Is Stripe Safe? Exploring the Realities of Using Stripe for Payments

You’ve probably heard of Stripe when it comes to online payments. But is it really worth your trust? Is it a good idea to integrate it into your business even? After reading this article, you will know for sure if Stripe is safe and what safety measures they offer. We will also talk about Stripe’s main security risks, and what best practices you can follow to ensure secure transactions.

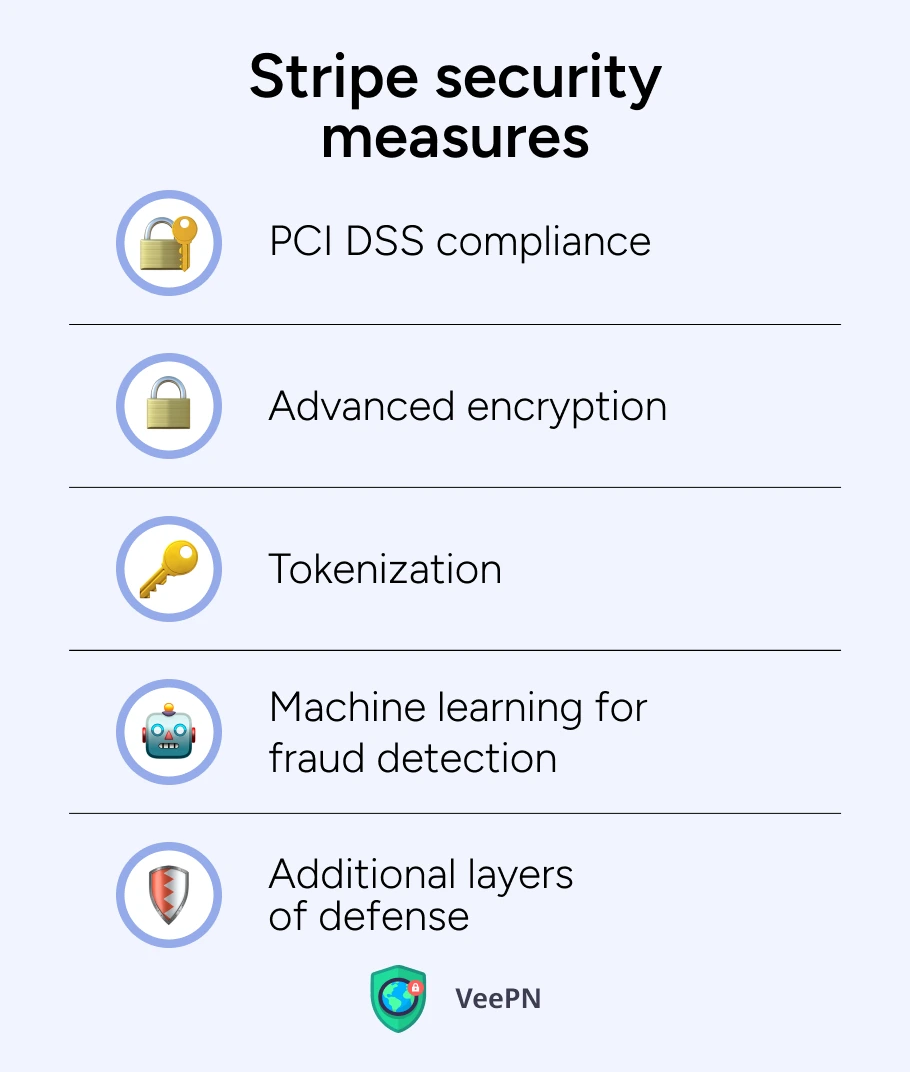

Stripe security features

To answer directly, Stripe features are truly built to safeguard users’ money and personal data. Here is how they do it:

PCI DSS compliance

Stripe is a PCI DSS Level 1–certified service provider. It means their services meet the highest standards that were set by the Payment Card Industry (PCI) for users’ data security. Practically, it means they use strict protocols to store, process, and transmit information of cardholders.

Advanced encryption

The platform uses AES-256 encryption, one of the strongest encryption standards existing. With this Stripe payment security feature in place, not even the smartest hackers or other snoopers can read your card details.

Tokenization

Instead of sending raw card details over the Internet, Stripe replaces them with unique tokens. This is a real game-changer because it reduces the chance of a Stripe security breach. Even if hackers somehow manage to intercept users’ data, they’ll only see meaningless tokens, not your real card information.

Machine learning for fraud detection

For fraud protection, Stripe uses machine learning models. In simple terms, they invest in teaching machines to detect suspicious users’ behaviour like extra fast typing speed, repetitive failed logins, uncommon swipe gestures or other app usage metrics to detect anomalies and prevent potential fraud.

Additional layers of defense

To strengthen Stripe’s security, the company uses HTTPS for encrypting data during transmission. This means that if you or your customers enter credit card details, the data is encrypted before being sent over the Internet. This way, even if some scammer were to intercept the connection, they would only see indistinct gibberish and not actual card details.

Though Stripe stands as a well-protected platform, there’re still a couple of risks associated with using this payment processor.

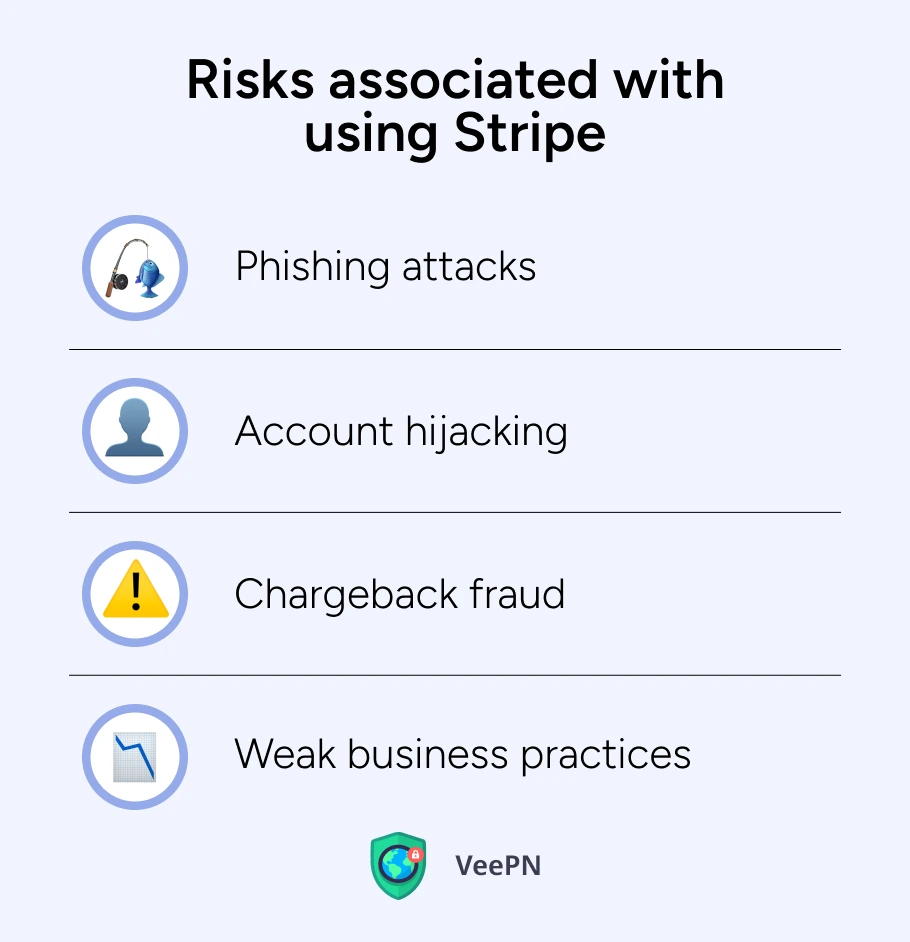

Potential security risks with Stripe

Even though Stripe security is on a high level, there are cases when things can go sideways. Usually, it’s due to hackers. They’re evolving and updating their tactics, so here are examples of risks you may come across:

Phishing attacks

Sometimes, cybercriminals send out fake emails that look exactly like the original Stripe support. Users may see such messages saying, “Your Stripe account is suspended. Log in now to fix it.” People may become nervous about how clients are going to pay if the payment processor is not working and click the link without the needed caution. Once a user clicks, they’re on a scam site and may enter login credentials. These charges were instantly paid out to the hacker’s prepaid debit cards using Stripe’s Instant Payout feature, but the transactions were invisible in the main dashboard and generated no notifications.

Account hijacking

Imagine a scammer gains control of your Stripe admin panel and starts funneling your customers’ money into their own bank account. It’s a real horror story that happened to a small business owner.

Hackers managed to create two fake accounts connected to her main Stripe account and processed over $70,000 in fraudulent credit card charges. These charges were instantly sent to hackers’ prepaid debit cards using Stripe’s Instant Payout feature, but the transactions were invisible in the main dashboard and the business owner didn’t receive any notifications. Stripe deemed the business owner responsible for the fraud, claiming that it was she who had exposed her API key (which she denies) potentially through Github, Pastebin, or other publicly available services to post code. As an outcome, the victim switched to another payment processor, and filed a police report.

Chargeback fraud

Chargebacks happen when customers dispute transactions and claim they were unauthorized, the product wasn’t delivered, or it didn’t meet their expectations. Stripe offers fraud protection tools like Radar that help to reduce potentially fraudulent transactions, but scammers exploit the system. Chargebacks can result in financial losses, additional fees, and potential loss of goods or services the business has provided.

Weak business practices

Small businesses sometimes neglect updating their Stripe integration or fail to enforce strong security practices like password management and data backups. But even with all these in place, malicious actors are cunning enough to fool business owners and get their money. Without proper care, such users can make themselves even more vulnerable – by revealing login details to the wrong people or not installing crucial security patches.

It would be really damaging for business and a horrible experience overall to fall victim to such scam tricks, agree? Then let’s consider what steps you can take to avoid similar situations in the future.

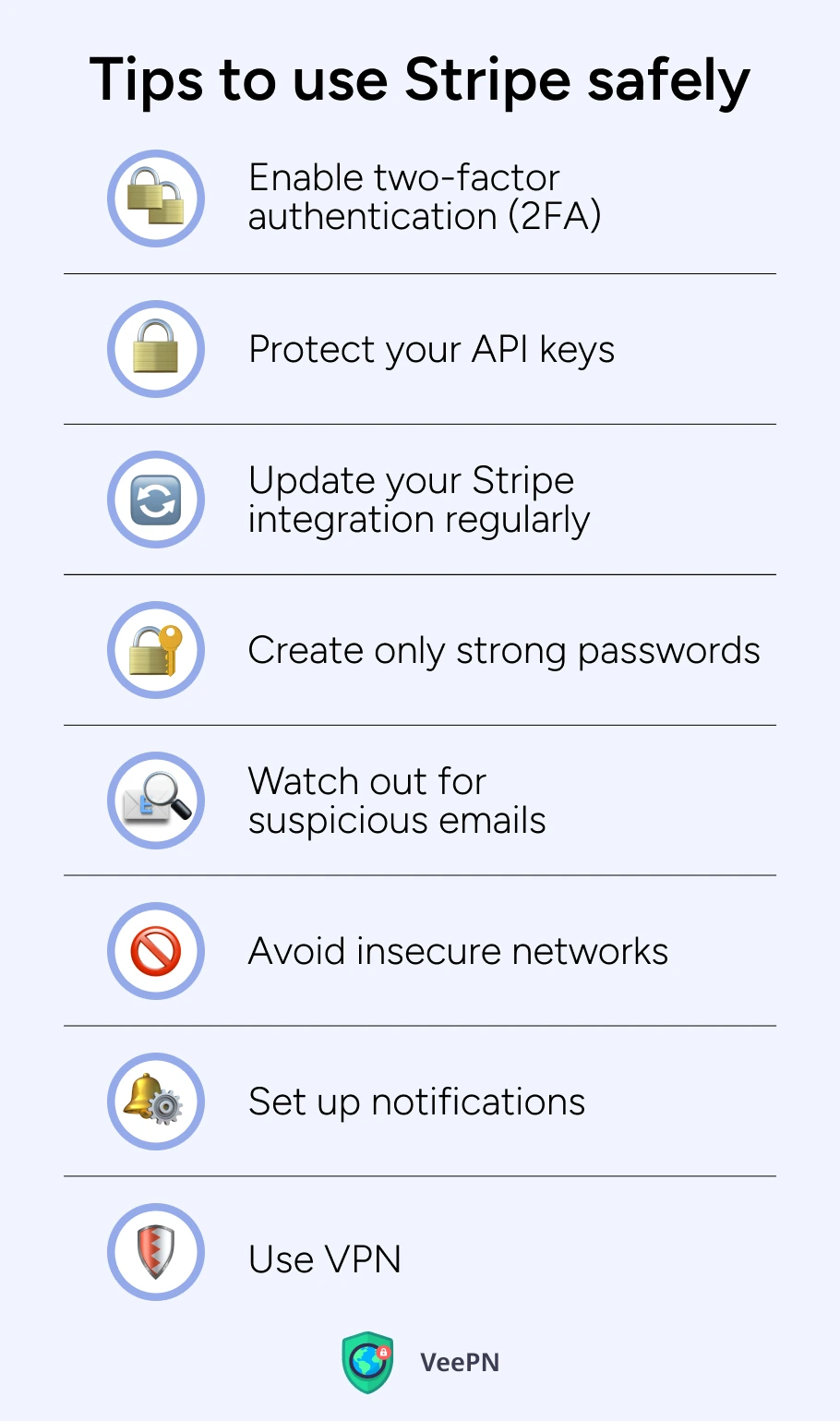

How to use Stripe safely

Stripe security measures are not a silver bullet for all problems, and this payment processing platform also has its vulnerabilities, which hackers actively use to cheat businesses. Take the following tips on board for better protection when using Stripe.

Enable two-factor authentication (2FA)

If someone gets your credentials, and you don’t have a 2FA, they get access to all financial details right away. Protect yourself by adding additional verification steps. This could be a special time-limited code sent to your phone, an email, or an SMS. In this way, intruders who cracked your password won’t succeed.

Protect your API keys

Treat your API keys the same way you treat your banking passwords. Use secure storage solutions and don’t let your developers share any code snippets on Github, Pastebin, or other publicly available services. This is generally the way how personal data leaks happen.

Update your Stripe integration regularly

Stripe developers release new security patches for a reason. Keep your Stripe plugins and custom code up to date and in a safe place, just as with API keys. This helps fix known vulnerabilities and have your solutions compatible with the latest features.

Create only strong passwords

Having a strong password is your first line of defense. For a great password, it’s better to combine uppercase and lowercase letters, numbers, and symbols. Passwords like “Stripe 12345” will not cut it. It’s also not safe to use the same password for other accounts. If you worry about forgetting so many passwords in your head, then consider using a password manager for convenience.

Watch out for suspicious emails

Do not immediately trust the “clickable” subject lines for your emails that come from the so-called “Stripe support.” Always check the sender’s address. When reading the mail, don’t hurry up to click on each and every link attached. Any Stripe-related official communication comes from an official domain – stripe.com. We advise you to manually type the official Stripe URL and check everything up yourself instead of following the suspicious link that may lead to a “Fake Stripe login portal.”

Avoid insecure networks

Public Wi-Fi networks in coffee shops and airports are not safe and not rarely a good ally for cybercriminals. If you need to login to Stripe and access your dashboard in such locations, then do it with a reliable VPN connection. A VPN hides your IP address and creates a protected “tunnel” that encrypts your data, making it invisible to hackers.

Set up notifications

Stripe has a drawback regarding privacy settings: you can’t just go straight to your settings and “turn on” notifications for your email or app to stay aware of the activities related to your connected accounts. This is possible only by setting proper webhook notifications. For this, you may need to consider working with a developer. Another tedious option would be to regularly check the ‘Connect’ section of your Stripe dashboard manually.

Use VPN

One more crucial way to secure your Stripe usage is by adding a VPN. Let’s discuss why you should do it in more detail.

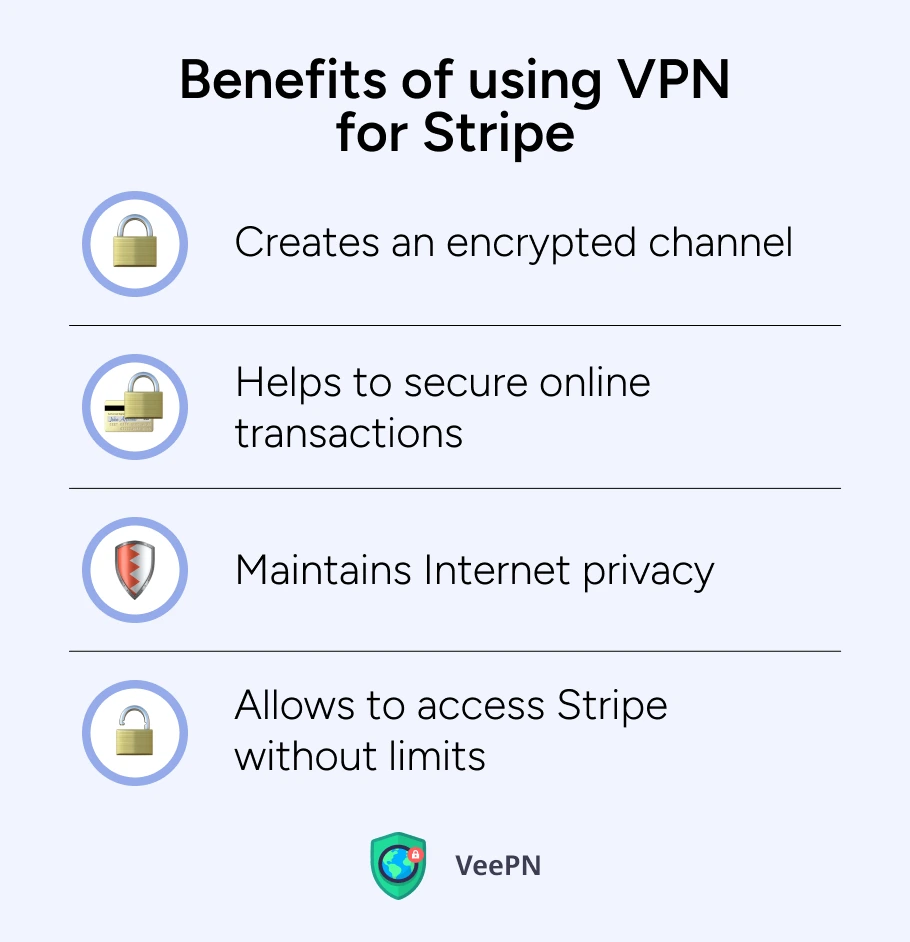

How VPN helps to safeguard using Stripe

Okay, Stripe is locked down and well-encrypted, but what about your own device or network? These could be weak links for scammers to abuse. This is when a Virtual Private Network, or VPN, helps and protects.

- A VPN creates an encrypted channel that shields your data from prying eyes. So, your sensitive data, such as login credentials, card details, and transaction records, becomes nearly impossible to intercept.

- VPN also helps to secure online transactions by hiding your real data from your Internet Service Provider (ISP), government, and hackers.

- It’s also a useful tool for maintaining Internet privacy. In case you prefer not to leave digital footprints wherever you go.

- In case you travel and need to access Stripe in locations with restrictive networks, like networks with corporate or regional restrictions, then VPN can come in handy to access the platform without limits and without exposing your real identity.

Are free VPN services okay?

In fact, not all VPNs are the same. While they might sound appealing for saving money, many free providers sustain their operations by collecting and selling your data to third parties, which contradicts the very idea of protecting your privacy. Many of them also log and store your browsing history, bombard you with ads, and some can even embed malicious code. This undermines the encryption a VPN is supposed to provide and puts your personal information, including your sensitive Stripe account data at risk.

If you want to safeguard your data without sacrificing performance, consider using a trustworthy solution – VeePN.

VeePN – your extra layer of protection

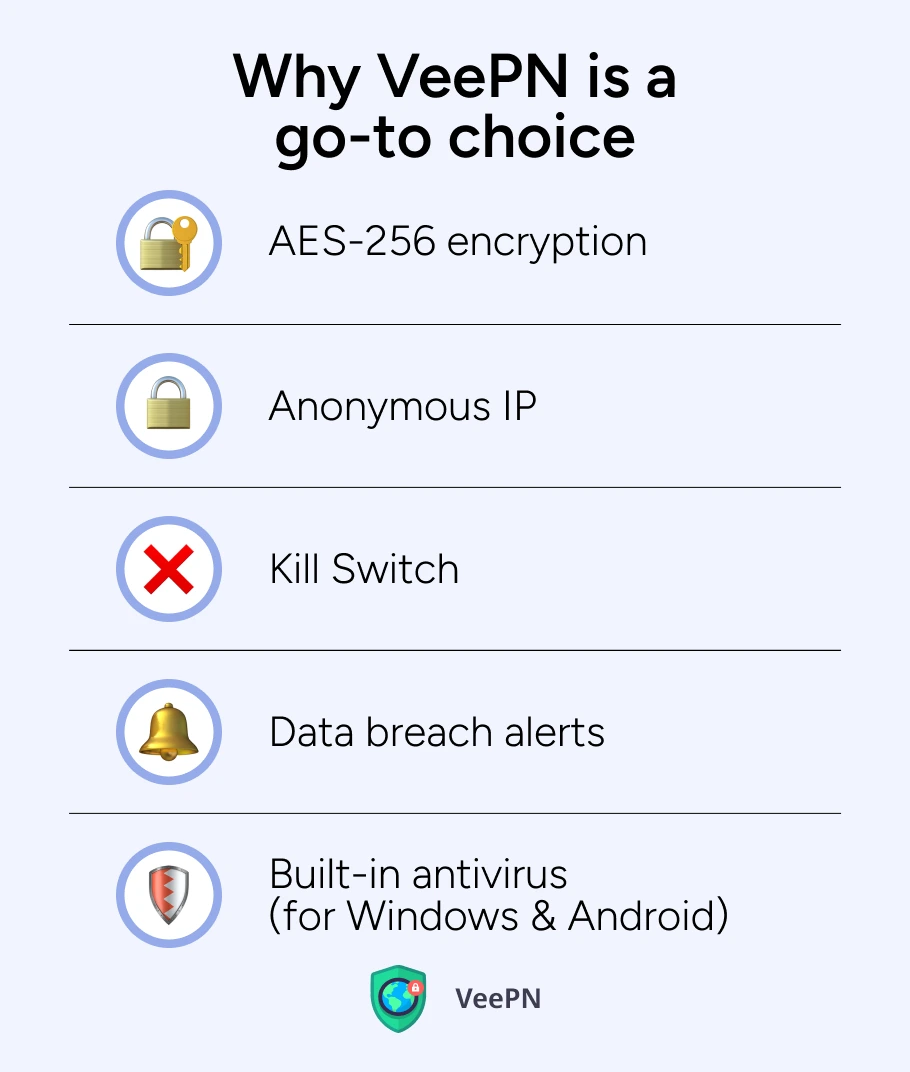

Now that you know how VPN matters for a higher grade of Stripe payment security, it’s high time to think which VPN provider to choose. VeePN stands out because it offers way more than a regular VPN:

AES-256 encryption

With VeePN, all your traffic from the device you use is guarded by AES-256 encryption. No one can snoop on what you do or the data you transfer, especially over sketchy public networks.

Anonymous IP

VeePN assigns you an anonymous IP that shields your real location. As a result, you don’t have to worry about targeted attacks or censorship.

Kill Switch

This feature instantly cuts off your connection if the VPN glitches. That way, your session won’t suddenly become exposed.

Data breach alerts

If you worry about potential leaks, VeePN keeps an eye out for compromised credentials. May it never happen, but if your email or password pops up in a known breach, you’ll get the alert and would be able to react fast.

Built-in antivirus (for Windows and Android)

Online criminals are evolving, using new techniques to exploit vulnerabilities. VeePN steps in with an antivirus solution (on supported devices), scanning for malware and preventing infiltration attempts that can steal your payment data or hijack your Stripe account.

If you’re unsure about committing, you can get your VeePN pricing plan risk-free with our 30-days money-back guarantee.

FAQ

If we compare Stripe vs PayPal security, then we can see that both platforms are recognized payment systems in the payments industry. However, Stripe provides a bit more customization and focuses heavily on secure payment features for all Stripe users. You can check details about PayPal security and see how they process payments. Ultimately, both handle credit and debit cards well, but your decision may heavily depend on your specific business needs.

Plenty of entrepreneurs link their banks to the Stripe payment gateway without trouble. Stripe has secure software development and shields cardholder data and other sensitive data from prying eyes. Though, there are painful cases related to account hijacking. For more details, check out this article. Stripe employs data encryption to protect users’ sensitive card data during online transfers. Overall, it’s a secure payment method, but the best decision would be to combine it with a reliable VPN like VeePN.

Many business owners consider Stripe highly reliable, thanks to ongoing audits and global compliance frameworks. It supports secure transactions because it is compliant with the general data protection regulations known as GDPR. If you want to add an extra layer of safety, you can use Stripe with a VPN.

Stripe is a robust payment systems platform that helps you process payments for online stores or services. It makes billing easier, handles subscription charges, and has advanced safety features in place to protect your finances. Users can also benefit from a VPN like VeePN, which keeps personal details private and stops digital snoops. With the right VPN, you can use Stripe with even greater confidence, no matter where you are.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan