Is Afterpay Safe? Key Things to Know Before Using

Another major purchase on the horizon? Be it a new TV or a pair of sneakers, you can buy all this and even more via Afterpay. And the best part is that you can buy anything you want now and pay later with 4 equal parts, without interest as long as you pay on time.

But apart from savvy shopaholics, online fraudsters and hackers are also interested in Afterpay, looking to steal users’ sensitive data. So if you want to stay on the safe side, keep reading. We’re about to discuss how safe Afterpay is and reveal proven ways to protect yourself online.

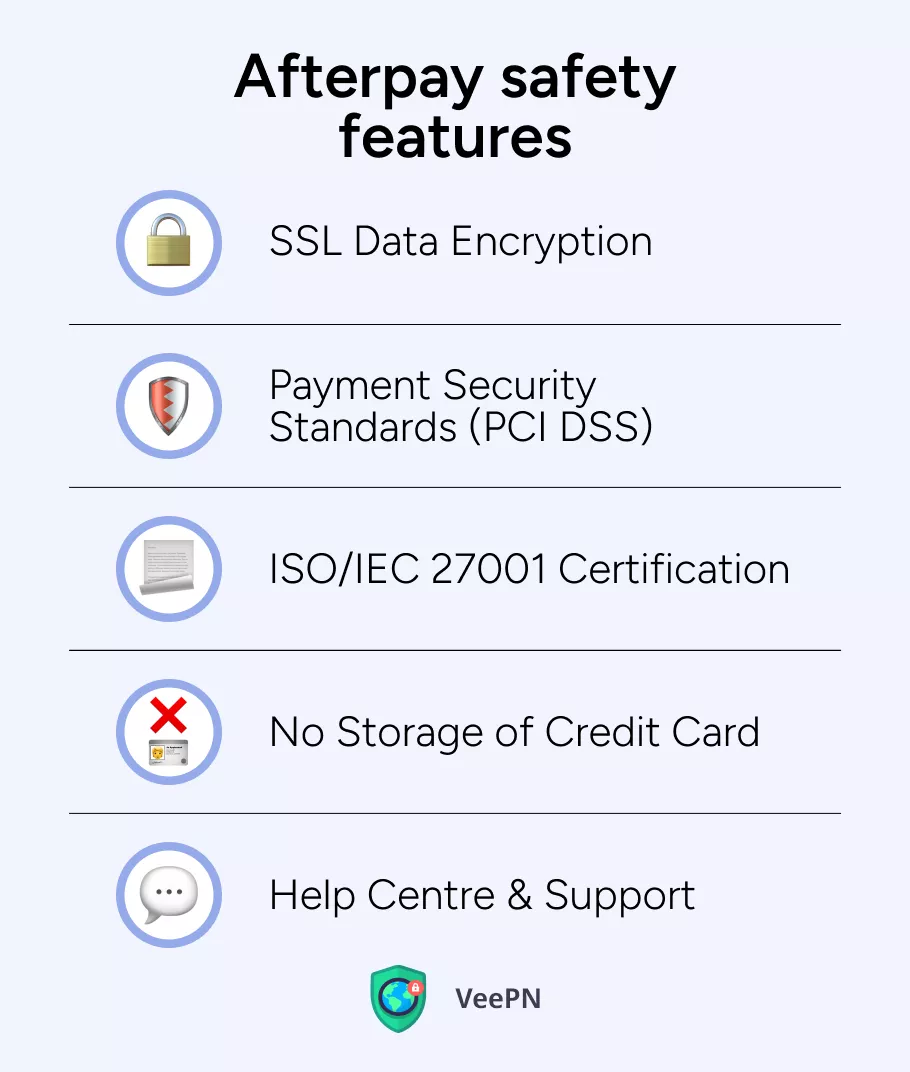

Afterpay security explained

Afterpay is integrated with online and in-store payment systems through APIs. Its infrastructure is compatible with a number of e-commerce platforms, retailers, and marketplaces.

Afterpay has advanced risk assessment algorithms and PCI DSS-compliant data encryption to safeguard transactions and mitigate risks of online fraud. With that said, let’s peek into the key features of the Afterpay security measures:

SSL data encryption

Afterpay uses SSL (Secure Sockets Layer) encryption to lock your data during transfers. It makes it unreadable to any scammer trying to intercept it. Known banks like Bank of America or JPMorgan, along with websites like Amazon and eBay, use this technology. So, Afterpay mobile app and platform is doing a great job in this case.

Payment Security Standards (PCI DSS)

Afterpay app and platform follows the PCI DSS to make sure they keep your payment information secure during transactions. They do it with the help of encryption, secure networks, and regular security audits.

ISO/IEC 27001 certification

Afterpay uses strict access controls and advanced encryption protocols to protect sensitive information about users. The advantage of Afterpay is that it handles security threats such as data breaches, and regularly monitors to manage risks and fix vulnerabilities.

No credit card details storage

Afterpay platform doesn’t store credit card details. They use tokenization, which is a secure method that replaces card details with a random token. So, even if there’s a breach, your card information will remain safe.

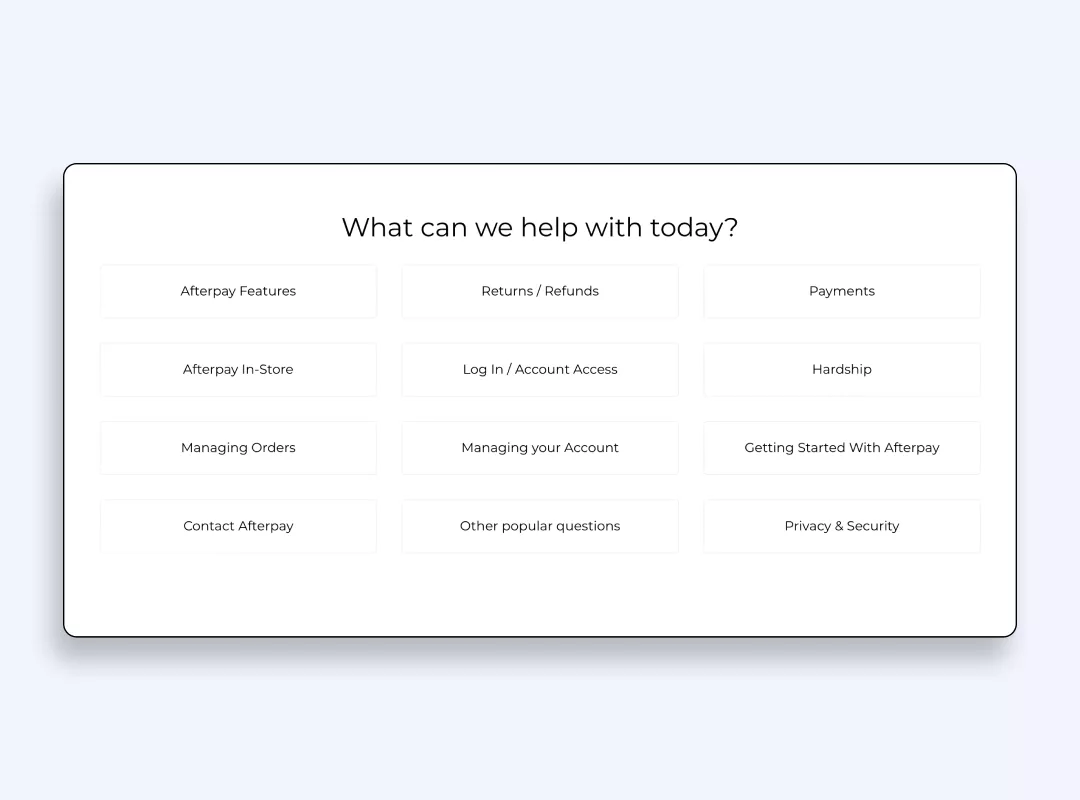

Help Centre & support

If you notice and suspect anything unusual related to your account activity, Afterpay’s Help Centre promises to give you quick responses to your security concerns: managing and protecting accounts, payments, refunds, and other hardships.

Risks associated with using Afterpay

The security measures mentioned above provide a solid layer of protection. However, when using any online financial service, you want to remain extra careful, agree? So let’s cover the main risks you may face when using Afterpay.

Privacy risks

Afterpay mobile app and platform and openly states in its privacy policy that they and their partners (they have hundreds of them) collect users’ personal data for advertising purposes. In other words, they have access to users’ IP address, geolocation, date and time of site visits or actions, browser settings, and device information.

So, the next time you notice the NB sneakers you once had your eye on chasing you across every site on Earth, you’ll know why. In fact, it’s not just Afterpay to blame. The phone you use so often might be listening to you 24/7. Check out how it works and how to stop it.

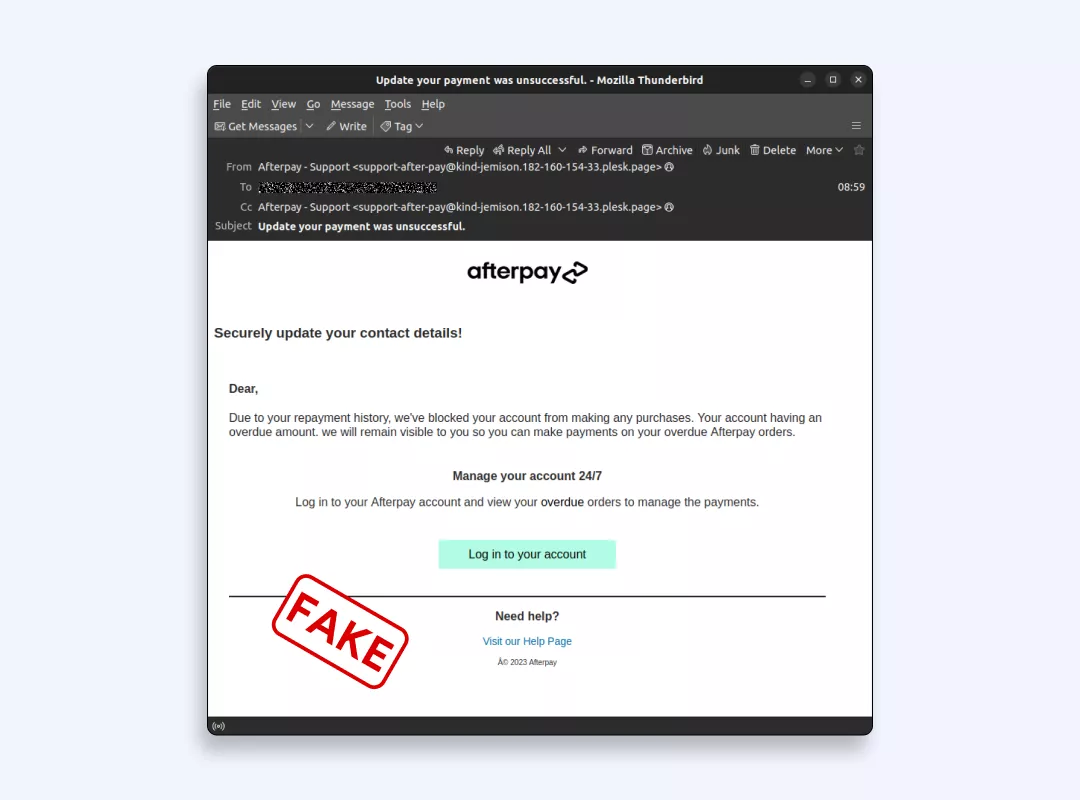

Phishing scams and fraud

Don’t trust all the emails you get! In a recent fraud case, scammers used the desire of Afterpay users to shop online during the hot season and profit from it.

They created fake “Afterpay Support” accounts and wrote letters with the subject line “Your account has been blocked.” The appeal was to update contact details to unblock it. Users saw a fake-branded Afterpay-like email, trusted it, and entered their login creds with passwords. Then they were requested to enter a 6-digit verification code that was sent to the mobile phone. Lastly, victims were to input their credit card info, including payment card number, expiration date, and the CVV number.

After they completed the steps – ouch… Scammers gained full access to users’ accounts.

If you want to learn how to protect yourself from such cases of buy now pay later scams, we’ll explain it in a bit so stay with us.

Data breach threats

The service you may love and trust can just fail to keep your personal data secure. Companies may write blooming descriptions on their websites, but reality sometimes differs.

Block is an on-point example. Afterpay shareholders are suing Block for not disclosing a major cyber breach before its $39 billion acquisition of Afterpay. The breach exposed data from 8.2 million customers. Quite a lot, isn’t it?

If you don’t want to fall victim to such instances, VeePN can help you out with our Breach Alert service that helps secure private data from leaks, including potential Afterpay data breaches.

Lack of regulation (in Australia)

Australian regulations of Buy Now, Pay Later (BNPL) services like Afterpay do not offer the same level of consumer protection as traditional credit products or personal loans.

Say you live in Australia and purchased an Xbox online from a seller that accepts Afterpay. But after you unpack it, you see the product is damaged or the box is empty. If you had bought it using your credit card, you could directly approach your bank and simply ask for a chargeback to recover the fraud money. Afterpay does not provide safeguards and does not get involved in purchase disputes. So, you’d have to resolve disputes individually with the seller. In case the dodgy retailer does not want to engage with you, your options would be limited. This is an apparent disadvantage of Afterpay using in Australia.

However, in the US, Afterpay users can feel more legally protected. They can dispute charges and obtain refunds on BNPL loans just like if this service were a traditional credit card provider.

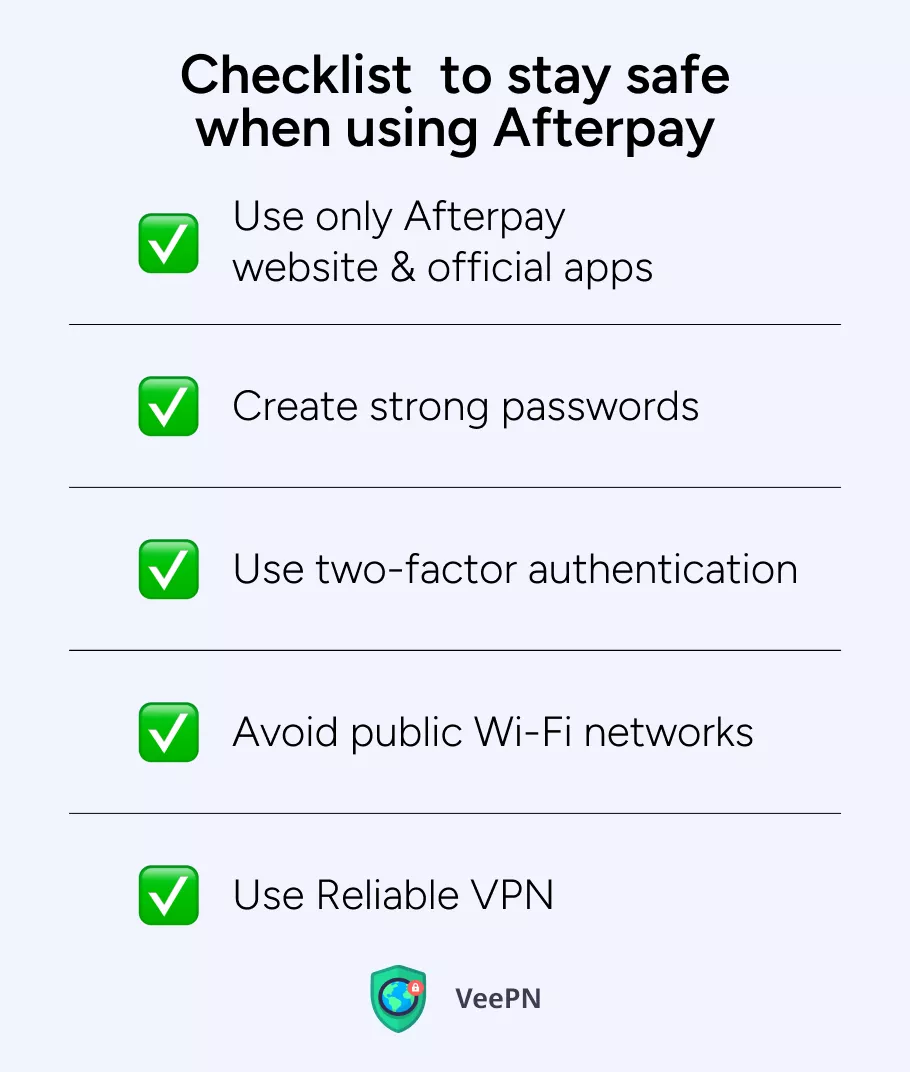

Tips to stay safe when using Afterpay

Now it’s about time we disclose ways to avoid any fraud cases. Protect yourself from hackers accessing your account details out of the blue with these simple actions.

✅ Use only the Afterpay website and official apps

From the story of how fraudsters mimicked the Afterpay support from above, here are some action steps to follow:

- Always check the sender’s email addresses. The verified emails come only from afterpay.com. Don’t click on links in emails, and don’t open attachments from unknown people or companies. Even if they seem credible initially.

- Check the URL. Hover your mouse over a link to see the actual link and where it is going to take you. If the website doesn’t start with afterpay.com, it’s likely a scam.

- Don’t share your password, verification codes, or personal and financial details with anyone. Afterpay Customer Service assures clients they will never ask to disclose these things.

- Install and use only official Afterpay applications. Here, you’ll find app links to download the app via Google Play or the App Store. If you have one, make sure you have the latest version and your contact information is up to date. This is an important Afterpay fraud protection measure!

✅ Create strong passwords

Your password is the first line of your protection. Make sure to create a powerful password. Here is the recipe:

small and CAPITAL letters + numbers + symbols = strong password

It’s not good to use easily guessed passwords such as “123456” or “password.” Complex passwords can help to minimize the chance of someone hacking into your account.

Afterpay also recommends not reusing a password with other accounts, such as email or social media, because in case of a hack, more of your data will be spoiled. In this case, a password management service can come in handy.

✅ Use two-factor authentication

Make your Afterpay account even more secure by activating the two-factor authentication (2FA). This way, even if someone hacks your password, they’ll not be able to log in until they get the second code sent to your phone or email.

✅ Avoid public Wi-Fi networks

Imagine you are sitting in an airport or cafe using public WiFi, leisurely browsing eBay in search of a gift for your mother. You found an amazing present paid with Afterpay. Haven’t you thought that hackers now also know what you’ve bought, as well as they know your passwords and credit card numbers? Such news may chill down the spine.

Most social Wi-Fi hotspots such as those in cafes, airports, and malls are insecure. When you use such free Wi-Fi in a cafe or airport, hackers can easily steal your information.

Here the guide on how to stay safe when using public WiFi.

✅ Use VPN

Reliable VPN services can help you stay secure and protected, as they encrypt your data by creating a sort of a secure virtual tunnel between your device and the Internet. So, your login, passwords, card information and other sensitive financial data will stay safe from hackers.

But not all VPNs are the same. When using free VPNs, you don’t get the extra security measures that are required to keep your data safe. In fact, a CSIRO study revealed that more than 50% of the top 10 VPNs were most likely to be infected with malware. In our article about free VPNs safety, you can learn other chilling insights.

That’s why it’s worth considering using a credible VPN service like VeePN for your Internet privacy.

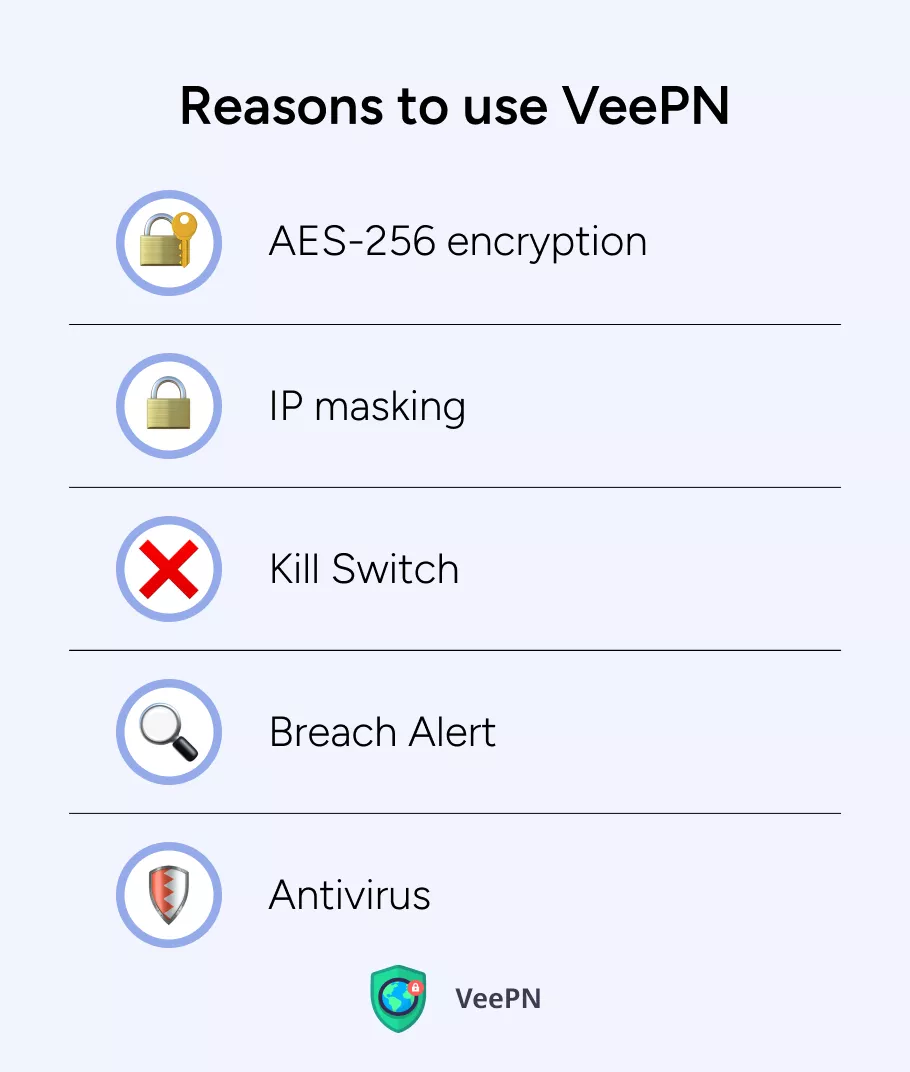

Reasons to use VeePN for protecting yourself online

Looking for a great VPN for online banking? Discover VeePN — an all-in-one online security solution with the following benefits:

AES-256 encryption

Protect all your traffic with one of the best VPN encryption standards when using online banking services, including BNPL, like Afterpay. No one will have a chance to spy on you, even when connected to a public Wi-Fi network.

IP masking

VeePN forwards the traffic through another server, making sure your online identity will not be disclosed, and your connection will be more secure.

Kill Switch

If your VPN connection suddenly drops, VeePN will take care to protect your private data and prevent data leaks. The Kill Switch function will immediately interrupt your Internet connection.

Breach Alert

Your banking data could fall into the wrong hands without you even knowing it — but not on our watch. VeePN Breach Alert will instantly inform you once your credit card details, SSN, or banking account credentials are noticed in a security breach.

Antivirus

Enjoy round-the-clock security on your Windows & Android devices with VeePN Antivirus. You can schedule complete system scans and relax as we will protect you from malware, hacks, injection attacks, and other risks.

Check out VeePN’s plans and give it a try with our 30-day money-back guarantee!

So, is Afterpay safe?

Let’s wrap things up. Afterpay app and platform is safe when you use it responsibly and with security precautions. The platform itself has strong security measures like encryption and fraud detection. But there are other risks of phishing scams, data breaches, and limited consumer protections in some regions.

Your safety can be on top of the game if you use official apps, create strong passwords, enable two-factor authentication, and secure Internet connection with a premium VPN like VeePN.

FAQ

Afterpay lets you split your purchase into four interest-free payments to make buying what you need easier. With convenience, no upfront costs, and other Afterpay benefits, it’s still better to stay aware of Afterpay scams and other Afterpay risks. Here’s how to secure your online transactions.

Yes, Afterpay is a legitimate service. It serves more than 24 million users worldwide. Many well-known retailers like Samsung, Nike, Sephora, IKEA, and others have integrated Afterpay into their payment system as an official and safe payment method. With this in place, get to know Afterpay reviews. Discover Afterpay security measures in our article.

Afterpay works differently from PayPal but is generally safe if used responsibly. PayPal has a long-standing reputation and offers users full fraud protection. Afterpay provides flexible payment options through its buy now pay later model. However, Afterpay charges and missed payments could lead to financial risks if you fail to pay bills on time. You can secure your payment activity when using the Afterpay app by protecting your data with a VPN service. Learn more about PayPal safety.

Afterpay works without performing traditional credit checks, so it won’t directly affect your credit rating or help you build credit. However, missed payments or late payment fees can really harm your finances if you’re not careful enough. Unlike traditional lenders that report payment activity to a credit report, Afterpay doesn’t impact your credit history unless unpaid debts are sent to collections. Always review your payment plan carefully and secure your payment activity online with a reliable VPN like VeePN for added protection.

Yes, Afterpay is safe to use with debit cards, but remember that late payments or a failed first payment could result in additional Afterpay charges. When you choose Afterpay for payment options, ensure your Afterpay card or linked account has enough funds to avoid missed payments. To further secure your payment activity, especially on public Wi-Fi, use a VPN. Learn how aVPN can secure online banking.

VeePN is freedom

Download VeePN Client for All Platforms

Enjoy a smooth VPN experience anywhere, anytime. No matter the device you have — phone or laptop, tablet or router — VeePN’s next-gen data protection and ultra-fast speeds will cover all of them.

Download for PC Download for Mac IOS and Android App

IOS and Android App

Want secure browsing while reading this?

See the difference for yourself - Try VeePN PRO for 3-days for $1, no risk, no pressure.

Start My $1 TrialThen VeePN PRO 1-year plan