Top Venmo Scams to Watch Out For (And How to Stay Safe)

Users love Venmo for making payments quickly and with ease, be it splitting dinner bills, sending money to friends, or even paying the rent. No wonder the platform boasts over 60 million active users in the US, which is about a fifth of the entire country’s population. But we know any popular platform can become a magnet for scammers eager to get their hands on users’ money.

In this article, we’ll uncover the common Venmo scams, show what they look like in real life, and give you go-to steps to steer clear of them, protect your money and safeguard your personal info from fraudsters.

Why Venmo is a primary target for scammers

When fraudsters observe a super-simple financial app boasting a fifth of the entire US population in users, making millions of transactions every day, they also see millions of potential victims to trick and steal their money.

Despite Venmo putting a lot of effort into the platform’s security measures, scammers are also creative enough to come up with ways to deceive Venmo users. Let’s take a look at the most common ones.

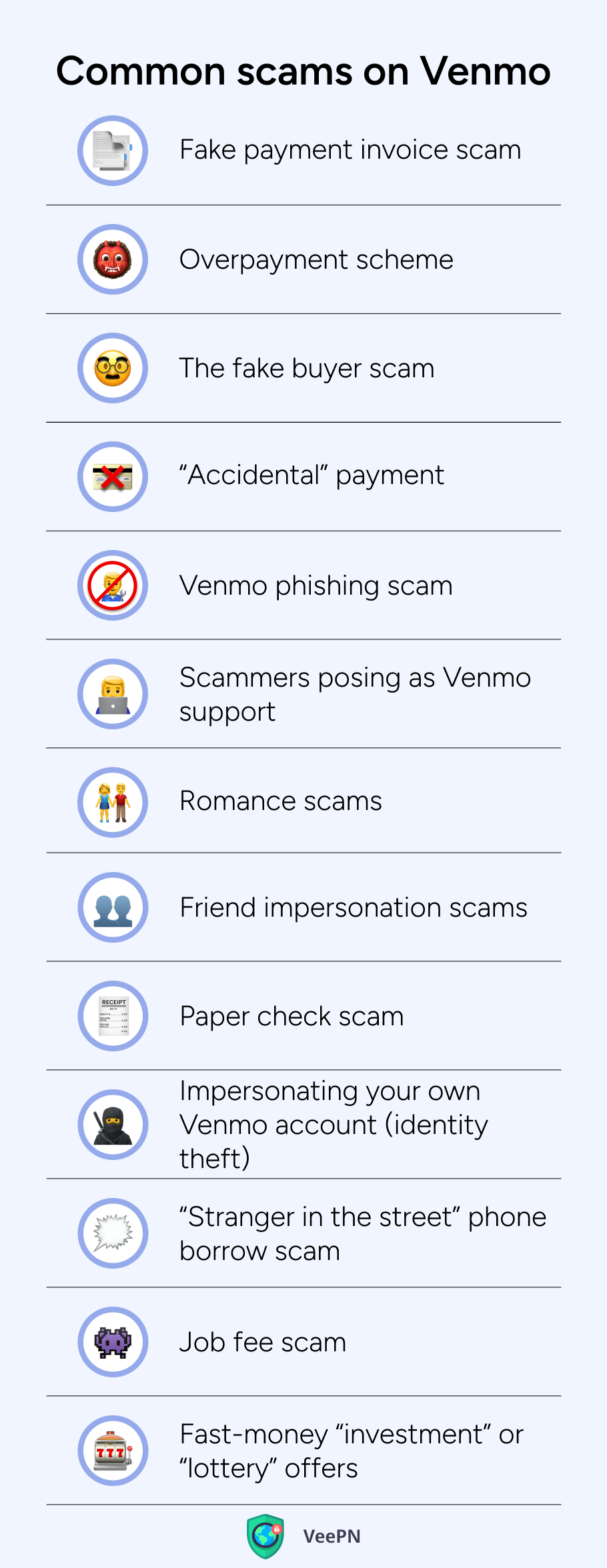

The most common scams on Venmo

We’ve completed the list of the top scams on Venmo and how they typically go down. But keep in mind that fraudsters tweak these methods all the time, so stay alert.

Fake payment invoice scam

You might see a random invoice pop up in your Venmo feed, labeled like “Service Fee” or “Charity Donation.” The invoice may look legit and even feature a professional logo. But in reality, it’s a Venmo fraud attempt. If you tap “Pay”, then it all goes straight to the scammer’s wallet.

Overpayment scheme

A malicious “buyer” pays you more than the agreed price for your goods or services. For this, fraudsters use stolen credit cards or hacked accounts and beg you to refund the difference ASAP for some important reason. As an honest person, you surely send the difference. But once the owner of a stolen card or hacked account discovers money loss and reports it to Venmo, the platform reverses the initial transaction Venmo scammers sent to you. So, the “extra” money you returned to the “buyer” is the money you can say goodbye to.

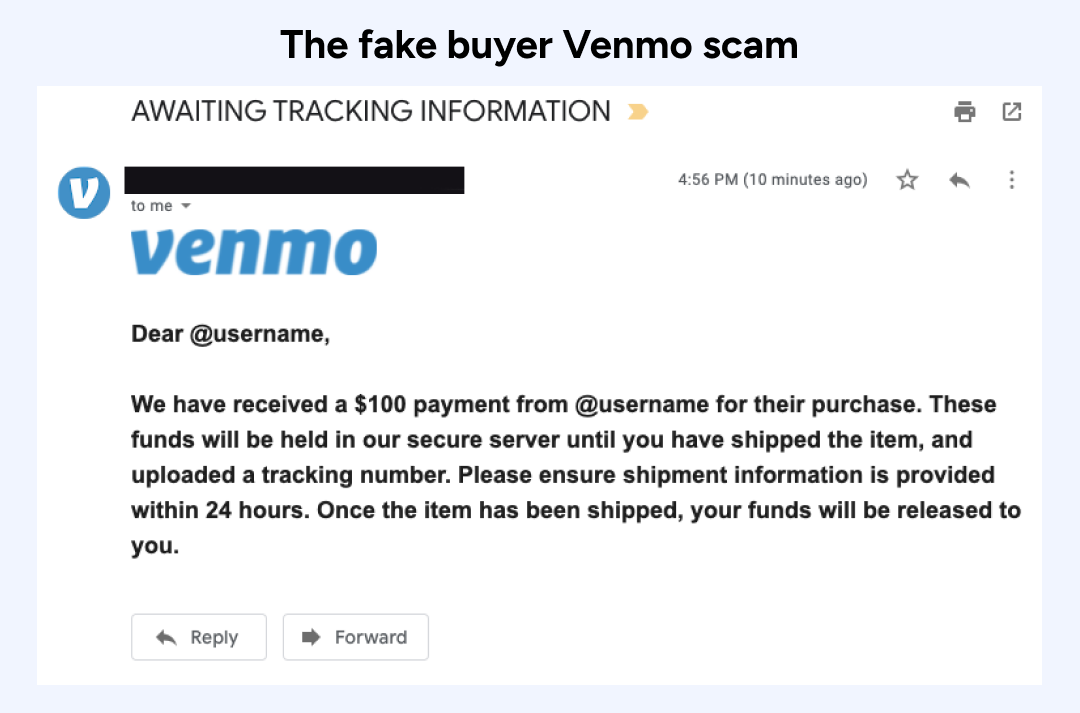

The fake buyer scam

This one can overlap with overpayment, but with a twist. Again, the “buyer” claims to pay you via Venmo for something you’re selling and then promptly asks you to ship the item to them. Once you see a fake “payment confirmation” email or a screenshot, you assume you’ve been paid but didn’t get notified, and ship the goods. But later on, you check your account and realize it was a scammer and they never sent actual funds. Therefore, check your transaction feed directly in the Venmo app before mailing anything and don’t believe any screenshots.

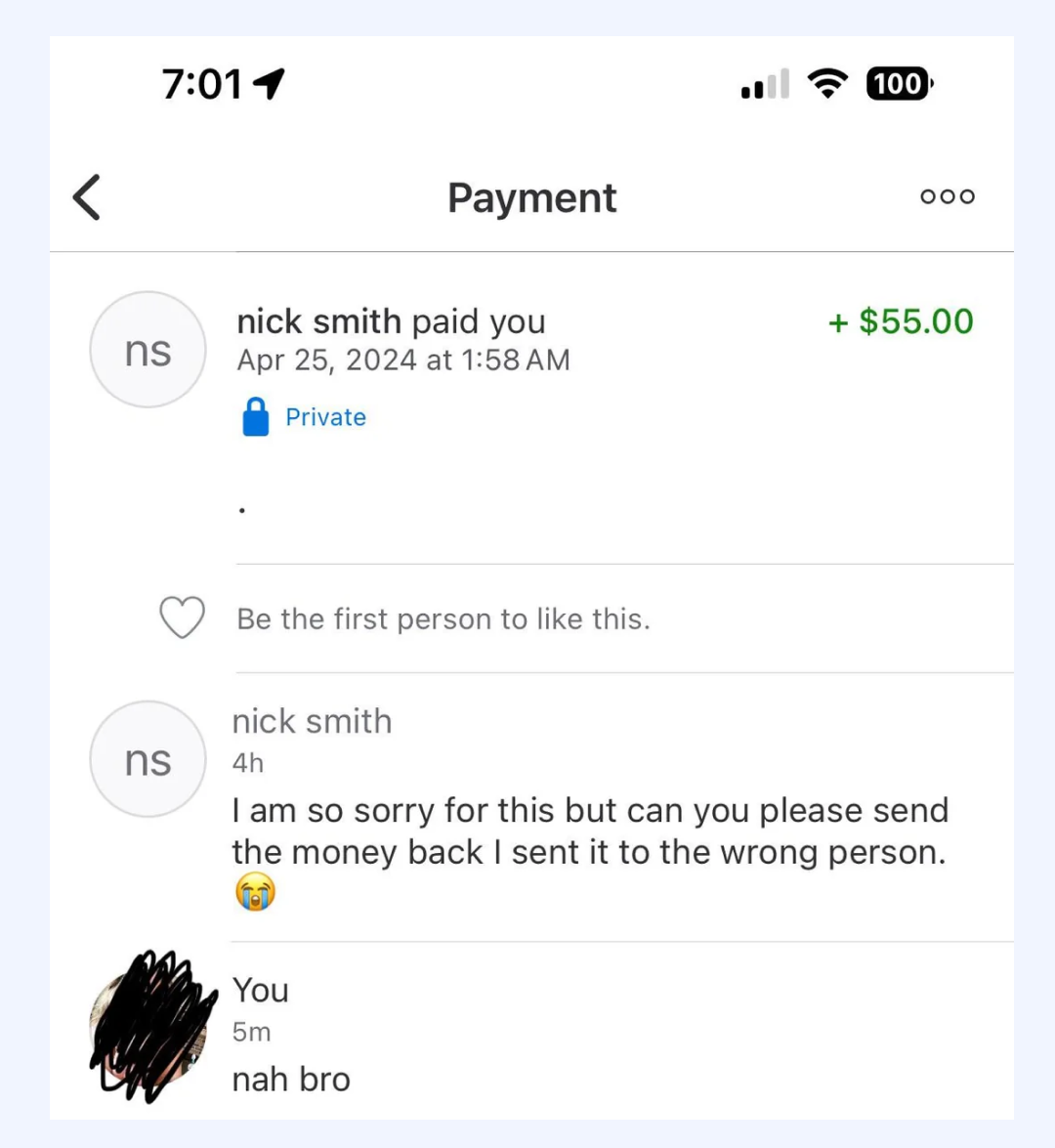

“Accidental” payment

This Venmo scam has similar notes to the previous schemes. Someone sends you money out of the blue, then begs you to send it back because they “accidentally” typed the wrong username. But the original transfer is again from a stolen card. Venmo finally reverses that deposit to a hacked user’s account, while the money you “refunded” is gone forever.

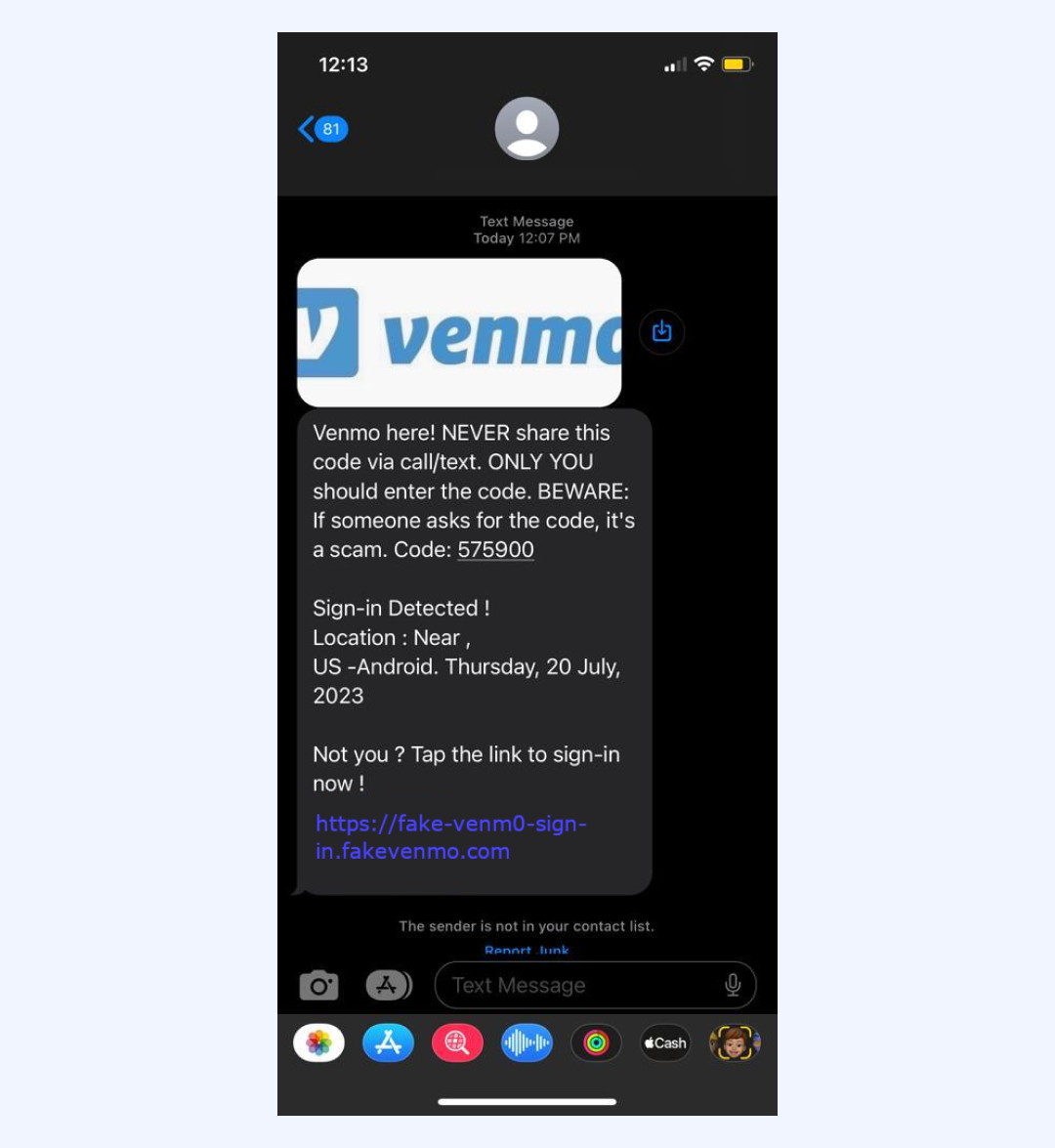

Venmo phishing scam

This Venmo text scam is also sarcastically called the “login info needed” scam. You receive a text or Venmo email scam call saying something about “Suspicious activity on your Venmo. Click the link to secure your account.” The link leads to a phishing Venmo look-alike website. When a victim enters a logo and a password – fraudsters gain access, and enthusiastically clean out victims’ linked bank accounts.

Scammers posing as Venmo support

In this case, criminals call or message you claiming to be from Venmo’s customer service. They might say they “noticed odd transactions” and ask to tell them the six-digit text code Venmo sent you. If you give it away, you’ve literally handed them your account.

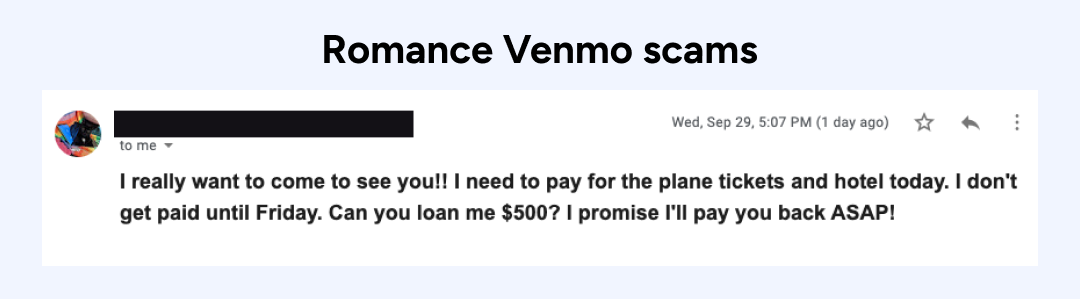

Romance scams

Sometimes scammers are trying to establish an online romantic relationship with users. Then, “sweetheart” may urgently request money through Venmo. And if the user falls into it – money is gone.

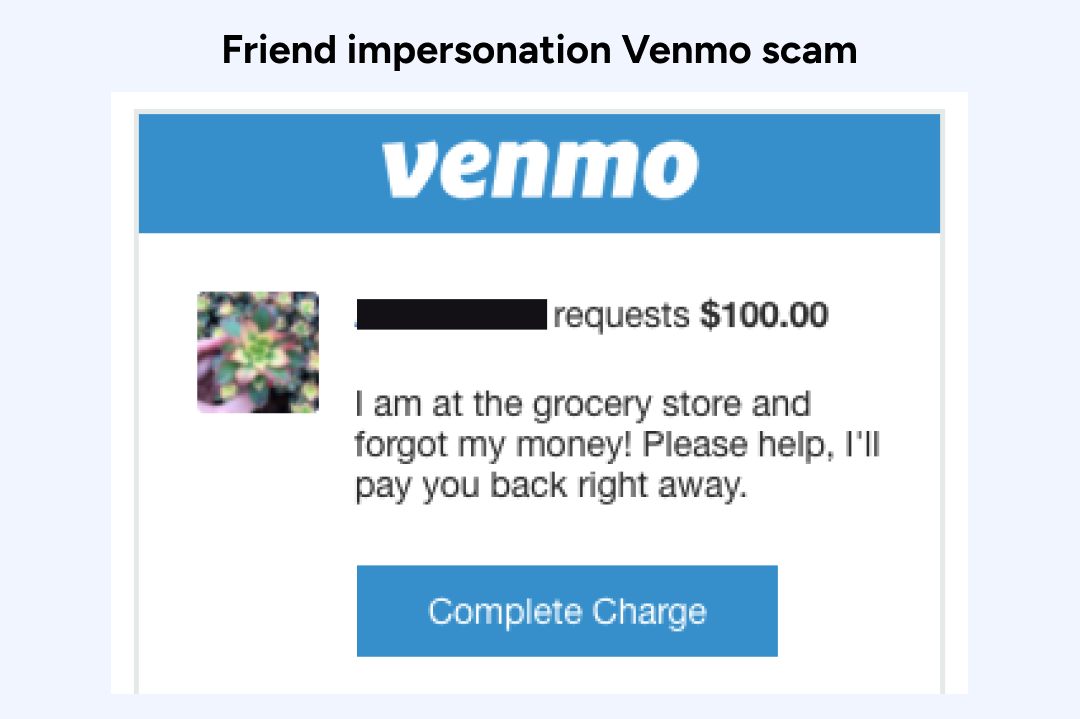

Friend impersonation scams

Another option is when a scammer replicates your friend’s Venmo profile pic and username and sends you a request. Unless you confirm that it’s really your friends in need of money, you risk “helping” a fraudster.

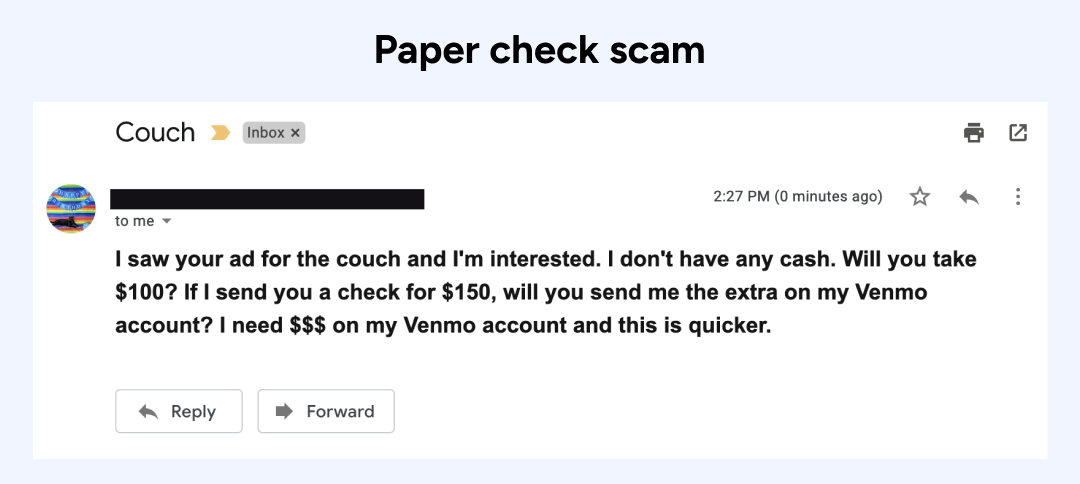

Paper check scam

Old-school but still a working scam. A scammer sends you a paper check with often a bigger sum than agreed, and then says something like “Go ahead and cash it — and Venmo me the difference.” You go and deposit the check into your bank account. Because the money appears in your account, you believe the check is good. You then send the scammer the payment they requested. In a couple of days, the bank realizes the check is fraudulent and “bounces” it. The bank takes back the money, and what you have sent to scammers stays with them.

Impersonating your own Venmo account (identity theft)

Could be a painful one. A cybercriminal might set up a new Venmo account under your name. They’ll send messages or payment requests to people in your network, claiming you have an emergency. Fooled friends who trust this message might send money — which, of course, goes straight to the thief.

“Stranger in the street” phone borrow scam

Imagine walking down the street, and a frantic stranger says their phone died and they need to call someone ASAP. Once you hand them your phone, they secretly open Venmo and send themselves money. You might not notice until much later — especially if your phone doesn’t require a PIN or Face ID to unlock Venmo. Luckily, such cases don’t happen every day, but still, never hand your phone to someone you don’t know.

Job fee scam

Some desperate job seekers sometimes fall for listings that promise a great role but require an upfront “training” or “equipment” fee paid via Venmo. The moment they get paid, the “employer” goes off the grid. Instead of earning, they fall victim to the scam. If a job wants you to pay them before you start, it’s almost guaranteed to be one of Venmo’s fraud cases.

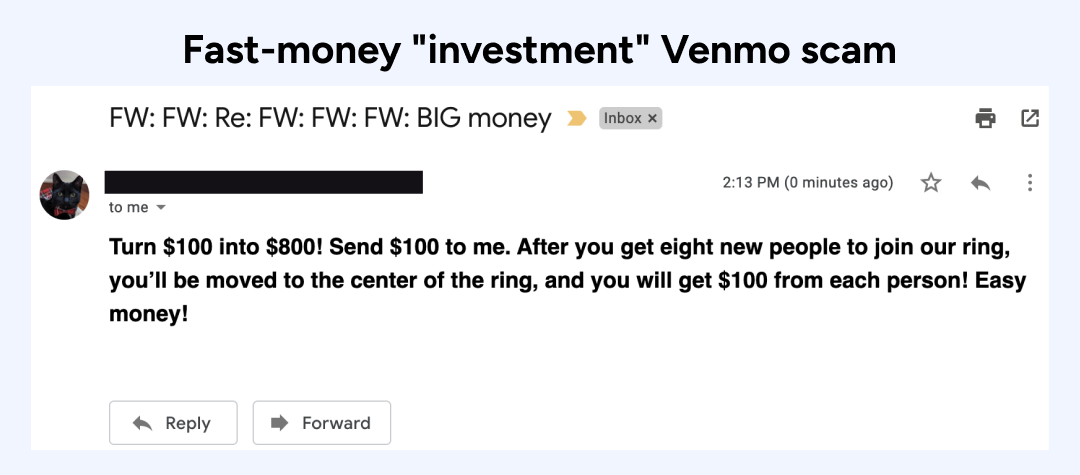

Fast-money “investment” or “lottery” offers

A con artist might promise big returns if you send them a small amount first. Or they’ll say you’ve “won a prize” and just have to pay a small “processing fee” via Venmo. Once you pay, they vanish, leaving you with zero return — and zero recourse. Anything that sounds too good to be true usually is.

With such volume and ingenuity of Venmo scam methods, miscreants could win top spots in the anti-record chart. But there ARE ways to protect yourself and your account from fraud. Let’s discuss them next.

How to protect yourself from Venmo fraud

While Venmo scammers keep inventing new twists and schemes, you can outsmart them with a few precautionary steps. Venmo is a good option for trusted contacts and small peer-to-peer exchanges. But if you still want to use it for bigger and riskier transactions, keep the following in mind.

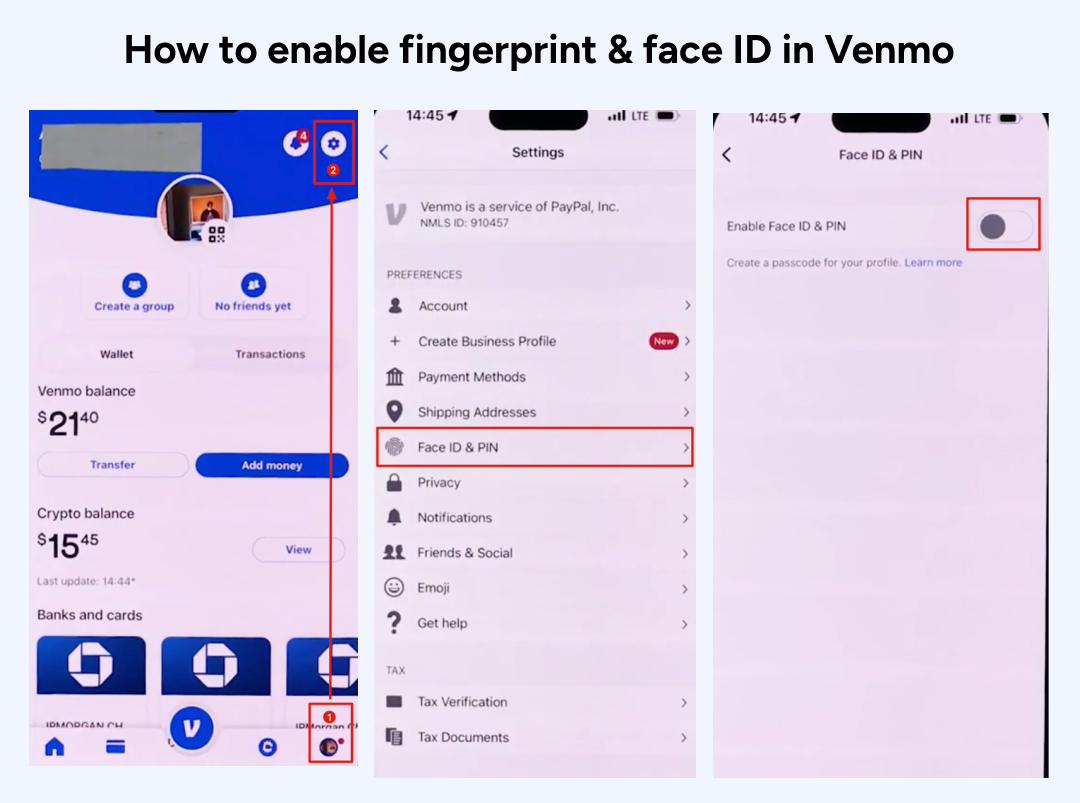

Enable fingerprint, face ID login, PIN code

In your Venmo app, go to settings and set Face ID & PIN (on iOS) or PIN code & biometric unlock (on Android). Create a robust PIN that only you know. Even if you lose your phone or let someone borrow it for a moment, they can’t enter Venmo without your secret code.

Turn on two-factor authentication (2FA)

With two-factor authentication, Venmo will text or email you a one-time code whenever you log in from a new device. It’s an easy but powerful solution for Venmo fraud prevention scam scenarios because even if someone gets your password, they can’t access your account without the special code.

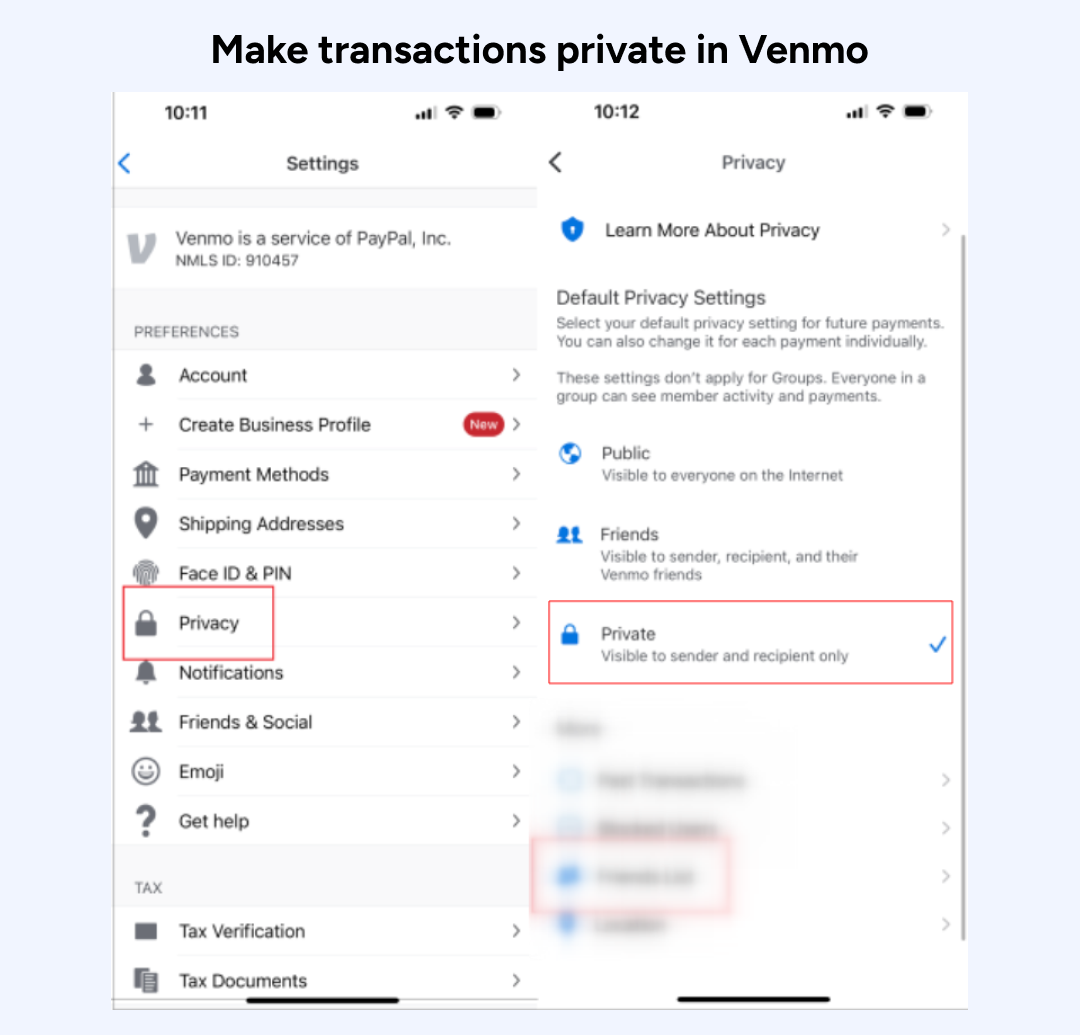

Make transactions private

Go to settings in your Venmo app → Privacy, and set your default visibility to “Private” so strangers can’t spy on your transactions and can’t target you.

Always double-check payment requests

Never rush to accept or send money to folks you don’t know well. Even if you think you do, confirm the username or scan a friend’s QR code to ensure you’re paying the right person. If something feels off — it probably is. Finally, you can call them or text via other messengers whether the transaction you’re going to make is expected and not a fraud.

Never refund and don’t trust online acquaintances

If a stranger overpays you on Venmo, never refund the difference if you don’t want to waste money. And regarding new love interests you met online – sometimes better single than scammed, what do you think?

Use a trusted VPN

A VPN secures your connection with a VPN encryption to prevent criminals from stealing your login info and phone data.

Let’s take a closer look at the benefits of using VPN for Venmo scam protection.

Why using a VPN for Venmo is a good idea

Here are the reasons why you might want to have a VPN on when using Venmo. So, a VPN:

Hides your IP address

By masking your true location, a VPN adds a layer to your Venmo scam protection and keeps invasive third parties including hackers from tracking where and what you are doing online.

Protects your sensitive data on public Wi-Fi

It is especially vital when you access financial apps on public Wi-Fi in cafes, airports, or malls. VPN encrypts your connection so thieves lurking on that free hotspot can’t grab your bank details or Venmo credentials.

Shields you from location-based attacks

Sometimes, cybercriminals exploit certain regions with weaker security standards. A VPN lets you choose where you connect from, deterring those targeted local threats.

Boosts online privacy

Beyond shielding just your Venmo transactions, a VPN also keeps your emails, browsing, and other private data out of the wrong hands.

If you value the safety of your financial apps and overall digital privacy, using a VPN can make a difference in staying safe from Venmo payment scam attempts. However, free VPNs might not do the trick. Many of them often sell users’ personal data to third parties in order to maintain their services. That’s why it’s way better to use a reliable VPN provider like VeePN, as it provides you with robust privacy features, and a strong security bundle.

Try VeePN – your top choice for Venmo safety

In addition to hiding IP, this is how VeePN can help with Venmo fraud defense:

AES-256 encryption

Military-grade encryption secures your data when making payments and prevents others from snooping — even on unprotected Wi-Fi.

Kill Switch

If your VPN connection ever drops, Kill Switch immediately interrupts your Internet connection to prevent accidental data leaks.

Blocking trackers and malicious websites

VeePN’s NetGuard feature removes cyberthreats before they can harm your device by instantly blocking malicious websites as well as trackers.

Breach Alert

This feature will instantly notify you if your credit card details, SSN, or bank account credentials show up in a known data breach. No more cybercriminals shopping with your money. Learn more about data breach prevention to stay one step ahead.

Antivirus

Enjoy around-the-clock safety on Windows and Android with VeePN Antivirus. You can schedule system scans and block malware, injection attacks, and all sorts of digital nasties.

Give VeePN a try risk-free with a 30-day money-back guarantee.

FAQ

If you suspect Venmo fraud, gather all details, such as your Venmo account information and any evidence of a scam, be it a phishing scam or any other type described in the article. Then, contact Venmo’s customer service to safeguard your personal and financial information. Qualified support will guide you through the steps to take to achieve this.

Once done, it’s still better to stay alert for other most common Venmo scams and never hesitate to report anything suspicious.

Venmo is a well-known payment app with solid protective measures. But it’s always good to be cautious in an online marketplace setting. Both PayPal and Venmo can be safe if you stay vigilant and do not fall victim to diverse “free money” schemes. Always verify who you’re sending or receiving money from to keep your funds secure.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan