7 Best Privacy.com Alternatives: Which Virtual Card Service Is Right for You?

If you often buy things online or sign up for digital subscriptions, you’ve probably come across Privacy.com. This platform lets you create virtual card numbers for online transactions so you never have to expose the details of your physical credit card. Additionally, users can set spending limits on “masked” cards, and even cancel the card on the spot in case of sketchy dealings.

But Privacy.com might not be a perfect-fit platform as it is available only in certain countries, comes with monthly usage limits (unless you pay for higher plans), and lacks some of the advanced perks that other virtual card services offer.

If you’re looking for something better than Privacy.com, this article will help you decide which Privacy.com alternative is right for you. We will also explain why a high-quality VPN like VeePN can protect you from threats that many Privacy.com alternatives can’t handle.

Why you may look for a privacy.com alternative

As we said, Privacy.com’s value is great. Users create virtual debit cards to shop online without revealing real bank accounts or physical credit card details. But with all the good stuff, there are reasons people might also consider hunting for privacy card alternatives:

Limited availability

Privacy.com is primarily aimed at U.S. residents. If you live outside the United States or need a solution that works globally, you may feel left out.

Strict monthly card limits

On a free plan, you can create up to 12 virtual cards each month. This can be a problem if you subscribe to tons of online services, want to test them out, or run an international business with multiple payees.

Few advanced features

Some privacy.com competitors come loaded with advanced analytics features, budgeting insights, or integration with accounting tools. For small businesses or entrepreneurs, it may sound more appealing.

Missing or minimal rewards

Privacy.com offers no cashback for the free and “plus” subscription tiers. For more advanced plans, there’s only 1% of cashback available with a limit on the sum amount. A few other sites like privacy.com such as Mercury offer higher rewards.

Multi-currency

If you do a lot of online transactions with merchants in other countries, you may want a service that supports multi-currency, has lower foreign transaction fees (privacy.com offers a 3% foreign transaction fee with a $0.50 minimum).

Having that covered, let’s move on to the overview of popular privacy.com alternatives and consider their strong and weak points so that you can make a grounded decision.

Best privacy.com alternatives

Here are privacy.com competitors that might just become your favorite ones for secure and convenient online payments.

| Provider | Coverage | Pricing | Limits |

| 1. IronVest | Mostly U.S. | 30 days of free trial, then ~$3-8/month | Limited masked cards on free tier |

| 2. Ramp | 190+ countries | Lifetime free for basic | Unlimited cards, business usage |

| 3. Pay With Moon | U.S. merchants | Free | Depends on the crypto top-up |

| 4. Mercury | 152 countries | $0/month. Pay only for optional extras | Per user or per transaction settings |

| 5. US Unlocked | 180+ countries | 3 months promo. Then ~$3.50/month + fees | Tied to account balance & deposit method |

| 6. Wallester | 35 countries (EU) | €0 to €999/month | Up to thousands of cards, custom limits |

| 7. Skrill | 180+ countries | Free sign-up, various fees | Linked to user identity & transaction history |

Now, let’s dive into the details of each platform and things to pay attention to before choosing the platform or app like privacy.

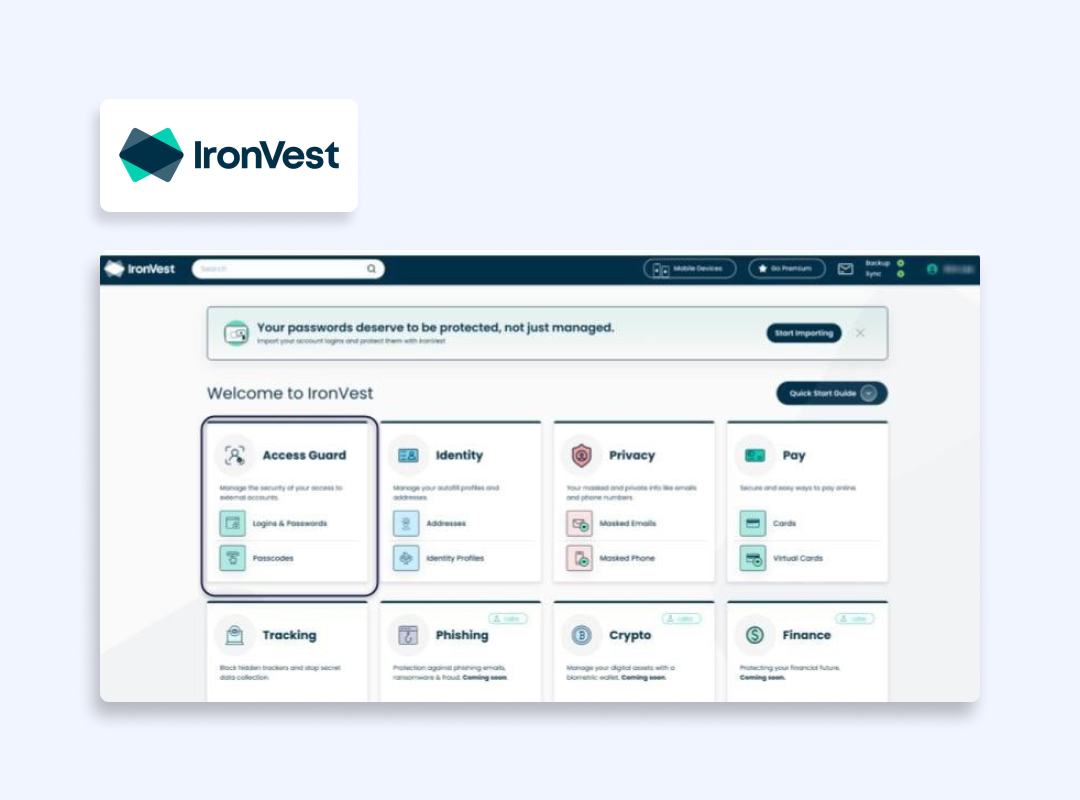

1. IronVest

With IronVest, it is quick and easy to create virtual credit card numbers. The platform also allows users to create “masked” cards that you can top up using your bank account or a standard credit card. It also offers masked email addresses and robust multi-factor authentication to add extra layers of safety.

| Pros | Cons |

| 👍 Masked credit cards IronVest’s main feature is letting you generate single-use or ongoing masked cards. 👍 Biometric account protection From face scans to fingerprint locks, IronVest can require a biometric step whenever you try to log in or confirm a payment. 👍 Flexible plan structure You can start with a free plan that includes a limited number of masked cards, then scale up to a paid option if you need a higher monthly allotment. 👍 Solid data encryption The company states it uses AES-256 encryption and other bank-level security measures to keep your details safe. 👍 Straightforward setup Link your existing card or checking account, load up a masked card, and start spending instantly. | 👎U.S.-centric IronVest is primarily geared toward U.S. users and U.S.-based merchants. 👎 No free plan You need to pay a minimum of $39/year to use the service. |

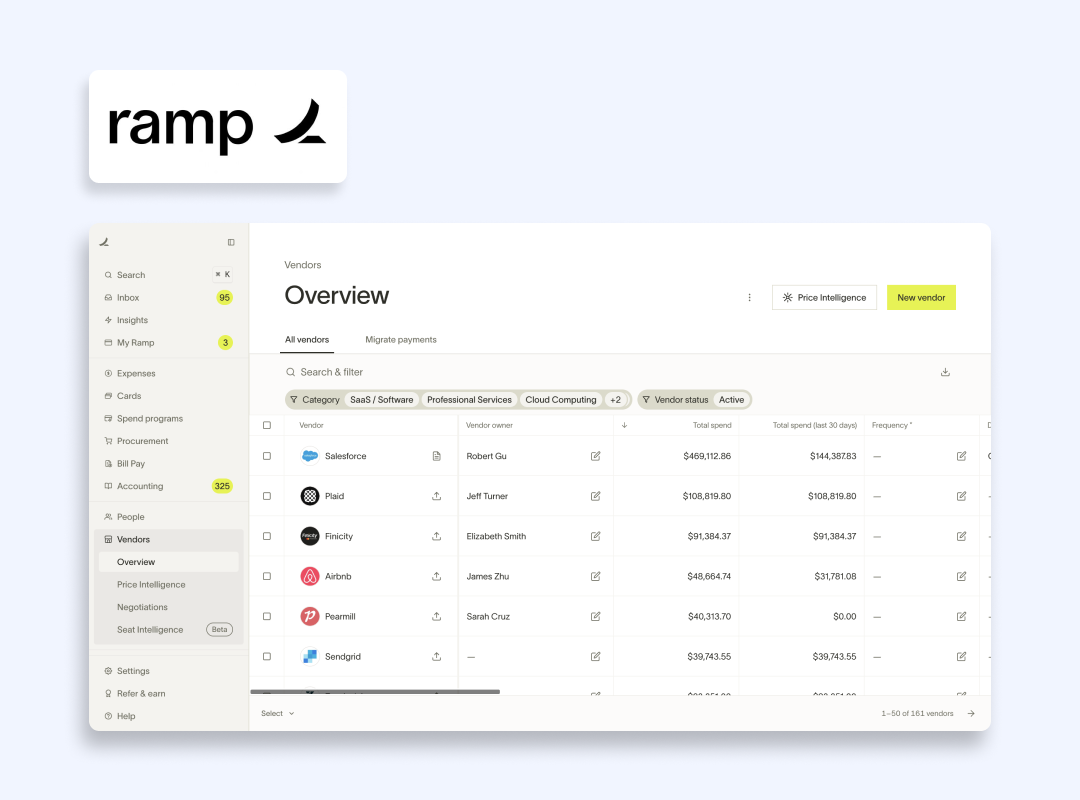

2. Ramp

Ramp is a privacy.com alternative originally developed for small businesses and those looking for robust financial controls features and customizable spending limits. Ramp will be more useful for corporate cards rather than personal ones. It gives teams unlimited virtual debit cards and advanced spending analytics.

| Pros | Cons |

| 👍 Unlimited cards You can issue a unique virtual card to each team member, vendor, or department. 👍 Detailed expense management Ramp automatically sorts your expenses, tracks receipts, and integrates with accounting software (like QuickBooks or Xero). 👍 No foreign transaction fees If your employees or teams purchase from overseas sites, Ramp’s Visa-powered cards typically skip those pesky extra charges. 👍 Worldwide coverage Ramp works in over 190 countries where Visa is accepted. 👍 Automation If you love hands-off workflows, Ramp’s built-in automation features can detect duplicate invoices or remind staff to attach receipts. 👍 Zero cost Ramp doesn’t charge monthly fees for a standard account, which makes it a cost-effective alternative to Privacy.com for companies. | 👎 Not for sole proprietors Ramp typically requires businesses to be structured as a corporation, LLC, or similar. 👎 Strictly corporate approach If you’re only shopping for personal use, Ramp might be overkill. |

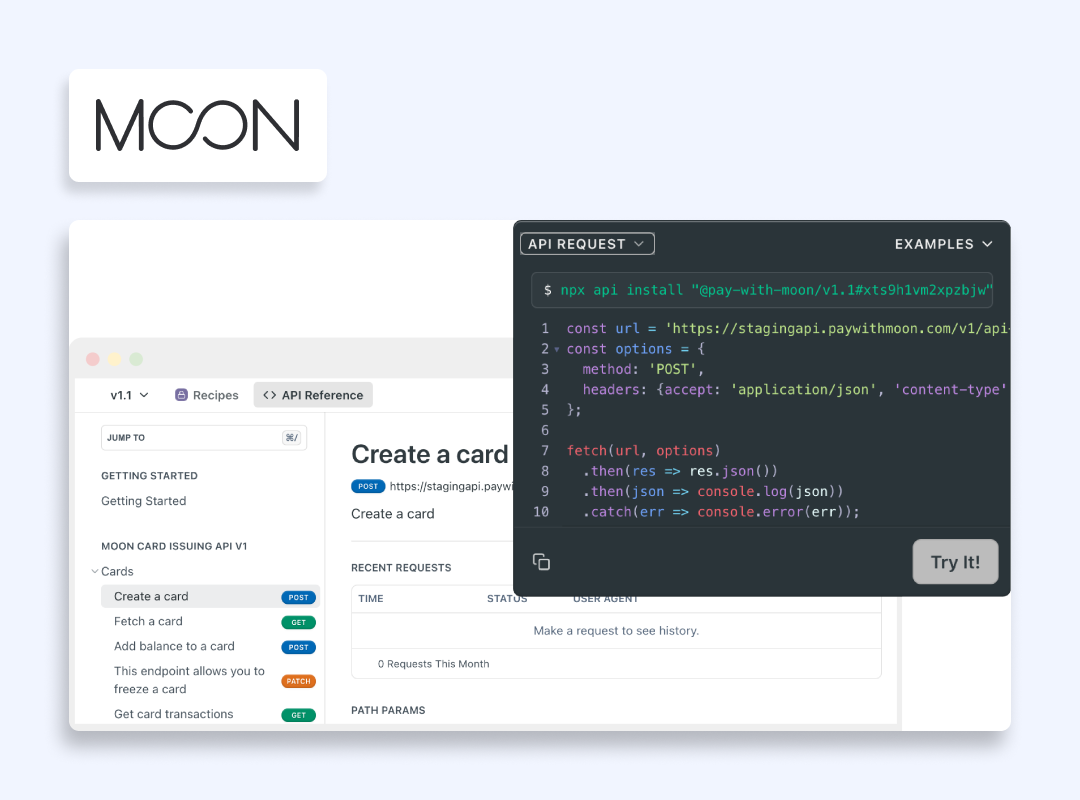

3. Pay With Moon

If you want to use crypto for your online purchases, Pay With Moon is a decent choice. Instead of linking to your bank account or a normal credit card, you can connect a Coinbase or Lightning wallet to pay with Bitcoin, Ether, or Litecoin. Pay With Moon instantly converts that crypto into U.S. dollars for use at major retailers.

| Pros | Cons |

| 👍 Crypto-based transactions Offers a straightforward route to pay at Amazon, Walmart, eBay, and many more using digital currencies. 👍 Prepaid approach Each virtual card is effectively a prepaid card. After you load it up with crypto, you can spend it anywhere that accepts a standard debit card. 👍 Worldwide coverage You can use the Pay With Moon’s X Card in over 130 countries, but you should be aware of the 1% transaction fee. Pay With Moon doesn’t charge any FX fees. 👍 Easy to generate multiple cards You can spin up a new card for each purchase if you want, each with its own usage limit. 👍 Simple sign-up Just link your crypto wallet, follow the steps, and you’re ready to go. 👍 Quick cancellation If you suspect any fraud or want to lock your card, you can do it in seconds. | 👎 No typical credit card perks What you’re doing with Pay With Moon is using your own crypto, so you don’t get the usual travel points or welcome bonuses you might with a bank card. 👎 No cashback and rewards If you look for additional incentives, Pay With Moon might frustrate you in this respect, as it doesn’t offer cashback or loyalty programs 👎 Depends on cryptocurrency volatility Pay With Moon’s cards are funded with cryptocurrencies, users are inevitably exposed to the inherent volatility of crypto markets, which can affect purchasing power. |

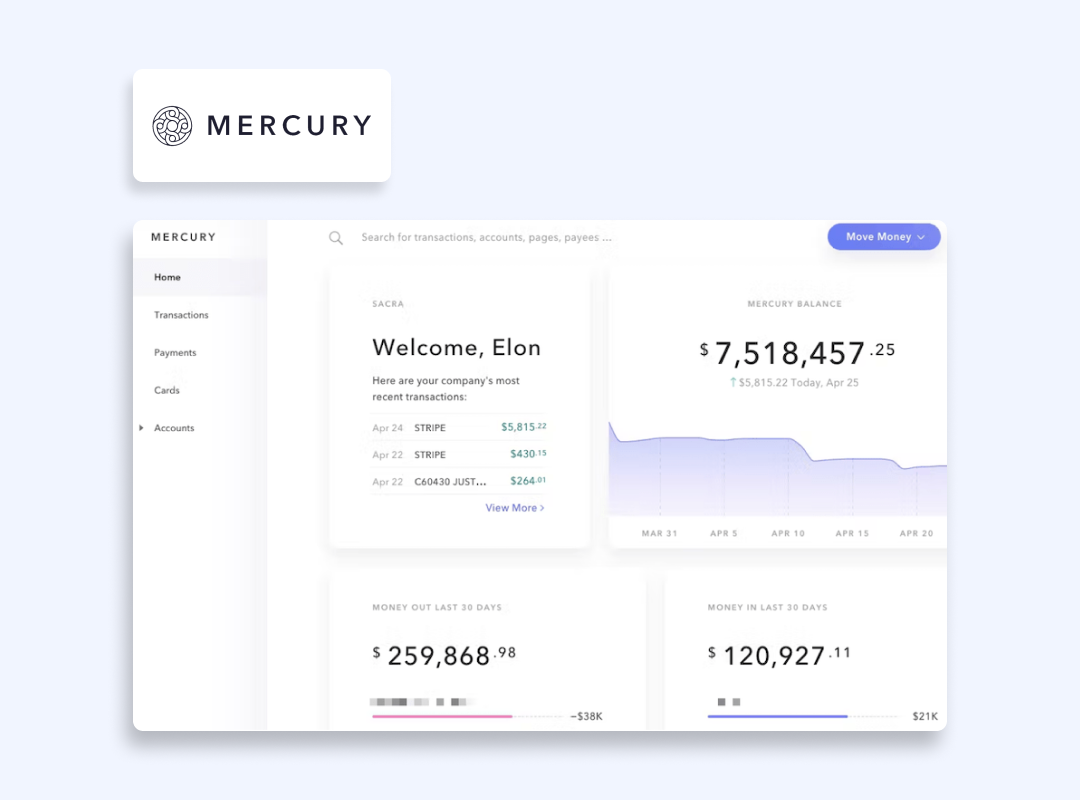

4. Mercury

Mercury is a fintech company that also acts as a business bank account solution. It’s made for startups and small-to-medium businesses to help them skip the bureaucratic hassle of a traditional banking system. Mercury also provides unlimited free virtual debit cards for authorized users.

| Pros | Cons |

| 👍Built-in business banking Mercury offers FDIC-insured checking accounts with support for wires, and a real debit card. 👍 No account fees Mercury claims to have no monthly charges, which is great for startups on a budget. 👍 Multi-currency You can transact in over 150 currencies, making it easier to handle cross-border deals. 👍 Cash back Some Mercury plans come with 1.5% cashback, which can be appealing if your monthly expenditures are high. 👍 User-friendly interface Opening an account takes minutes (for U.S.-based companies), and you can quickly generate multiple virtual credit cards as your team grows. 👍 Worldwide coverage Over 150 countries are supported when paying bills or making purchases. | 👎 Not the best for personal use Mercury is tailored mainly for businesses and offers integrations with accounting software and capabilities to manage multiple users with different access levels. 👎 No physical branches If you like in-person bank visits, this purely online approach may feel insufficient to some extent. |

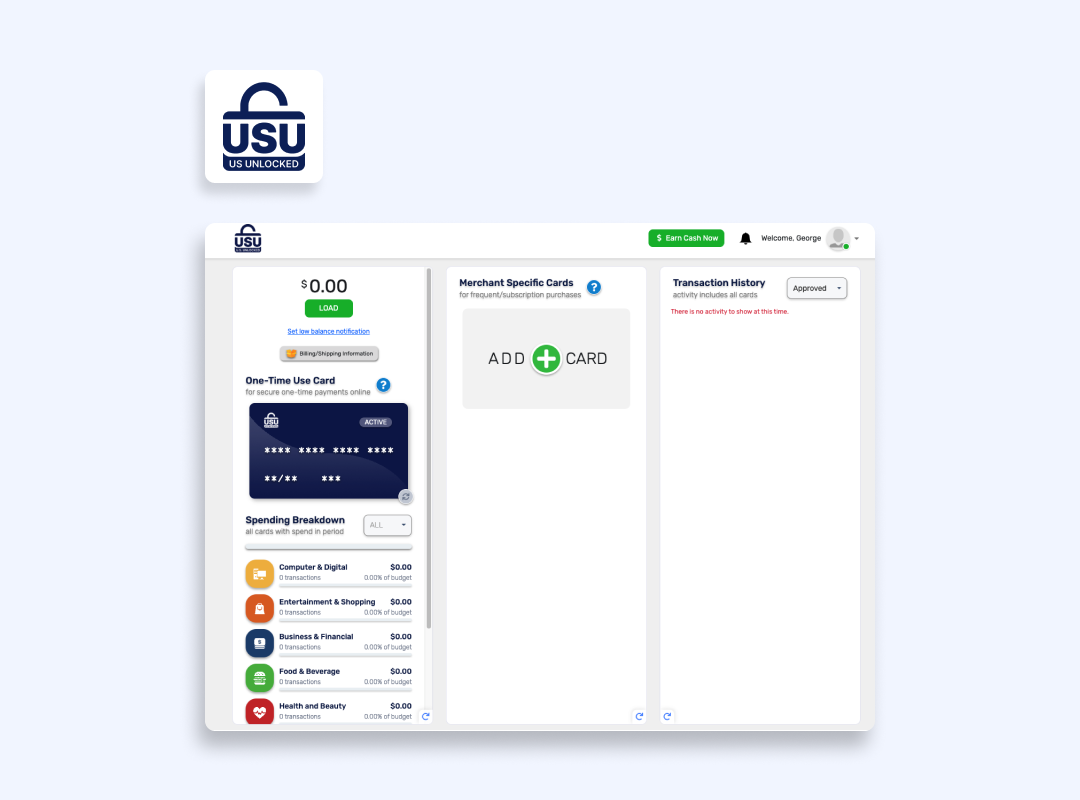

5. US Unlocked

If you’re outside the United States but want to shop at American-only websites, US Unlocked can help. This Privacy.com alternative issues virtual debit cards denominated in USD so you can quickly pay for goods and services in the States.

| Pros | Cons |

| 👍 Global access People in over 180 countries can sign up, deposit funds, and get a card that’s accepted across the U.S. e-commerce platforms. 👍 One-time use cards Generate single-use cards for an extra layer of security if you’re not sure about a particular site’s reliability. 👍 Subscription management The platform allows creating separate cards for Netflix, Hulu, or any other service to have direct control over each subscription. | 👎 Transaction fees US Unlocked takes a $0.50 fee for transactions, $6.50 for monthly maintenance, and $11.50 for unloading. 👎 Slower loading methods Bank transfers to top up your account might take a couple of days. 👎 No cashback US Unlocked does not offer cashback rewards on purchases made using its virtual cards. So, don’t expect to get any money back. |

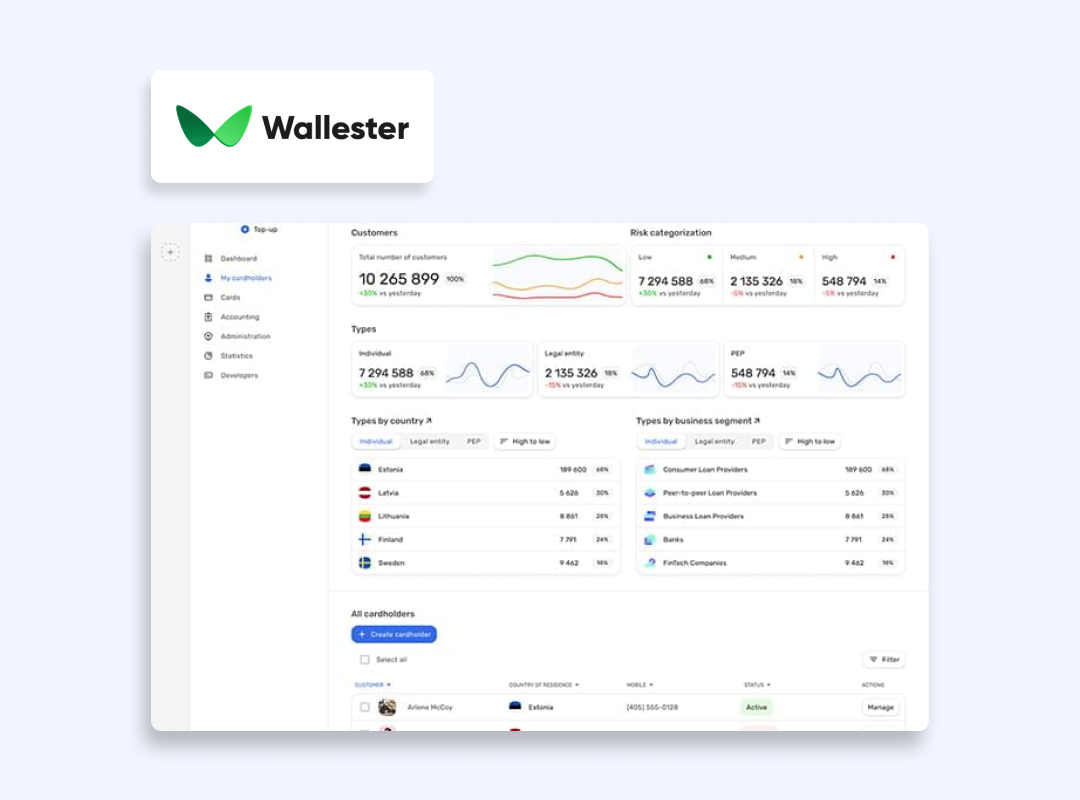

6. Wallester

Wallester is an enterprise-level platform with flexible credit lines and a modern expense-management approach. It’s especially popular in Europe and supports both virtual credit cards and physical ones (white-labeled with your business branding if you want).

| Pros | Cons |

| 👍 Corporate focus Perfect for established businesses that need to issue a lot of cards while controlling each one’s limit and usage category. 👍 High-level security Compliant with PCI DSS standards, Wallester uses 3D Secure and other modern anti-fraud protocols. 👍 Card freezing and blocking Users can instantly freeze cards or block them after a single purchase in case of potential data leaks. 👍 API integration Large companies can integrate Wallester with their internal systems to automate reimbursements, invoice approvals, and real-time analytics. 👍 Scalable pricing Wallester offers a free plan that includes 300 virtual cards and advanced paid plans that to open thousands of cards. 👍 Works with multiple currencies Wallester is a sound option if your business deals with various markets in the EU (the platform is available in 35 countries, primarily in Europe). | 👎 Not the best for personal usage The platform offers services and a lot of advanced features not really needed for personal use. 👎 Relatively high fees You can face unexpected extra foreign transaction fees for purchases made in currencies different from your account currency. There are also relatively high (€2,00 + 2,00%) fees for international ATM withdrawals. |

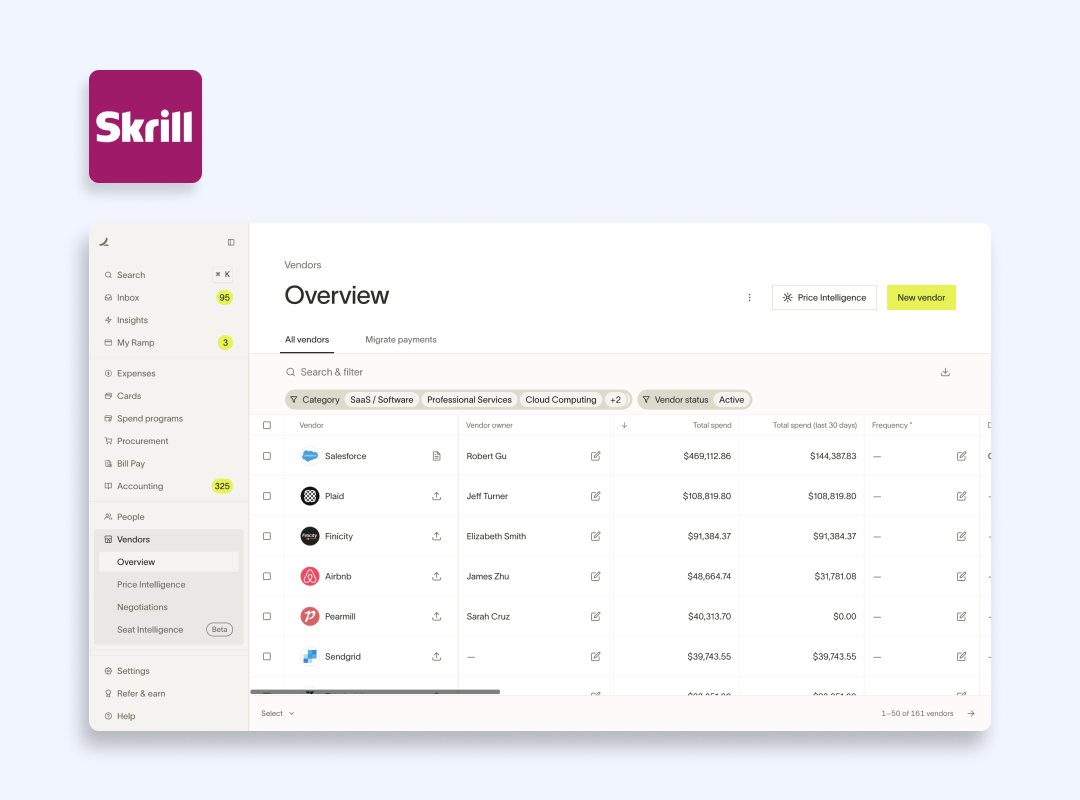

7. Skrill

Skrill is a global payment provider known for sending money abroad and trading in the Forex market. Skrill can generate virtual debit cards that you can manage from the same wallet. If you prefer an all-in-one service for money transfers, currency exchange and trading, and online shopping, Skrill might be your pick as a privacy.com alternative.

| Pros | Cons |

| 👍 Worldwide acceptance Skrill is accessible in 180 countries and available in more than 40 currencies. 👍 Prepaid card You can get a physical prepaid Mastercard that links to your Skrill balance if you still need plastic for in-store purchases. 👍 Fraud protection Skrill offers two-factor authentication and Secure Socket Layer (SSL) technology with 128-bit encryption. 👍 Can act as a checkout option If you run an e-commerce store, you can add Skrill as a checkout option for your customers. 👍 Multi-feature platform You can manage crypto, buy or sell currencies, pay bills, or shop online from one account. | 👎 Transaction fees Expect charges on money transfers, withdrawals, and currency conversions. For instance, fees can range up to 4.99% for international transfers, and 2% for domestic ones. 👎 No advanced analytics If you need to have detailed expense breakdowns or budget tools, you’ll need to use a separate solution. |

To this point, you might know which privacy.com alternative you want to jump on. But before doing that, we need to warn you that even strong and popular virtual card solutions are not bulletproof and won’t shield you from cybercrimes. Let’s consider threats you may face.

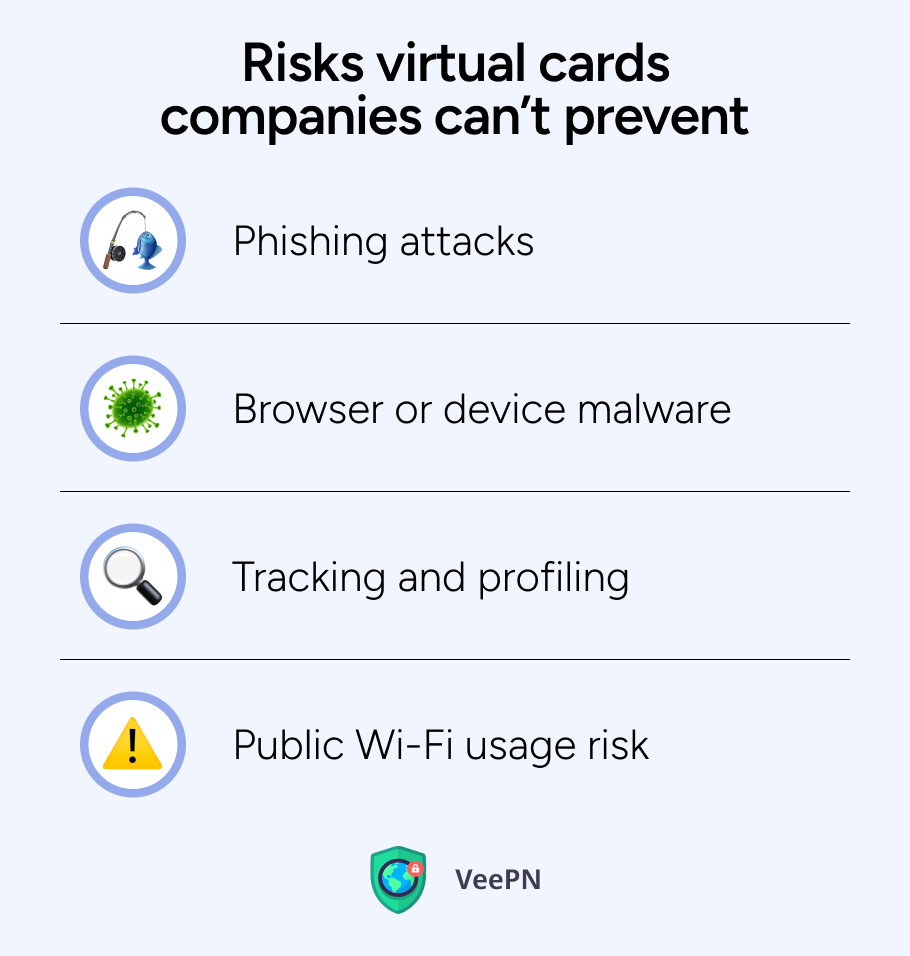

Risks even the best virtual card providers can’t help with

Even though virtual card platforms offer security measures, there is still a risk of cybersecurity attacks that can lead to data breaches, because even household names like AT&T, Ticketmaster, Block and dozens of others have fallen victim to strong cyber attacks compromising millions of user records. Here is the list of the problems you may come across:

Phishing attacks

Scam sites or emails might trick you into entering your personal data. If you’re curious about how cunning attackers can be, consider reading our article about phishing vs spear phishing.

Browser or device malware

Keyloggers can grab your keystrokes or intercept your screen in case you visit malicious websites or download infected apps or programs. This type of device malware can help hackers silently steal your login details, credit card information, or even one-time passwords so that users won’t even realize it.

Tracking and profiling

Even if you use a masked card, criminals and marketers can try to link your purchase patterns to your identity if you have the same IP address on a device you use for purchasing. The outcome? Over time, with this information, scammers can send a targeted scam tailored right for you or even steal your online identity.

Public Wi-Fi usage risk

Public Wi-Fi networks in cafes or airports can be hotspots for eavesdropping and allow intruders to intercept your data mid-transaction. Without strong encryption, any data you transmit, be it payment details or login credentials, could be visible to anyone else on the network.

A VPN is one of the best ways to fill these security gaps. But don’t trust free VPNs, as they often sell users’ personal data and browsing logs to third parties to keep their services running. Instead, consider using a trustworthy VPN provider – VeePN.

VeePN is your must-have layer of security

These VeePN features matter most when you’re managing online transactions:

Military-grade encryption (AES-256)

VeePN offers AES-256 encryption. This is the same standard banks and the military use. Even if a hacker intercepts your data, they will see indistinctive gibberish instead of login and passwords. This way, your credentials, virtual card numbers, or billing addresses will remain safe from prying eyes.

Phishing & malware protection

While it is difficult for humans to spot the difference between legitimate websites and well-designed fakes, VeePN’s NetGuard feature blocks domains flagged for phishing or malware distribution. With it, you will be protected from unintentional landing on harmful websites that can steal your credit card and personal info.

Kill Switch for data leak protection

Imagine you’re halfway through buying a plane ticket, and your VPN connection drops. Your real IP or payment data could suddenly become exposed. Kill Switch automatically blocks Internet access until a secure connection is re-established. This helps you secure your private data from leaks 24/7.

IP masking

With VeePN, your IP is replaced by the one in a remote location, so advertisers, data brokers, or even cybercrooks can’t easily identify your geographic position. A single VeePN account subscription helps you get an anonymous IP across multiple devices.

Breach Alert feature

VeePN features include data breach monitoring tools that will instantly alert you if your email or personal data appears in a known breach. This early warning system will help you to act fast and change credentials, close or freeze virtual cards before cybercriminals can exploit your money or info.

Secure public Wi-Fi usage

Even if you decide to buy a last-minute flight or pay for an e-book on cafe Wi-Fi, VeePN’s secure tunnel ensures that no one on the same network can eavesdrop on your traffic.

No Logs policy

VeePN never tracks what you do online, so your browsing stays private. There are no records left for anyone to subpoena or hack into.

Cross-platform compatibility

Whether you want to manage your online transactions on a Windows, Mac, Android phone, or iOS tablet, VeePN supports them all. You can connect up to 10 devices on one account and get consistent protection across all your gadgets.

Try using VeePN risk-free with a 30-day money-back guarantee.

FAQ

Yes, it’s primarily US-based, but there are good privacy.com alternatives you can explore. Check out the article for more info.

Yes, it is a robust platform with strong security features. However, many other services also offer virtual credit cards. Read how they compare with Privacy.com in the article.

It offers a free plan but if you need more cards at your disposal or want advanced features, be ready to pay monthly fees. You can also compare privacy.com to similar solutions. Check out the details in the article.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan