How Does a Cashless Society Affect Your Privacy?

Swiping cards, tapping phones, and scanning QR codes: welcome to the cashless society. It’s convenient, quick and seemingly efficient. But beneath this seamless financial evolution lies a big question: what does going cashless mean for your privacy?

A growing concern is the privacy implications of a cashless society as more people worry about how their financial data is collected and used.

As we trade tangible coins and notes for digital footprints, our spending habits become traceable in ways never imagined, putting our privacy at risk. With each transaction recorded, analyzed and often shared across platforms, the dream of financial convenience might be leading us to a surveillance state.

Worried about your digital privacy? VeePN can help

Before we get into the nitty gritty of a cashless society, consider this: every tap or transfer without proper protection leaves a digital trail. Your location, habits and even preferences can be exploited by data brokers, corporations or worse — cybercriminals.

That’s where VeePN comes in. VeePN encrypts your Internet traffic with military-grade encryption, hides your IP address and ensures your financial activity is private, even on public WiFi or shady networks. Whether you’re paying online, using mobile banking or just browsing, VeePN makes sure your financial privacy is yours.

👉Try VeePN today — one click, total digital freedom.

What is a cashless society?

A cashless society is where physical money is replaced with digital transactions. From mobile wallets and credit cards to bank transfers and cryptocurrencies, almost every payment method becomes traceable and recorded. This shift to cashless payments brings convenience and new challenges for consumers and businesses. Although cash is legal tender, many establishments in cashless societies may not accept it, raising questions about the obligation to accept cash.

Sweden, China and the UK are leading the way in this transition, but many other countries are catching up, embracing fintech and government pushes for digital economies.

The privacy trade-offs of going cashless

A cashless society is where physical money is replaced with digital transactions. From mobile wallets and credit cards to bank transfers and cryptocurrencies, almost everything becomes trackable and recorded. This shift to cashless payments brings convenience and new problems for consumers and businesses. Although cash is legal tender, many places in a cashless society may not accept it, so what about the obligation to accept cash?

Sweden, China and the UK are leading the way but many other countries are following, embracing fintech and government pushes for digital economies.

Complete financial surveillance

Every digital transaction creates a record – what you bought, when and where. Banks, fintech companies and government agencies can access this data. This opens the door to profiling, tracking and even censoring purchases.

Such systems can enable authorities to monitor and control individuals’ financial behavior.

Data monetization by third parties

Your purchase history is gold for advertisers. An insurance company could also use your transaction data to assess risk or adjust your premiums based on your spending habits. Payment processors and apps may share or sell anonymized (or not-so-anonymized) data to third parties, influencing the ads you see and the offers you receive.

Security risks and data breaches

Centralized financial data attracts hackers. If a payment provider or digital wallet gets compromised, your transaction history, personal information and even identity could face an increased risk of identity theft and data breaches.

Exclusion and control

Cashless societies will marginalise those without digital access. The digital divide means certain groups, the unbanked or those without reliable internet, can’t access cashless services and participate fully in the digital economy. Worse still if your account is frozen or flagged for an error or political pressure you can be locked out of your own money. And relying on digital payment systems introduces risks of infrastructure failures, cybersecurity threats and privacy concerns.

Cashless stores and their limitations

The shift to cashless stores is changing the way we shop, eat and pay for services. From trendy coffee shops to big box stores, more businesses are going cashless: credit and debit cards, mobile wallets and other digital payment methods only, and leaving cash behind. While this promises faster checkouts and streamlined operations, it also brings a host of limitations we can’t ignore. One of the biggest is the exclusion of people who use cash. For many in low income communities or rural communities, access to banking services and digital payment options is limited. Without a bank account or reliable internet, being cashless is almost impossible, and that raises big questions about financial inclusion. In cities like San Francisco, local governments have even passed laws requiring businesses to accept cash, because going cashless can leave vulnerable populations behind.

Privacy and security are also at stake. Every cashless transaction generates digital data – what you bought, where and when. That data can be tracked, stored and shared, and that increases the risk of identity theft and exposes customer info to hackers. Cashless systems are a target for hackers and one breach can put thousands of consumers at risk.

Technical failures are another problem. Cashless stores rely on stable power and the Internet. A simple outage or system glitch can bring all transactions to a halt and leave both businesses and customers stranded. That’s especially bad for online shopping platforms and mobile wallets where even a brief disruption can mean lost sales and frustrated customers.

There’s also the cost issue. Some digital payment methods – especially certain credit and debit cards – have higher processing fees. Those fees are often passed on to consumers and that makes everyday purchases more expensive. As cash transactions decline, the whole economy may feel the impact, with small businesses and those who rely on cash-based services facing new hurdles.

Governments and institutions like the federal reserve bank are encouraging digital payments, seeing benefits in efficiency and traceability. But we must make sure those policies don’t disproportionately affect those who are already underserved. Consumer privacy and security must be top of mind as we go cashless.

To address these concerns, solutions should focus on expanding access to banking services and digital payment methods for all, especially low income and rural communities. Businesses and governments must also invest in robust security, like encryption and secure data storage to protect transaction data and prevent identity theft. So it’s all about balance.Real-world scenarios: when convenience turns into vulnerability

For example, consider the following scenarios that illustrate the impact of digital payments and related technologies.

Real-world scenarios: when convenience turns into vulnerability

- In China’s social credit system, financial behavior affects travel, loans and education.

- In India and Nigeria, mobile wallet hacks compromised millions of users’ data and funds.

- In the West, post-pandemic tracking systems used payment data to monitor individual movement and behavior.

- A customer bought groceries using a digital wallet, but the transaction data was tracked and analyzed, more so than cash purchases.

- Other services like ride-sharing, bike and scooter rentals, public transit systems have shifted to digital payments which affects user privacy and limits cash options.

- Over the past year, there has been a huge surge in digital payment usage especially after COVID-19 pandemic, accelerating the move towards cashless transactions and new privacy and security challenges.

How VeePN protects your digital finances

A reliable VPN like VeePN is essential in a cashless world. Here’s how:

- Encrypts transactions to keep your financial data safe from prying eyes

- Hides your identity to prevent transaction tracing

- Blocks data collectors from building your habit profile

- Secures public WiFi especially for mobile banking or payments on the go

Choosing a privacy-focused VPN: what to look for

Not all VPNs are created equal. Here’s what you need to stay safe:

- No Logs policy to ensure your activity isn’t recorded

- AES-256 encryption for military-grade protection

- Global servers for smooth access anywhere

- Multi-device support for all your gadgets

VeePN meets all these criteria and has 24/7 support with flexible pricing.

How to set up VeePN for cashless security

- Download and install VeePN on your device

- Create an account and choose your plan

- Connect to a secure server

- Use banking and payment apps with peace of mind

Conclusion: convenience not surveillance

A cashless society offers speed and simplicity but at the cost of your privacy. But you can enjoy digital payments without giving up your personal data.

With VeePN, your financial freedom remains intact. Take control of your privacy and protect every transaction.

👉 Download VeePN now because your digital wallet deserves a digital shield.

VeePN is freedom

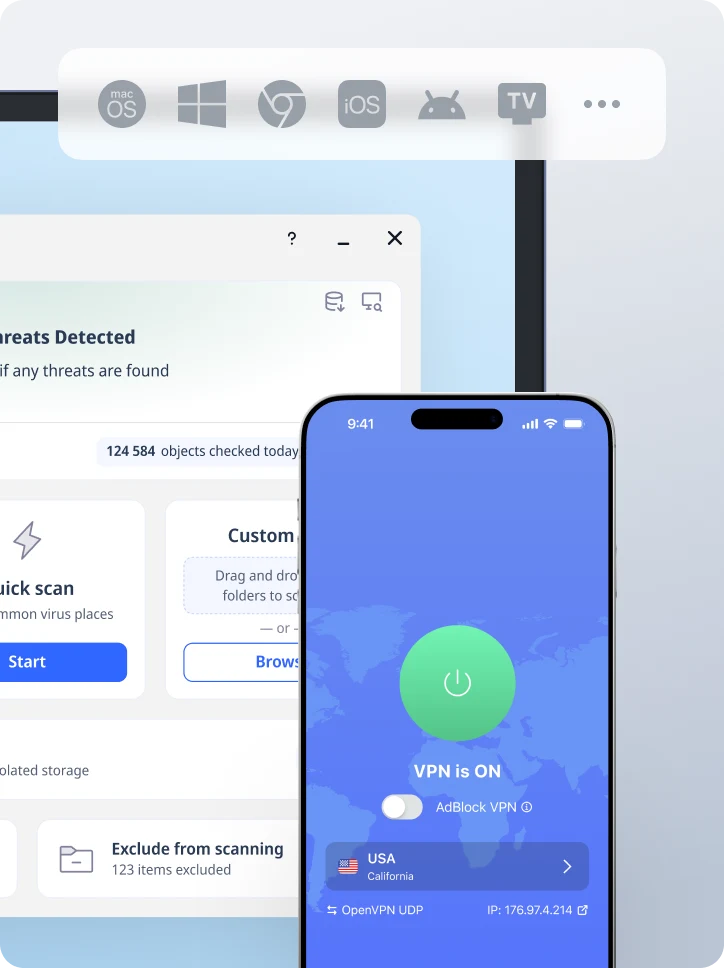

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan