GLBA Compliance Checklist: Steps to Keep Your Business Clean

If you’re running an online business that operates online, you’re surely concerned about your Gramm-Leach-Bliley Act (GLBA) compliance that obliges online businesses to protect users’ data. The lack of understanding how the act works can make you feel anxious. Does GLBA apply to your company? If it does, how do you know you comply with every single requirement? To help you make sure your business is law-obedient, we’ve prepared a GLBA compliance checklist and described the core principles of this act. Get ready, lots of useful information and tips are ahead!

GLBA compliance requirements and its three core components

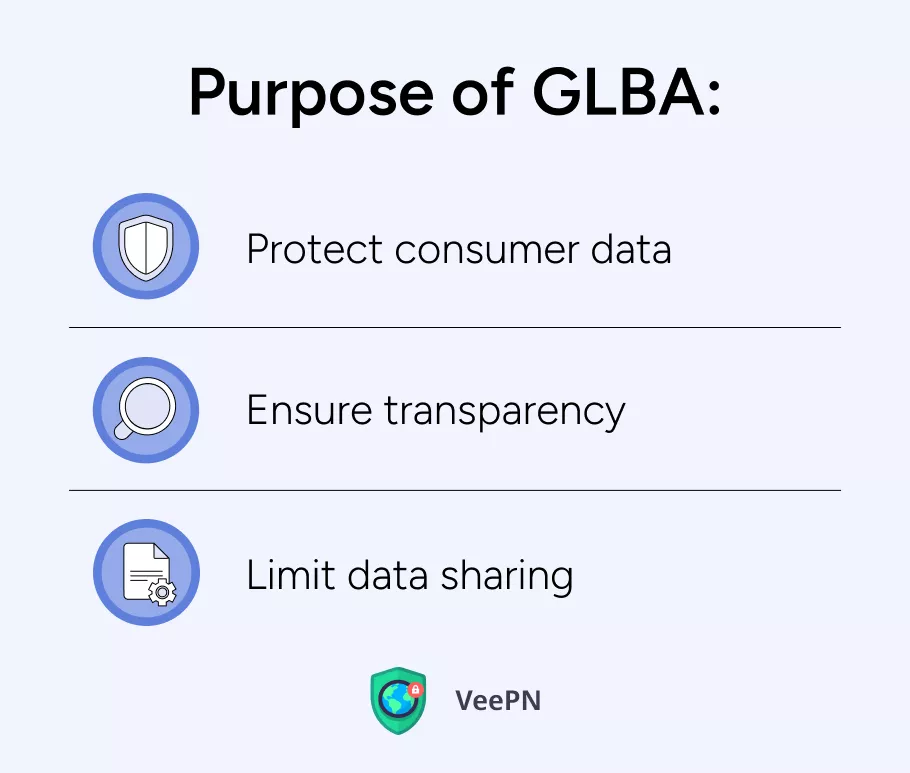

To begin with, we need to understand the purpose of GLBA. The main aim of the act is to protect consumers’ personal financial information held by financial institutions. Its primary purpose is to:

- Protect consumer data: Businesses aren’t just trusted with your data — they’re legally required to keep it safe. That means bank details, Social Security numbers, and personal info must be secured and confidential. No excuses.

- Ensure transparency: Financial institutions have to be upfront about how they collect, use, and share your data. You get clear privacy notices (no fine print trickery) and the power to opt out if you’re not cool with them sharing your info.

- Limit data sharing: Your private info should stay private. This law restricts companies from passing your details to third parties, unless you give them the green light. No auto opt-ins, no shady backdoor deals.

GLBA compliance should be based on three core principles any relatable business should follow, which are financial privacy rule, the safeguards rule, and the pretexting provisions. Sure thing, we need to discuss them in detail.

The financial privacy rule

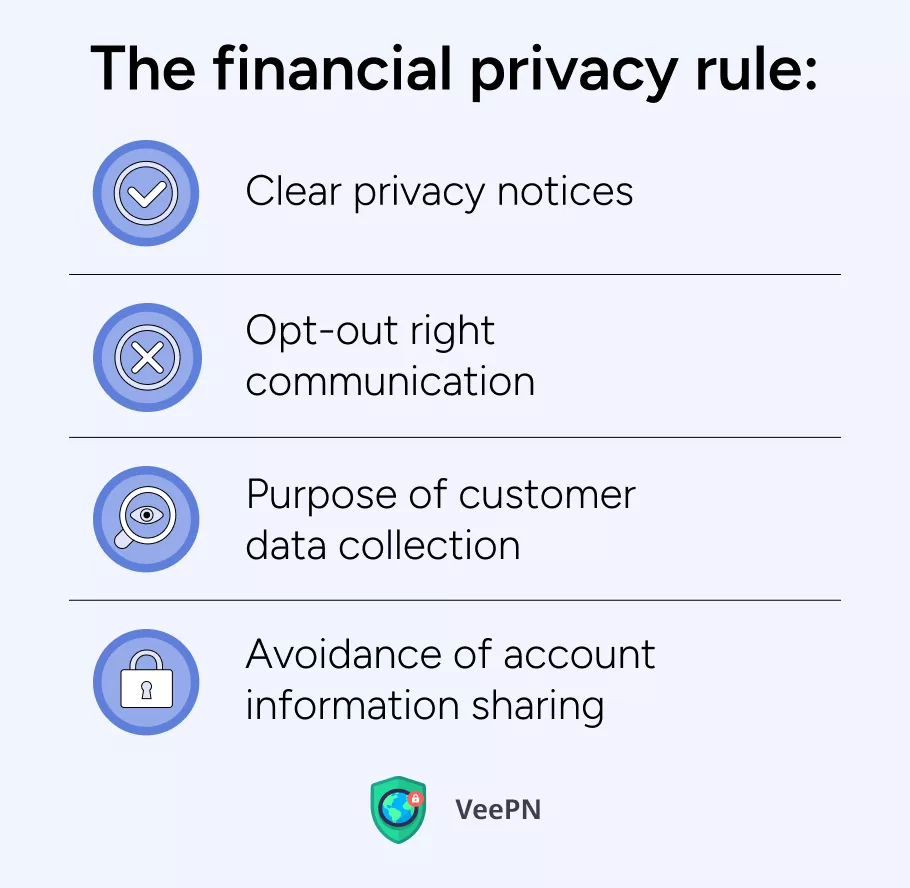

The financial privacy rule includes a number of important practices you should adopt in your financial institution:

- Clear privacy notices. You have to clearly notify your users about their data being collected, for what purpose, and what method is used. Also, according to the financial privacy rule, you should clearly state the rights of your customers in regards to their data sharing and usage. You have to provide this notice as soon as you collect customer data, and the message must repeat in a year, in case the customer still uses your service.

- Opt-out right communication. It’s also crucial to leave your customers an opt-out right before their data is shared. Your service should notify your customers with a relevant and timely notice, so they can make an adequate decision whether they’re ready to share their data with your site.

- Purpose of customer data collection. You should describe the purpose of collecting your customer data and stand up to the promise not to use their data in other ways than mentioned in your purpose statement. For example, if you collect user data for analytics, you can’t sell it to advertising agencies.

- Avoidance of account information sharing. As we’ve mentioned before, it’s prohibited to sell/share customer information to third parties such as advertisers, telemarketing agencies, and so on.

Those are the most critical aspects of the GLBA privacy rule you should pay attention to for strict compliance with this regulation. However, it’s just the beginning, so bear with us to explore other principles.

The safeguards rule

The safeguards rule obliges you to adopt numerous security policies to ensure your customers can use your service safely. The safeguards rule also implies security of your business data and improved customer experience, which is why following these practices is beneficial for your company, even though the list of to-do actions is quite long:

- Comprehensive information security program. You must create, implement, and maintain a comprehensive security program to protect the confidentiality and integrity of customer information.

- Qualified individual appointment. The safeguards rule requires you to appoint a separate role in your company for managing security programs for your organization. You have to ensure this person has relevant qualifications and can complete their workplace duties without serious challenges.

- Risk identification and assessment. Regular checkups for risks and identification of their types as well as ways of their mitigation are obligatory for effective data security.

- Control threats safeguard. Financial institutions have to regularly use and review safeguards rule measures to be able to protect customer data. Additionally, appropriate measures must be implemented to secure the applications that store, collect, and transmit customer information.

- Safeguard measures testing and monitoring. Once safeguard measures are adopted, they require regular testing and update when necessary.

- Staff training. You must provide security awareness training and conduct regular refresher sessions for your staff. Remember, the security of an organization is only as strong as its least vigilant employee!

- Third party service providers management. If you outsource any of your processes to third party service providers, it’s essential to check the vendor’s security practices and request to adopt safeguard measures consistent with your own data security plan.

- Incident response planning. The safeguards rule obliges financial institutions to develop an incident response plan and write scenarios for any case possible to predict, so that your team can react to the incidents according to a well-prepared guide. Still, you should analyze every single incident and record the key lessons learned for improvement of your response plans.

- Board of directors reporting. Your employee responsible for data security must provide a written report to the board of directors or governing body on a regular basis, or at least annually. This report should include details about meeting GLBA information security requirements, its legal compliance, risk assessments, risk management, and recommended changes to safeguards rule compliance methods.

Aaaand that’s all for the safeguards rule. Sure, it’s a big project to implement all these things in your company, but your customers and you will be grateful for such an important job done.

The pretexting provisions

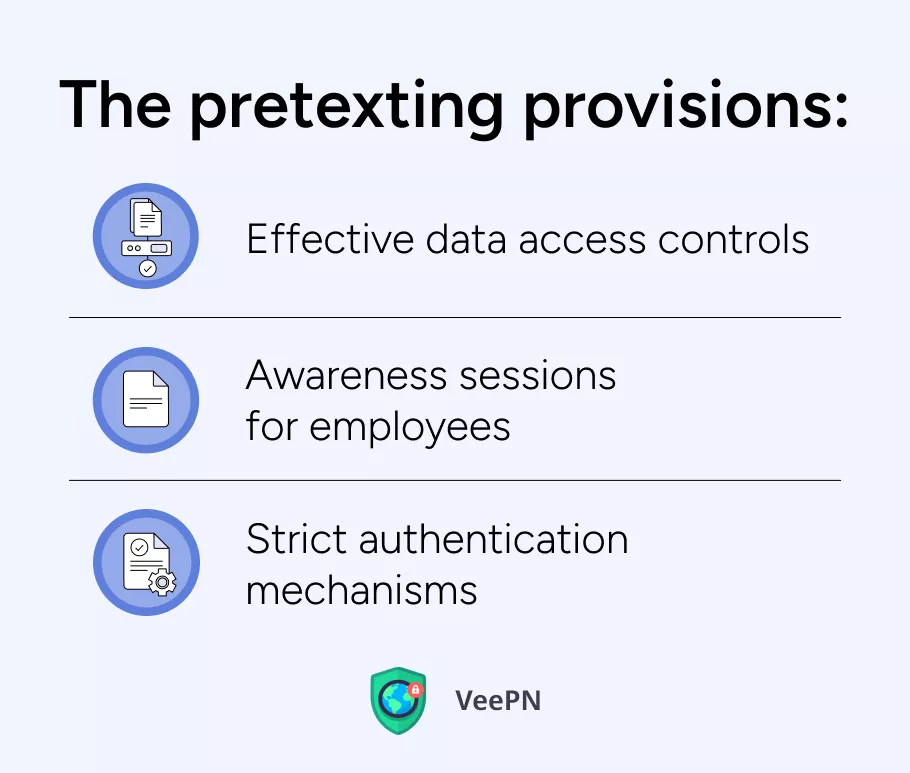

Social engineering attacks have surged significantly in recent years, resulting in billions of dollars in global damages. The pretexting provisions aim to prevent the unauthorized access to and use of customer information through deceptive practices. To comply with GLBA requirements under this provision, you may consider the following recommendations:

- Effective data access controls. To avoid social engineering attacks such as phishing and scams, you need to create and adopt data access policies that state access permission rights, role-based access, and user activity monitoring.

- Awareness sessions for employees. Since the human factor is one of the most persistent threats for your cybersecurity, arranging regular awareness sessions for your staff is the key to reducing risks of breaches and improving their skills to safeguard sensitive data.

- Strict authentication mechanisms. Setting strict access controls such as multi factor authentication, role-based access controls, and strict password policies are the backbone of protection from unauthorized access attempts and social engineering attacks.

These are the three core principles of GLBA compliance. But who should follow them?

What businesses require GLBA compliance?

If you’re in doubt whether your company has to undergo GLBA compliance, check the image below to see what kind of companies must adhere to the policy.

But what will happen if you fail to comply with GLBA? Let’s see the case study of Venmo.

In 2018, Venmo, a popular peer-to-peer payment service, found itself in the center of a privacy scandal. This financial institution was accused of violating the GLBA: the primary issue was Venmo’s default privacy settings.

By default, user transactions were public, meaning anyone could view them, including sensitive financial details. This lack of transparency exposed users’ personal information to a wider audience than intended. Venmo didn’t just mess up – it got called out for failing to provide clear and honest privacy notices, leaving users in the dark about how their data was being collected and used. These privacy failures came with major consequences for both Venmo and its parent company, PayPal. The Federal Trade Commission (FTC) stepped in, forcing Venmo to clean up its act, demanding stronger data security, better privacy settings, and full transparency on how user info is handled.

Beyond a doubt, it’s much safer to comply with the regulations not just to follow the law but to care for your customers, your own data security, and your good name. That’s why we have prepared a detailed checklist which will let you not to miss a single important aspect of compliance with GLBA.

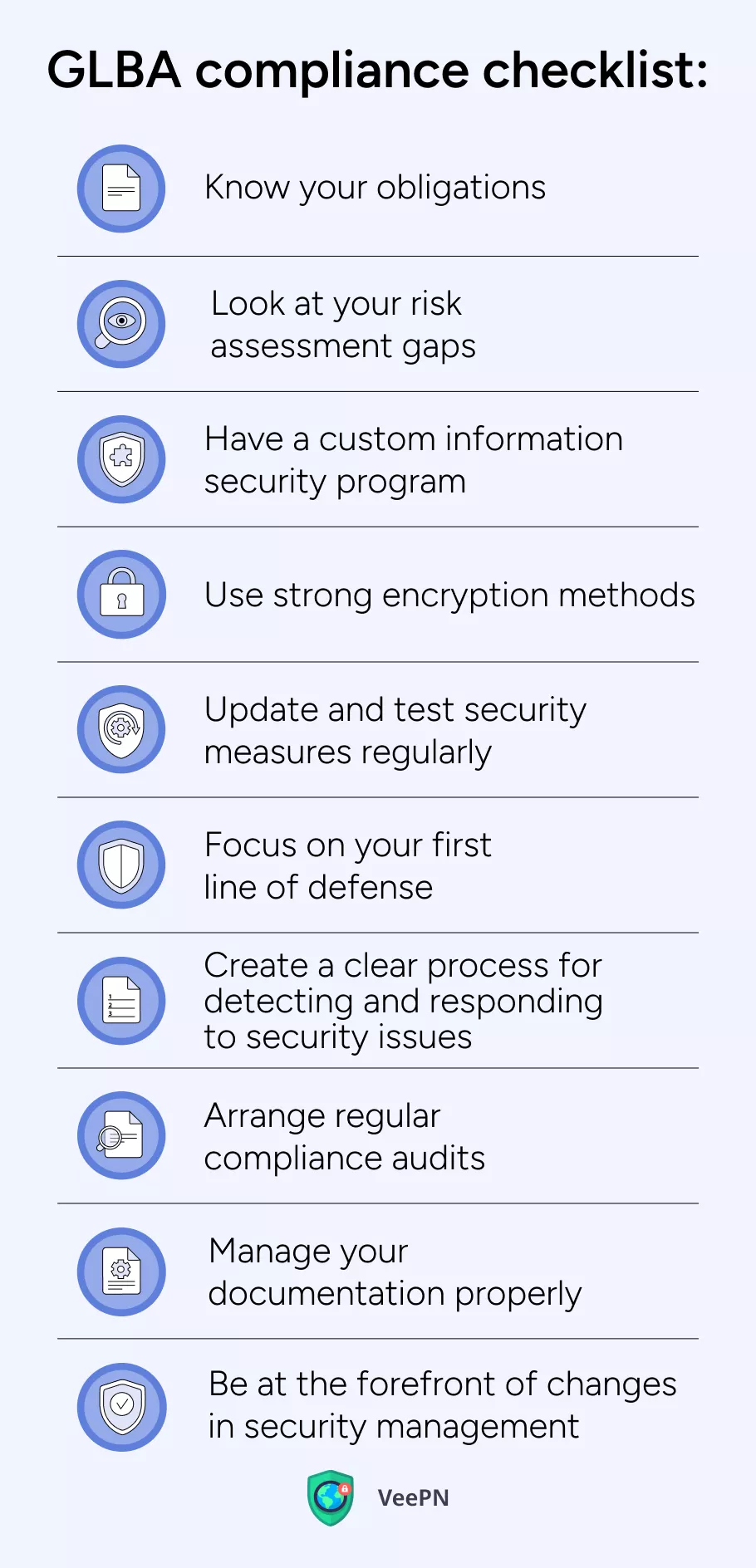

Main steps to comply with GLBA

- three core principles we’ve described above. That’s the basic requirement that aims to ensure you’re fully aware of responsibilities you must hold in the face of the law and your customers.

- Look at your risk assessment gaps. Review your risk assessment practices and try to identify what blind spots you have in order to adopt relatable decisions.

- Have a custom information security program. Transform your risk assessment conclusions into an actionable plan you will follow in case of security breaches and other relatable emergencies.

- Use strong encryption methods. Make sure you encrypt your traffic with robust encryption methods. We suggest you try VeePN — a premium virtual private network (VPN) service that uses AES 256-bit encryption which is considered the most secure standard so far. In addition to reliable encryption, VeePN offers such security features as Double VPN, NetGuard, and Alternative ID that make this app an ideal solution for protecting your business data.

- Update and test security measures regularly. Review and update your information security program from time to time to address any gaps that prevent you from GLBA compliance.

- Focus on your first line of defense. Responsiveness of your employees is the main defense mechanism you should care for, which is why their training and education should be one of your priorities for the information security program.

- Create a clear process for detecting and responding to security issues. Create and rehearse narrow-specific scenarios for detecting and responding to security threats, as long as the success of your data protection activities depends much on how well and fast they’re handled by your team.

- Arrange regular compliance audits. Review your basic compliance activities just to be sure you don’t deviate from the GLBA compliance regulations, and in case you do, adjust your processes respectively.

- Manage your documentation properly. Timely documentation of every compliance step taken is the cornerstone of your successful information security program and GLBA compliance.

- Be at the forefront of changes in security management. Do your best to stay informed about the most recent changes in the industry and cybersecurity to be prepared for new types of hacker attacks and minimize risks of unexpected strikes with new hacking methods.

Feel free to print this checklist out and hang it on front of your desk to have it at your fingertips.

Enhance your data protection processes with VeePN

It is difficult to ignore the fact that data security is important not just for formal compliance with GLBA but first and foremost for the greater good of your customer information. With this checklist for GLBA compliance you can be sure you won’t miss anything important to data security of your users and your online business.

If you want a rock-solid defense against online threats, VeePN has your back. With top-tier encryption, it shields your data and blocks out phishing scams, malware, and trackers before they even get close.

Plus, it’s got full support for all major platforms, so you can protect up to 10 devices with just one subscription. Total security, total convenience, and zero compromises.

Download VeePN today and enjoy a 30-day money-back guarantee!

FAQ

GLBA stands for the Gramm-Leach-Bliley Act, the US federal law enacted in 1999. It mandates financial institutions to protect the privacy and security of consumers’ personal financial information by requiring them to explain their information-sharing practices and implement safeguards to prevent data breaches.

A GLBA compliance checklist ensures that financial institutions meet the requirements of the Gramm-Leach-Bliley Act to protect consumer data. Key components of the checklist include:

- Privacy rule: Develop and deliver a privacy notice that explains information-sharing practices to customers and provides opt-out options.

- Safeguards rule: Implement a comprehensive security plan to protect sensitive information, including risk assessments and employee training.

- Pretexting protection: Prevent unauthorized access to personal information through social engineering (pretexting).

Regular audits, secure data handling procedures, and vendor management are also vital for maintaining compliance. Read this article to learn more about the core principles of GLBA compliance.

The GLBA does not explicitly require encryption, but it mandates financial institutions to implement appropriate safeguards to protect consumer data. Under the safeguards rule, organizations must take measures that are “appropriate” to their size and complexity, which often includes encryption as a best practice for securing sensitive data during storage and transmission. While encryption isn’t specifically mentioned, it’s commonly used to meet GLBA’s security requirements.

A GLBA risk assessment is a key requirement under the safeguards rule of the Gramm-Leach-Bliley Act. It involves evaluating an organization’s potential risks to the security, confidentiality, and integrity of customer information. The assessment identifies vulnerabilities in processes, systems, and policies that could expose sensitive data to threats such as data breaches, unauthorized access, or cyberattacks. Based on the findings, financial institutions must implement safeguards to mitigate these risks and regularly update their security measures to ensure ongoing protection of customer data.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan