Crypto Wash Sale: Legal (But Not for Long?)

Crypto wash sales have been a hot topic for crypto traders and tax enthusiasts for years. Unlike the traditional stock market, where wash sale rules prevent investors from claiming tax bills if they repurchase the same asset within 30 days, crypto remains in a regulatory gray zone. In fact, the loophole allowing crypto wash sale strategies is still very much alive and kicking in 2025. This opens doors for savvy investors to strategically lower their tax liabilities, but it also raises critical questions about legality, ethics, and potential future risks.

In this article, we’ll break down why crypto wash sales still work, how to use them responsibly, and what to watch out for if you want to stay on the right side of the law.

What is a wash sale and how does this concept apply to crypto?

Wash sale rule is an established practice in conventional finance that uses manipulation of stocks and securities. A wash sale is a sale of securities and claiming capital losses followed by the purchase of the same security within 30 days prior or following the sale. In such a way, tax loss harvesting comes into play as you generate a “capital loss”, getting a tax advantage as an outcome.

But when we speak about the wash sale rule in crypto, the story changes. The Internal Revenue Service (IRS) currently classifies crypto as property, not securities, so it’s a different type of taxable income. This key difference means the wash sale rule doesn’t apply to crypto transactions as you simply don’t buy and sell substantially identical securities, it’s actually a digital currency.

These cryptocurrency tax rules allow crypto wash sales to remain a good way to ensure future gains, but the legal landscape of crypto loss tax harvesting is under strong and constant scrutiny, so it could change quickly.

Since the IRS hasn’t yet focused on the cryptocurrency wash sale rule, traders can still take advantage of this tax strategy. It’s a powerful method for reducing offset capital gains taxes, especially for short-term and day traders who experience frequent market swings. Nevertheless, there are risks you have to be aware of.

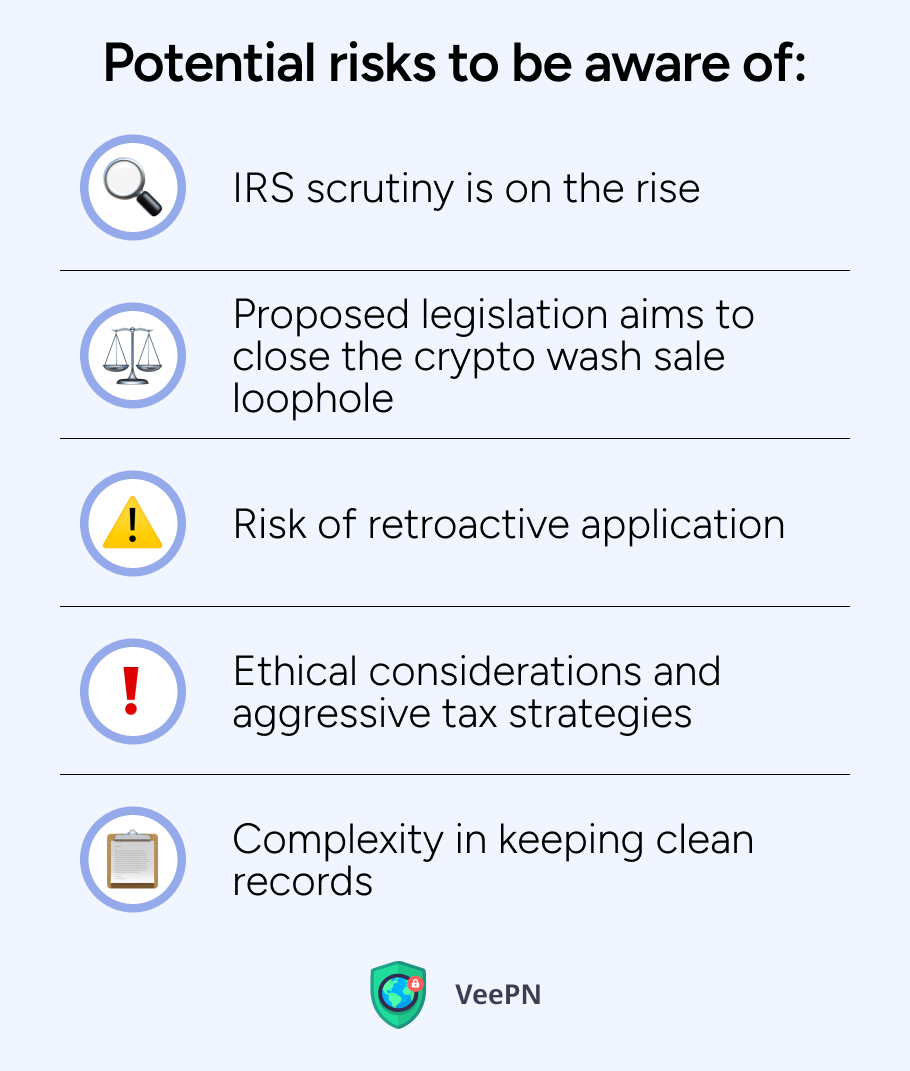

Potential risks and areas to be aware of

Crypto wash sale rule carries several important risks you should be aware of:

⚠️IRS scrutiny is on the rise. The IRS has significantly increased its focus on crypto tax filings, audits, and enforcement actions. Investors who aggressively use crypto wash sales may find themselves under the agency’s microscope.

⚠️Proposed legislation aims to close the crypto wash sale loophole. There have been multiple legislative proposals to apply the wash sale rule to cryptocurrencies. Although none have passed yet, it’s clear that crypto wash sales are on lawmakers’ radar.

⚠️Risk of retroactive application. If new laws are passed, there’s a chance they could be applied retroactively, potentially invalidating previously claimed losses and leading to penalties or back taxes.

⚠️Ethical considerations and aggressive tax strategies. Some tax professionals warn that over-reliance on wash sales might be viewed as aggressive tax behavior, which could harm your standing in case of an audit.

⚠️Complexity in keeping clean records. Without detailed records and supporting documentation, it could become challenging to defend your tax position if questioned by authorities.

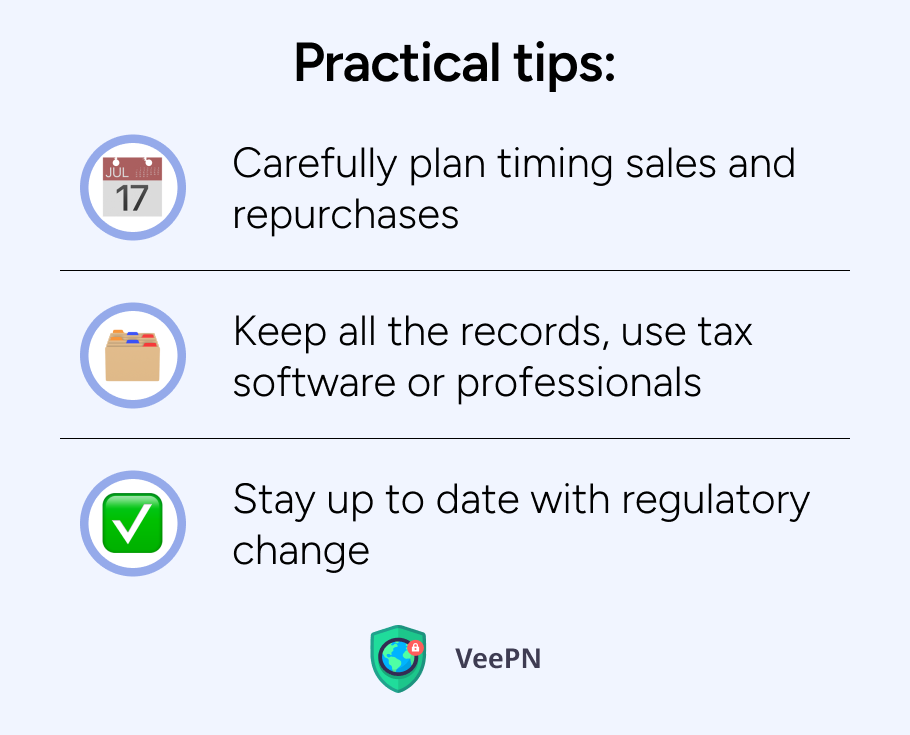

Practical tips for executing crypto wash sales responsibly

If you choose to take advantage of this tax tactic, do it with caution and responsibly:

✅Carefully plan timing sales and repurchases. Time your transactions thoroughly and document every step. Even though the wash sale rule doesn’t apply now, regulations can change quickly.

✅Keep all the records, use tax software or professionals. Keep meticulous records of each transaction, including time stamps, prices, and wallet addresses. Use crypto tax software or work with a tax professional who understands the nuances of digital assets.

✅Stay up to date with regulatory changes. Crypto tax laws are evolving fast. Subscribe to official IRS updates or follow reputable crypto tax analysts to ensure you’re always ahead of changes. If necessary, seek expert advice to make sure you’re up-to-date with laws and regulations.

Why use a VPN for safer crypto trading activities

Besides tax, privacy and security is key when trading crypto. Hacks, phishing schemes and snooping Internet Service Providers (ISPs) are threats to your financial data. Using a virtual private network (VPN) adds an extra layer of protection by masking your IP, encrypting your data and securing your connection, especially when trading over public unsecured WiFi networks.

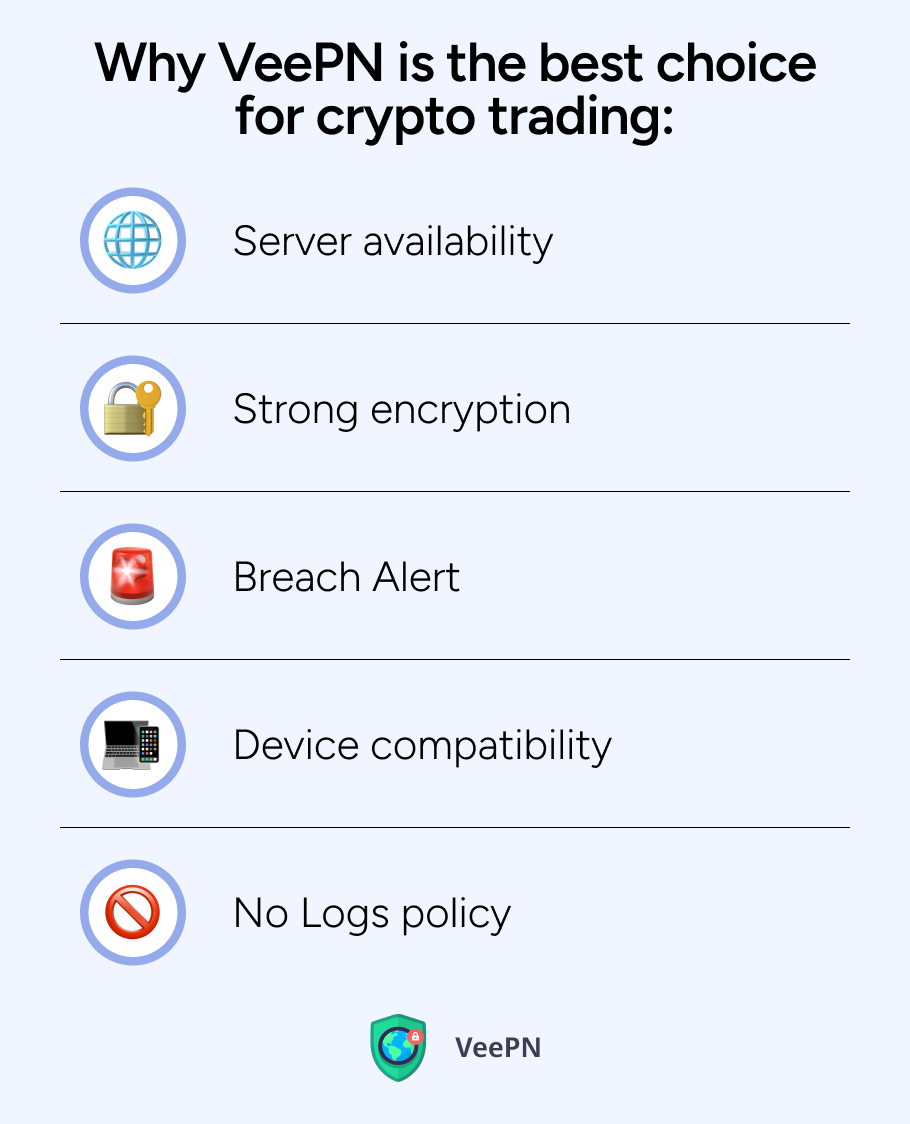

Why VeePN is the best choice for crypto trading

When it comes to protecting your crypto trades, VeePN offers unmatched security and convenience:

🛡️Strong encryption. VeePN uses military-grade AES-256 encryption to protect your data from cybercriminals and surveillance.

🛡️Server availability. With 2,500+ servers in 89 locations, you can connect from anywhere and bypass geo-restrictions or local network throttling.

🛡️Breach Alert. VeePN notifies you instantly if your personal information appears in known data breaches, so you can take action quickly.

🛡️Device compatibility. Protect up to 10 devices simultaneously, including your PC, mobile, and web browsers, with one VeePN account.

🛡️No Logs policy. VeePN works under a strict policy of not collecting your personal information, ensuring your crypto trading activities stay private and anonymous.

Get VeePN now and enjoy a 30-day money-back guarantee!

FAQ

You can’t take a tax loss on a security if you sell and then buy the same or a very similar one within a 30-day period. This rule is intended to prevent you from faking tax losses while you’re still holding your initial investment. In the United States, this rule just applies to stocks and securities, and not to cryptocurrencies.

To avoid the wash sale rule, just wait at least 31 days before purchasing the same or a similar investment again after selling it at a loss. You could go with a similar investment to ensure your case doesn’t classify as a wash sale. However, cryptocurrencies aren’t subject to wash sale rules at the moment, so you’ve got more choices for tax loss harvesting there.

There are many discussions of reverse wash sale, even if it isn’t very common. Actually, it works in the opposite way: you buy a security first, then you sell the same or a really similar one at a loss in the following 30 days. Because you got your security before making the loss, the IRS won’t let you deduct the loss from taxes bill, which is just the opposite of a normal wash sale. You can still use the normal ways to sidestep or postpone a wash sale. Again, this strategy doesn’t make much sense in respect to crypto trading.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan