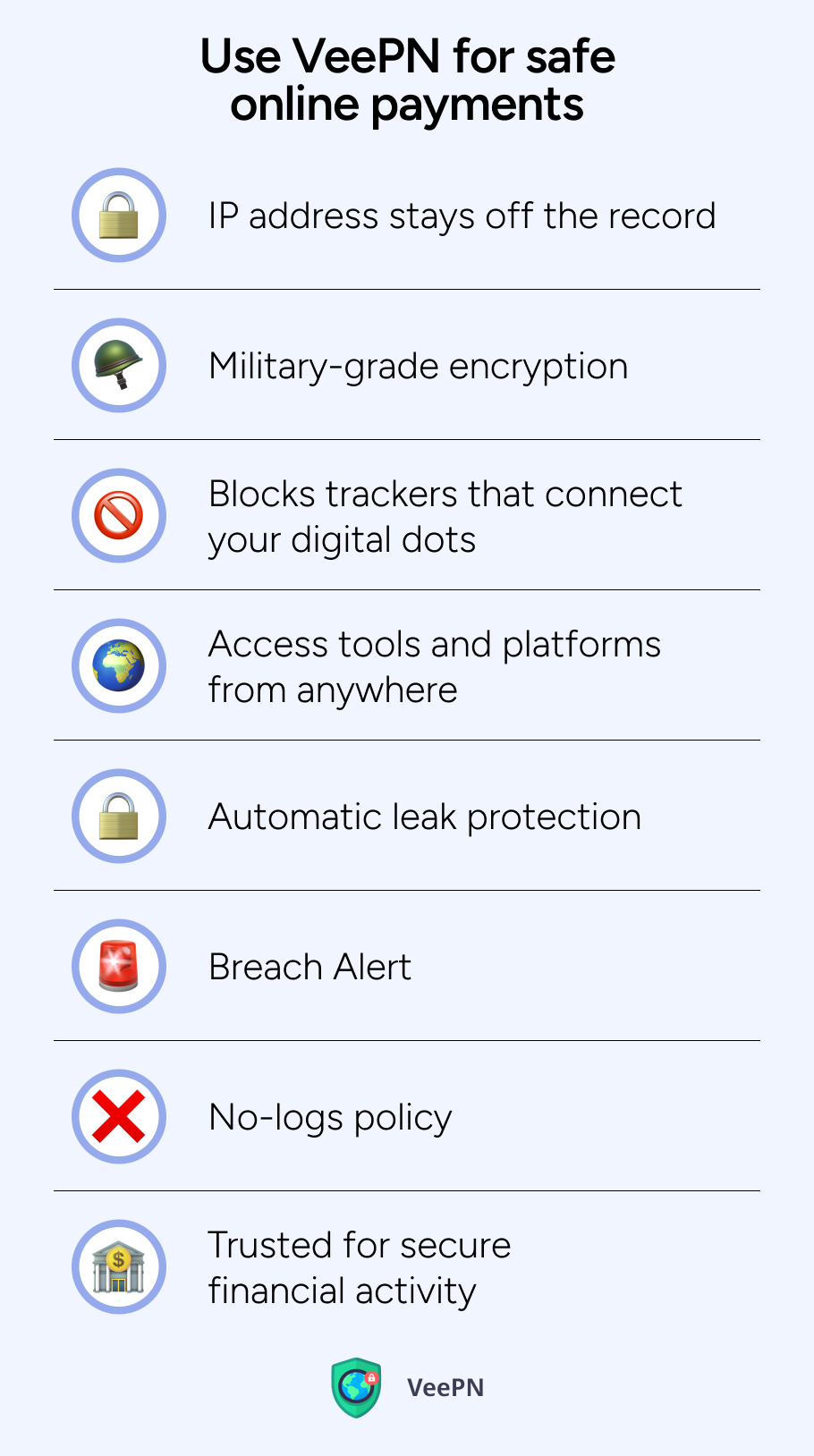

Choose VeePN for secure online payments

Here is what makes VeePN the go-to tool for this job:

IP address stays off the record

Every time you connect to a website or open a payment app, your IP says exactly where you are. VeePN assigns you an anonymous IP address from another country. In this way, neither websites nor payment platforms can trace your activity back to your real location.

Military-grade encryption

Whether you’re logging into a wallet or sending money, your connection gets fully encrypted with the strongest to date AES 256-bit encryption. Even if you’re on public Wi-Fi, your payment information is scrambled and unreadable to anyone watching. That includes hackers, snoopers, and even your Internet service provider.

Block trackers that connect your digital dots

Sites and payment tools usually track users, from page views to clicks to purchases. VeePN’s NetGuard feature blocks all those trackers and scripts that help you keep online activities disconnected from your anonymous transactions.

Access tools and platforms from anywhere

Some exchanges, voucher shops, and private checkout services are geo-blocked. With VeePN’s 2,500+ servers in 89 countries, you can access them like a local. For this, you just need to pick a location and go.

Automatic leak protection

If the VPN ever disconnects, VeePN’s Kill Switch instantly cuts off your Internet so your real IP address doesn’t leak.

Breach Alert

VeePN’s Breach Alert feature instantly notifies you if your personal or payment information shows up in a known data breach so that you can take action before it’s too late.

No Logs policy

VeePN doesn’t log anything. Not your browsing. Not your payments. Nothing. So even if someone comes knocking, we have nothing to hand over.

Trusted for secure financial activity

VeePN is safe enough for online banking. So whether you’re paying anonymously or logging into your main bank account, you can trust your data is staying private.

Try VeePN without any risks today with a 30-day money-back guarantee.

FAQ

- Cash-bought prepaid Visa/Mastercard cards. This is a prepaid payment method that doesn’t require your ID.

- Privacy coins like Monero: no banks, pseudonymous by design.

- Single-use virtual credit cards tied to your real card but shielding its number.

All three are widely accepted once you pair them with a VPN for extra cover. Discover more in this article.

- Move crypto into a burner wallet, run it through a mixer, then pay.

- Load cash onto a prepaid card and plug it into alias profiles on online payment services like PayPal.

- Use a VPN like VeePN plus a fresh email when shopping online so nothing links back to you.

- Keep each funding source separate and never reuse wallet addresses or usernames.

Discover more anonymous payment methods in this article.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan