RFID Blocking Technology: Does It Protect Your Online Privacy?

Contactless payments are all the rage. It’s quick and convenient, but with all this talk of digital transactions, it’s natural to worry about security. Could some shady character use their own card reader to swipe your identity and wipe out your bank account? It’s a scary thought.

Enter RFID blocking — a technology that promises to keep your personal information protected. But is it really necessary to stay safe? Let’s take a closer look and find out.

What is RFID?

RFID (Radio Frequency Identification) is the technology that enables contactless payment cards to work.It was initially applied in monitoring inventory, but it developed to checking identity, passports, ID cards and payment cards. A small Wi-Fi-like logo on your card indicates that it is RFID-tagged and can be tapped on the merchant terminal to pay.

The RFID technology involves the use of radio waves to transmit between a small electronic chip in your contactless cards and a reader. The RFID credit or debit card — like many modern bank cards — has a small RFID chip that holds the information about the cardholder like the cardholder name, card number, and card expiry date. In order to pay, we only have to bring the card near the payment terminal and the terminal will send out a radio frequency signal that will trigger the RFID chip. The chip sends the payment information wirelessly to the terminal which processes the payment.

How important is RFID protection?

This contactless payment process is designed to be fast and convenient. But some users worry it can lead to data breaches since the RFID chip in the card is transmitting sensitive financial information. Scammers with unauthorized RFID readers can potentially intercept it — a scam known as RFID skimming.

What is RFID skimming?

RFID skimming is the act of stealing sensitive information from RFID-enabled cards or tags using a scanner that wirelessly reads the data. A criminal can hide a scanner, like in a glove or a bag, and put it near someone to steal their payment card details without touching the card. They can later use this stolen information to make fraudulent purchases.

What is RFID blocking?

RFID skimming seems to be worrisome. Some people may be concerned that a stranger nearby can secretly use their card’s RFID feature. Identity theft is another potential risk, which can cause long-term problems for victims. This leads to many RFID blocking products growing in popularity.

How does RFID scanners blocking work?

The point is that RFID blocking technology interrupts the electromagnetic fields produced by RFID scanners. It blocks radio waves accessing or transmitting information on RFID chips in credit cards, passports and other identification forms. There are various types of this technology, such as RFID blocking wallets and sleeves, as well as waterproof fanny packs. Most of these products incorporate materials such as carbon fiber or aluminum to protect you against contactless attacks.

Is RFID blocking necessary?

So while we get the idea, there’s another question worth asking — is RFID blocking really necessary? That is, is RFID skimming a grave threat rather than a scary concept? Truth is that no convincing data is available on this matter as of now. For example, while the UK saw the increase in card-not-present fraud in recent years, there aren’t any numbers on RFID skimming specifically. And the situation is pretty much the same in the US.

Of course, it’s natural to be worried about RFID skimming and identity theft. It can cause irreversible damage if your card or passport details get into the wrong hands. But in most cases, RFID blocking won’t help much with this issue. And here’s why:

- Most credit card chips are not RFID-capable. Chip-embedded credit cards do not transmit any information without being inserted in a reader.

- Contactless credit cards contain payment info protected with encryption. Cards like Visa PayWave or MasterCard PayPass encrypt the information they transmit, even if they are contactless.

- Same goes for passports: they usually contain RFID blocking material already, and the information available via RFID is encrypted.

- RFID skimming is not worth the effort for thieves. The process is time-consuming, hit-or-miss, and depends on the availability of the technology being used. It is easier and faster for thieves to steal credit card numbers and identities through Internet scams or buying them on the dark web.

Now, about Internet scams…

A card-not-present (CNP) fraud is a more real threat

It’s estimated to make up for 73% of payment card fraud loss in 2023, a rise from 57% in 2019. Same way here, there are no numbers that point to RFID skimming as part of the problem in a card-not-present scam.

Card-not-present fraud occurs when a criminal gets a cardholder’s name, billing address, account number, three-digit CVV security code, or card expiration date. This way, they can make fraudulent purchases without a physical card of a victim present. And as we’ve said before, it’s easier for criminals to steal financial info through online scams rather than go through all the trouble for RFID hunting.

In 2022, victims lost $10.3 billion to online scams

Phishing and personal data breach are two main culprits here. But there are many crime types, from tech support scams to identity theft. So with online scams being a real escalating threat, you need the kind of the protection that actually responds to the challenges you face.

How to protect yourself from online scams?

While there is no harm in protecting your credit cards in RFID-blocking wallet, there are far better behaviors you could adopt if you want to keep your information and your funds safe.

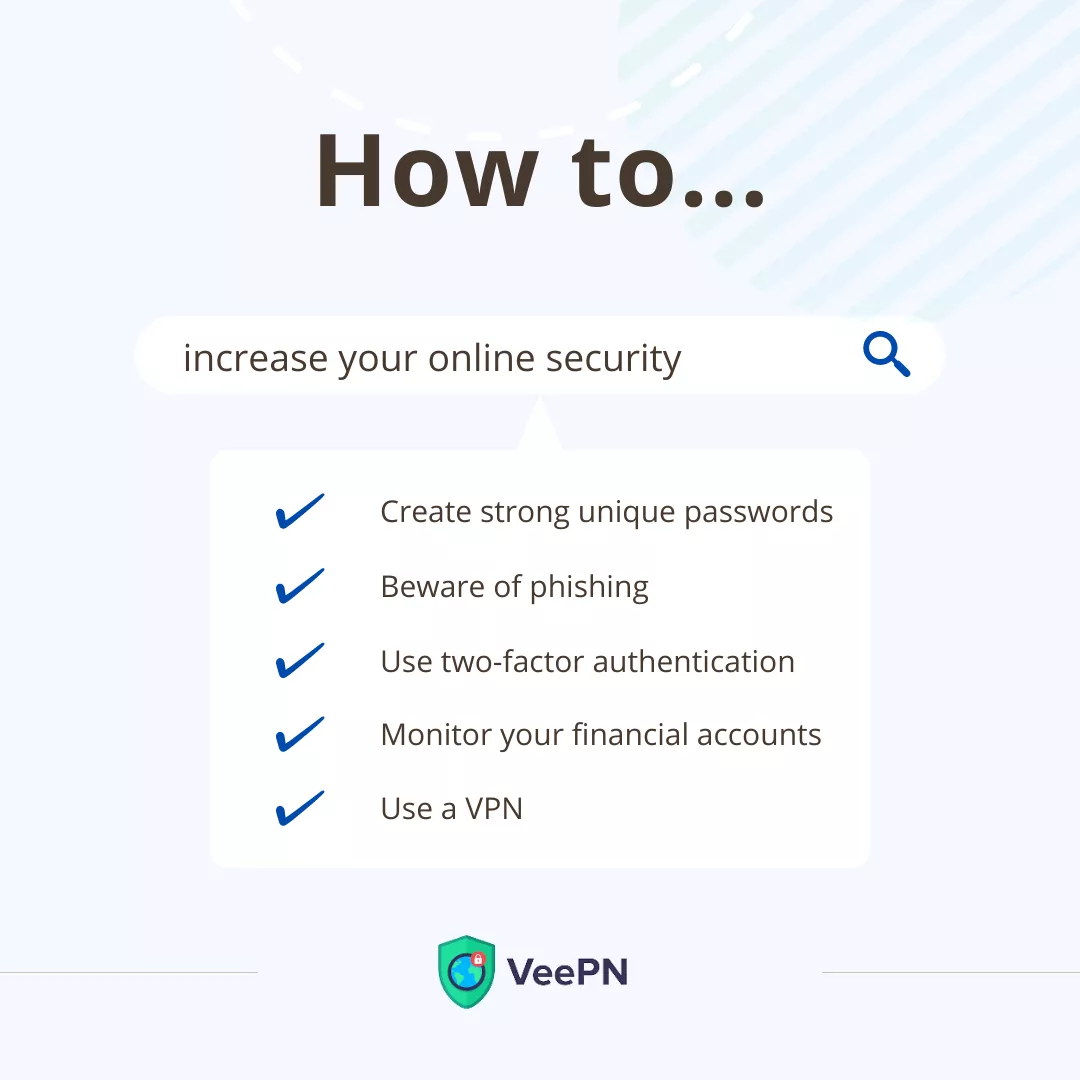

- Create strong passwords. Make sure all of your online accounts are protected with passwords that consist of unique combination of letters, numbers, and symbols. Use a different password for each of your online accounts to minimize the risk of multiple accounts being compromised at once.

- Beware of phishing scams. Phishing and smishing scams are related to the creation of emails or messages that appear to be sent by a reputable company or organization, but are fake. They want to either frighten you or get you interested to later deceive you into giving sensitive information such as passwords or credit card numbers. Always beware of any suspicious or urgent messages and always verify the email or website URL of the sender.

- Go for two-factor authentication. 2FA means you must enter a second authentication method, such as a code sent to your phone or an application, on top of your password. A lot of online services, such as banking apps, have 2FA as an option, so be sure to turn it on where you can.

- Monitor financial statements regularly. Closely monitor your financial statements in order to identify any frauds in good time. Look through your credit card and bank statements to check whether there have been any transactions that you are not aware of. Contact your bank or credit card company and notify them of any suspicious activity.

- Use a virtual private network. A VPN encrypts your entire Internet connection and protects your online privacy. VeePN provides secure encryption with the strongest AES-256 algorithm and boosts your online security. Change your IP address in a click and get the best protection for your data when going online.

Bottom line

You may want to give it a chance in case you believe that RFID blocking will make you feel more comfortable. Meanwhile, you can do it with a couple of pieces of heavy-weight aluminum foil and it will do the same thing (only not as cool-looking).

Ultimately, it comes down to whether you feel like there’s enough of a risk to justify the expense. But remember that today’s criminals know they can get money and sensitive information from people without meeting them in person. Online scams are a thing, and we should take measures to keep our private info as it should be — private.

FAQ

Is RFID technology blocking really necessary?

No actual statistics on RFID scams are available. So it depends on whether you think the risk is real or whether such RFID blocking products are worth spending the money. Find out more in our article.

Is RFID blocking a gimmick?

While the idea behind RFID blocking cards is solid, we don’t believe it should be the only thing to consider when buying a wallet, for example. But if having an RFID blocking wallet can bring you peace of mind by protecting you against low-probability RFID theft, it surely won’t hurt.

How common is RFID theft?

Data theft concerning RFID cards is uncommon. No actual statistics are actually available on this type of scam.

Is RFID stealing real?

In theory, yes — criminals can use RFID skimming devices to steal your personal information from RFID-enabled cards, such as credit cards, passports, and key fobs. But RFID stealing is not that worth the effort for thieves. It’s easier and faster for them to steal credit card numbers and identities through Internet scams or buying them on the dark web. So it’s more imperative to take measures to protect your data online. Learn more in our article.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan