Securing Your Online Transactions: Choose Safe Online Payment Methods

We all love the convenience of whipping out a credit card and shopping online with just a few clicks. But did you know there comes along with that convenience, a bunch of big risks that you have to be on the lookout? Whether it is a premeditated phishing scam or an intruder who steals your credit card details, conducting transactions over the Internet may expose your personal information to scams and theft. That is why it should be a priority of all e-commerce shoppers to secure your online payments. Read and know the safest ways of paying online today, and a help tool to have a secure info.

Is online payment safe? Unveiling online transactions risks

Online payments have made our lives easier, but they’re not completely secure. The numerous cases of payment card fraud, phishing and identity theft have questioned the safety of our transactions. Actually one research indicates that an astonishing 93 percent of banking fraud occur on-line. This brings us to the importance of making online payments security the first priority.

How to choose a safe online payment method

In case you are asking yourself how to make payments online safely, then these are some points that you would consider when deciding on a payment method.

- Security features: Prioritize platforms with robust security measures, like encryption and fraud detection, to safeguard your transactions and sensitive data.

- Real-time monitoring: Look for platforms that offer tools to monitor transactions, customer behavior, and sales patterns. This helps you manage your business more effectively.

- Mobile compatibility: Ensure the chosen payment method works seamlessly on both mobile and desktop devices — where most online purchases are made.

- Customer support: Choose platforms with responsive and accessible customer support to address any issues promptly.

- Costs: Consider the fees associated with the payment method, including transaction fees and processing costs.

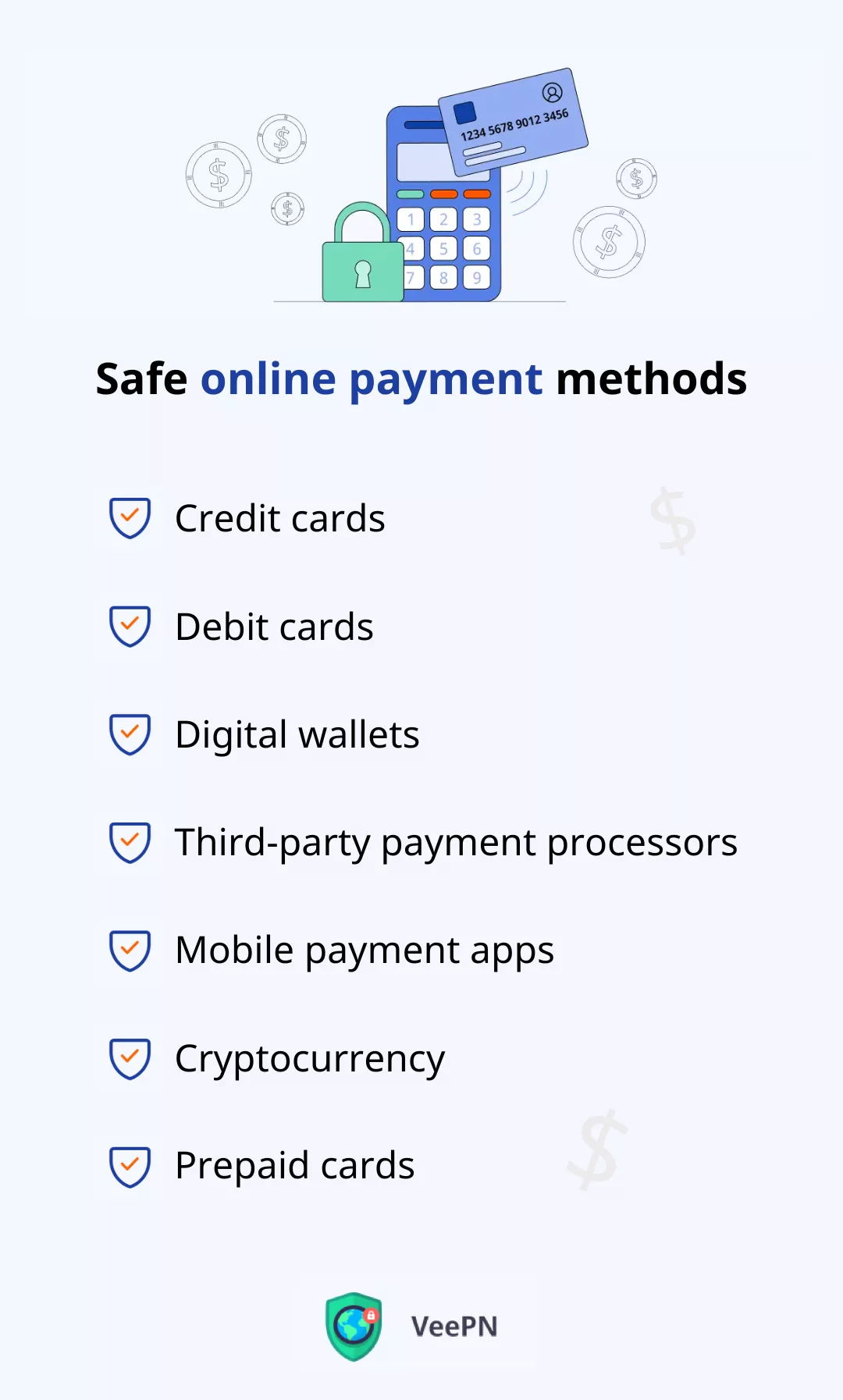

Safe online payment methods: Quick look

Now onto the specifics. Short on time and need to quickly find the most secure payment method? Check out the safest options to pay online.

| Method 💳 | Pros 🌟 | Cons ⚠️ | Best for 🥇 |

|---|---|---|---|

| Credit cards | Widely accepted, fraud protection, credit building | Transactions tied to identity, potential for debt accumulation | Everyday purchases, building credit history |

| Debit cards | Convenient, spending control | Direct link to bank account, limited fraud protection compared to credit cards | Budgeting, controlled spending |

| Digital wallets (Apple Pay, Google Pay) | Enhanced security, quick payments | Limited merchant acceptance, device compatibility concerns | Contactless payments, online shopping |

| Third-party processors (PayPal, Stripe) | Added security, international ease | Not universally accepted, potential transaction fees | Secure online transactions, cross-border use |

| Mobile payment apps (Venmo) | Convenient, biometric security | Compatibility issues, limited usability in certain areas | Quick in-store payments, peer-to-peer transfers |

| Cryptocurrency | Privacy, global transactions | Requires technical understanding, price volatility | Digital investments, privacy-focused payments |

| Prepaid cards | Controlled spending, separate transactions | Limited for larger purchases, potential activation and usage fees | Travel, budgeting |

Wish to know more about each option? Let’s do it!

Exploring secure online payment methods

In the realm of digital transactions, a myriad of options awaits you. Let’s dive into some of the most secure online payment methods available today.

Credit cards

Credit and debit cards are a staple of online shopping. They provide a compromise between security and convenience. Credit cards can be a great tool in the management of payments and credit building when used in a responsible way.

Pros

- Widely accepted for various purchases.

- Fraud protection and potential refund for unauthorized transactions.

- Can help establish and improve credit history.

Cons

- Transactions tied to your identity and bank account.

- Possibility of accumulating debt.

Summary: Credit cards are easy to use and they can provide fraud protection. All you need to do is to control your budget and balance your payment, so you will not go into debt.

Debit cards

Similar to credit cards, debit cards provide the ease of card payments while keeping you accountable for your spending. They are linked directly to your bank account.

Pros

- Convenience of card payments without the risk of overspending.

- Limits transactions to available funds.

- Usable for cash withdrawals at ATMs.

Cons

- Direct link to your bank account, posing potential risks.

- Limited fraud protection compared to credit cards.

Bottom line: Is it safe to use a debit card online? Yes, using a debit card online can be safe. They provide spending control, but be cautious about potential direct access to your bank account.

Digital wallets

Digital wallets, such as Apple Pay and Google Pay, offer a modern twist to protected payment methods. They use tokenization — disguise for digital data — to improve security and streamline transactions.

Pros

- Your card number and other sensitive information aren’t shared during transactions; the seller only sees the transaction ID.

- Quick and convenient payment process, often with biometric authentication.

- Suitable for both in-store and online purchases.

Cons

- Limited acceptance at certain merchants.

- Compatibility issues with specific devices.

Bottom line: Digital wallets add extra security through tokenization and quick payments. They’re great for contactless shopping, especially when you’re on the move.

Third-party payment processors

Third-party services such as PayPal and Stripe act as intermediaries, often relying on systems like the automated clearing house to move funds securely while keeping your financial data off-limits to merchants. They assist businesses to get payment online and operate by transferring money in the bank account of the customer or in his/her credit account to the bank account of the business, which makes the processes easier.

Pros

- Additional security layer as an intermediary.

- Avoids exposing your financial data directly to the merchant.

- Simplifies international transactions and currency conversion.

Cons

- Not universally accepted across all online vendors.

- Potential fees associated with certain transactions.

Bottom line. The third-party payment processors ensure an extra level of security and can facilitate the cross-border transactions. However, be careful to look up at the amount of transaction fee.

Mobile payment apps

Mobile payment apps, like Venmo or Cash App, is another safe way to pay online that has gained traction for its convenience and added security features. They allow you to make payments directly from your smartphone.

Pros

- Convenience through mobile device usage.

- Often includes biometric authentication for enhanced security.

- Enables person-to-person transfers quickly.

Cons

- Compatibility limitations with older devices.

- Less viable in areas with limited technological infrastructure.

Bottom line: Mobile payment apps are handy for quick transactions, but need to ensure compatibility with your device. They’re also great for sending money to friends and family.

Cryptocurrency

Cryptocurrency is a modern online payment method for those seeking decentralized and private transactions. It operates independently of traditional financial systems and is considered among the most secure ways to pay online.

Pros

- Connect to digital addresses, not personal identities, making it a fully private option.

- Aren’t controlled by one entity, making it resilient against attacks.

- Ensures faster and cheaper global transactions.

- Advanced cryptography to protect financial transactions.

- Potential for investment opportunities.

Cons

- Requires understanding of cryptocurrency technology and security practices.

- Price volatility can lead to value fluctuations.

- No central authority — getting back your coins can be tough since there’s no central authority or clear rules. Users need to safeguard passwords and trust reliable sellers.

- Not many shops or websites take cryptocurrencies as payment.

Bottom line: Cryptocurrency offers privacy and global transactions. But keep in mind the learning curve, as well as the potential for value fluctuations.

Prepaid cards

A prepaid card offers a controlled approach to spending by limiting your transactions to a predefined balance. It’s similar to a debit card but isn’t linked to a checking account and instead requires you to load money onto the card.

Pros

- Reduces financial risk with a fixed card balance.

- Keeps transactions separate from primary bank accounts.

- Useful for budgeting and controlling expenses.

Cons

- Limited usability for larger purchases due to balance restrictions.

- Potential fees for activation, reload, and usage.

- Often limited buyer protection or none at all.

Bottom line: Prepaid cards help you budget and control spending. They’re useful for specific purposes like travel or online shopping, but watch out for fees.

Safest way to pay online: The round-up

Each method has its benefits and drawbacks, so choose wisely coming out of your needs. Credit cards, reputable digital wallets, PayPal, and secure payment processors are all known secure options, while crypto is not that widespread yet but no less private and safer method.

Speaking of keeping your online transactions safe, let’s dive into another powerful tool that can give you an extra boost of security: a VPN, a true ally for safeguarding your transactions.

Enhancing security with a VPN: Your online transactions’ best friend

Imagine the Internet as a bustling marketplace with various corners and alleys. Just like you’d want to stroll through these streets with bodyguards by your side, a VPN offers that very protection for your online activities, especially for your payment transactions.

Using a VPN for online transactions brings great perks:

- Encrypting your data: Think of it like sending secret messages that only you and the recipient can read. Even if someone tries to snoop on your payment info, they won’t understand it due to VPN encryption that makes your data unreadable.

- Anonymous identity: A VPN cloaks your online identity by giving you a new IP address (your “home address” online) and changing your virtual location. Hackers can’t easily track you, which makes your transactions safer.

- Internet privacy boost: With a new IP address and your data encrypted, a VPN creates a safer bubble surrounding your digital life.

So, in the world of online transactions, a VPN isn’t just something extra – it’s your shield. With encryption, secure connections, and identity hiding, a VPN keeps your money matters secret and ensures your transactions remain secure.

Selecting the right VPN for the job: Key features and why VeePN stands out

As you take a cautious approach to an online payment system by selecting a safe one, a VPN that you select must also be safe and reliable. When searching the best VPN to protect your online transactions, these are the most important features to consider:

- Strong encryption: Look for AES-256 encryption. It’s like wrapping your data in an unbreakable code.

- No Logs Policy: A trustworthy VPN won’t keep tabs on your online activities as it won’t collect and retain your data.

- Wide server network: More servers in more countries mean better speed and coverage.

- Robust security: Such features as the Kill Switch, DNS leak prevention, Double VPN will make sure your online matters remain private and secure.

- Customer support: 24/7 support is your safety net. It’s like having a tech-savvy friend to guide you.

Speaking of reliable providers, consider VeePN for peace of mind. With its top-grade encryption, a strict No Logs policy, a vast server network and reliable security features, VeePN has your back providing the highest level of security.

Also, a great bonus is the Antivirus feature that will help your device steer clear of viruses and other malware!

The setup is simple and quick:

- Sign up with VeePN risk-free.

- Download the app for your device — VeePN works on Android, iOS, Windows, macOS, Linux.

- Open the app and choose the server location to connect to. You can opt for Double VPN servers for double protection or set up a regular VPN connection.

- Connect to the VPN and pay safely!

Keep in mind that, in case you are determined to protect your online transactions, you should not let go of the second best thing. VeePN is one of the vendors to consider when buying a VPN to protect your online privacy.

FAQ: Safe Online Payment Methods

Yes, using a debit card online can be safe, but it’s important to take precautions:

- Make sure you’re on a secure website (look for “https” in the URL).

- Avoid sharing your card details on shady sites.

- Regularly monitor your account for any unauthorized transactions.

- Use a VPN to protect your data.

Find out more in this article.

PayPal is one of the safest ways to pay online. It adds an extra layer of security between your bank account and the seller. But remember, no method is entirely risk-free. Find out pros and cons of the safest online payment methods in this blog post.

Credit cards, reputable digital wallets, PayPal, and secure payment processors are generally safe. Discover the benefits and drawbacks of each payment method in our article.

Credit cards and PayPal are among the safest forms of payment to accept as a seller. They offer protection against fraud and disputes. But always verify transactions and ensure the payment method is secure.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan